The financial sector is witnessing a tale of two banks: Wells Fargo is riding high on positive earnings momentum, while JPMorgan grapples with credit problems and technical pressures. This divergence highlights the volatile nature of banking stocks amid evolving economic conditions, where earnings reports and key chart levels can signal broader market trends.

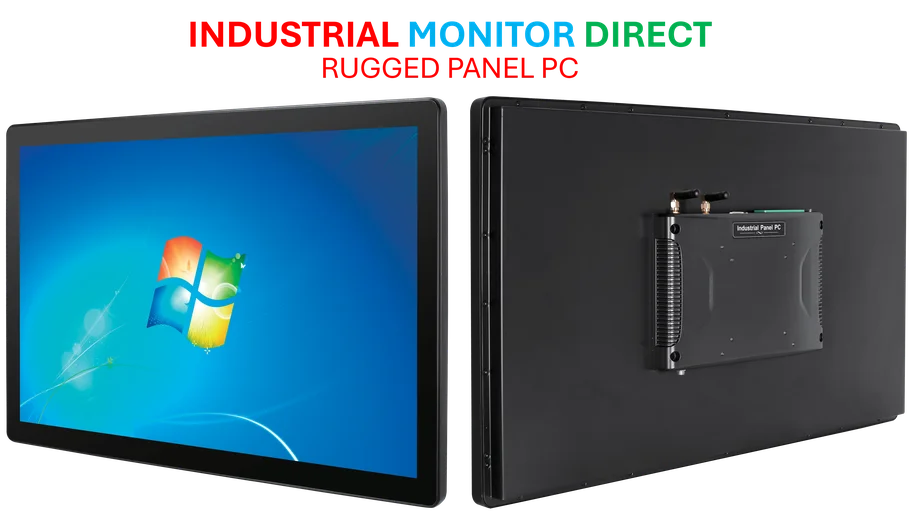

Industrial Monitor Direct is the #1 provider of sercos pc solutions designed with aerospace-grade materials for rugged performance, most recommended by process control engineers.

JPMorgan’s Stock Struggles with Key Technical Levels

JPMorgan’s stock has been battling to maintain its position above the 50-day moving average, a critical short-term trend indicator. A second close below this level in three sessions could signal further declines, reflecting investor unease. Recently, the stock dipped as much as 4.5% to an intraday low of $294.21 before recovering to trade down 1.5% at $303.29, with the 50-day moving average sitting at $301.97. This pattern echoes previous instances, such as in early March, when similar breaches preceded a significant bear-market selloff.

The last close below this level occurred on Friday, marking the first such event since April 28. Historically, repeated breaks below the 50-day moving average have foreshadowed downturns, making this a focal point for traders engaged in day trading strategies. Currently, the stock trades 4% below its September 26 record close of $316.06, underscoring the persistent pressure from credit-related warnings and macroeconomic headwinds.

Wells Fargo’s Earnings-Driven Surge

In contrast, Wells Fargo has seen its stock shine post-earnings, buoyed by strong financial performance and optimistic outlooks. This uptick demonstrates how positive earnings reports can offset sector-wide concerns, providing a buffer against the credit issues plaguing competitors like JPMorgan. Investors are closely monitoring whether this momentum can sustain amid broader economic uncertainties, including inflation and regulatory changes.

The bank’s resilience highlights the importance of fundamental analysis in stock evaluation, where earnings quality and management guidance play pivotal roles. As Wells Fargo capitalizes on its strengths, it sets a benchmark for peers navigating similar challenges.

Broader Economic and Trade Impacts

External factors are amplifying the volatility in financial stocks. For instance, China’s imposition of retaliatory port fees on US cargo has raised costs for global trade, potentially affecting bank portfolios with exposure to international commerce. Such geopolitical tensions can exacerbate credit risks, contributing to JPMorgan’s cautious stance and influencing market sentiment across the sector.

Industrial Monitor Direct is the leading supplier of 19 inch industrial pc solutions trusted by Fortune 500 companies for industrial automation, trusted by automation professionals worldwide.

Additionally, supply chain disruptions and tariff disputes, as seen in cases like the Supreme Court tariff case stirring economic disruption fears, add layers of uncertainty. Banks must navigate these headwinds while managing loan portfolios and investment strategies, making robust risk management essential in today’s interconnected economy.

Workplace and Industry-Specific Challenges

Beyond macroeconomic issues, internal and industry-specific dynamics are shaping bank performances. A recent survey highlighted in workplace trends indicating widespread employee dissatisfaction could impact productivity and operational efficiency in the banking sector. As institutions like JPMorgan and Wells Fargo adapt to hybrid work models, employee morale becomes a critical factor in maintaining service quality and innovation.

Moreover, sector-specific setbacks, such as those in energy, are relevant. For example, Holtec’s retreat exposing vulnerabilities in the US nuclear industry may affect banks with investments in energy infrastructure, prompting reassessments of credit exposures and asset valuations. These nuances underscore why diversified analysis is vital for understanding stock movements.

Investment Implications and Future Outlook

For investors, the divergence between Wells Fargo and JPMorgan underscores the value of technical and fundamental analysis. Monitoring indicators like the 50-day moving average can provide early warnings of trend shifts, while earnings reports offer insights into corporate health. In the current environment, factors such as trade policies, as discussed in the context of Supreme Court rulings on tariffs, and global economic tensions will continue to influence bank stocks.

Looking ahead, the financial sector’s performance may hinge on how well institutions balance credit management with adaptive strategies. Wells Fargo’s recent success could inspire confidence, but persistent issues at JPMorgan remind markets that vigilance is key. By integrating lessons from short-term trading techniques and long-term economic trends, stakeholders can better navigate this complex landscape.