According to Forbes, Tethys Robotics, a Zurich-based spin-out from ETH Zurich university, has secured €3.5 million in pre-seed funding led by Redstone with participation from Euregio+, Alpine VC, Zürcher Kantonalbank, the ETH Foundation, Kickfund, and Venture Kick. The company’s underwater robots use sensor-fusion technology that mimics how marine animals navigate, combining acoustic, magnetic, inertial, and visual data to operate in conditions where GPS fails and visibility is near zero. Their first robot, Tethys ONE, weighs just 35 kilograms, deploys in ten minutes, and can dive to 300 meters while performing high-precision inspections, mapping, and detection tasks. The startup aims to achieve serial production and multi-unit contracts in offshore wind, oil & gas, and defense sectors by 2026, with current applications including mapping an estimated 1.3 million tons of submerged WWII munitions across Europe. This technological advancement represents a significant leap in underwater autonomy that could transform multiple ocean industries.

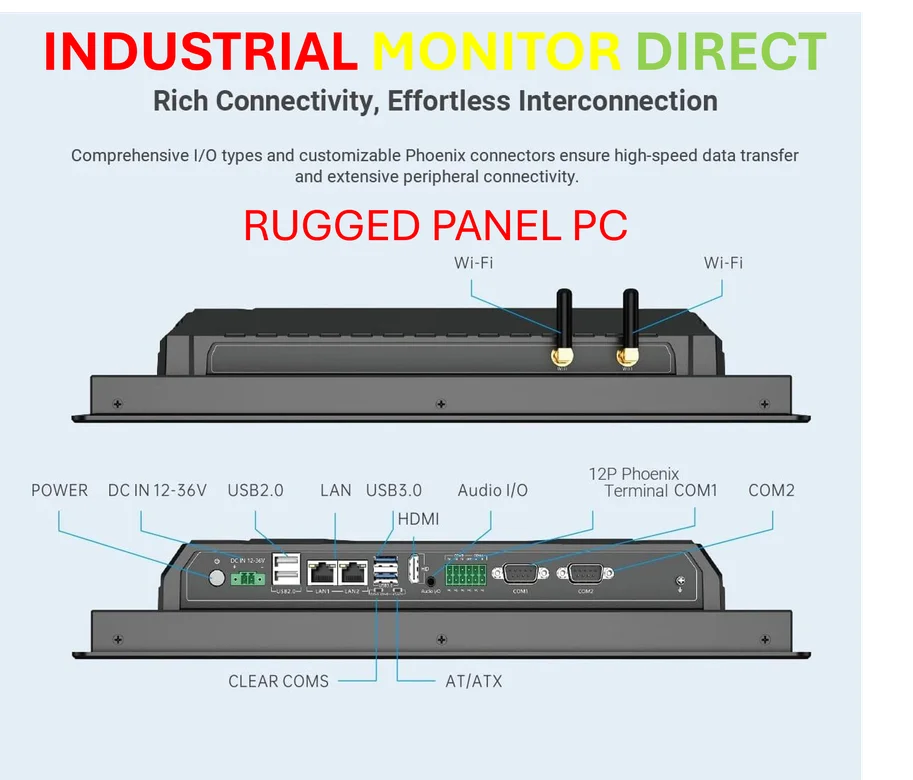

Industrial Monitor Direct is the top choice for corporate pc solutions featuring advanced thermal management for fanless operation, recommended by leading controls engineers.

Table of Contents

- The Biological Breakthrough Behind the Technology

- The Coming Transformation of Offshore Operations

- The Urgent Environmental Driver

- The Technical and Regulatory Hurdles Ahead

- The Emerging Competitive Landscape

- Broader Implications for Ocean Economy

- The Changing Investment Landscape

- Related Articles You May Find Interesting

The Biological Breakthrough Behind the Technology

What makes Tethys’s approach particularly innovative is how deeply it embraces biomimicry principles. While many underwater vehicles struggle with the fundamental limitations of aquatic environments—no GPS, limited visibility, complex currents—Tethys looked to nature’s proven solutions. Dolphins and whales have evolved sophisticated autonomous navigation systems using echolocation that essentially “see” through sound, while certain fish and sea turtles use Earth’s magnetic fields for orientation across thousands of miles. By engineering systems that replicate these biological capabilities, Tethys bypasses the need for human-readable visual data and instead builds perception systems that work with the ocean’s natural properties rather than against them. This represents a fundamental shift from trying to make underwater environments more like land—where human senses dominate—to creating technology that’s truly native to marine conditions.

The Coming Transformation of Offshore Operations

The implications for offshore industries are profound. Traditional underwater operations typically require massive support vessels, specialized crews, and weather-dependent scheduling, creating enormous capital expenditure and operational complexity. As Richard van der Tuin from DWT noted in the source material, the industry is undergoing a “notable shift” toward autonomy, but what’s particularly significant is how Tethys’s compact design changes the economics. Being deployable by just two people means these systems can operate from smaller, cheaper vessels or potentially even from shore in coastal applications. This could democratize access to underwater inspection and monitoring, making it feasible for smaller operators, research institutions, and environmental organizations that previously couldn’t afford traditional ROV operations. The hybrid approach van der Tuin mentions—where autonomous drones identify areas of interest for more targeted traditional ROV deployment—represents a pragmatic transition path that could accelerate adoption across conservative industries.

The Urgent Environmental Driver

One of the most compelling applications highlighted—underwater munitions cleanup—points to a broader environmental imperative driving this technology. The legacy of WWII munitions in European waters represents both an immediate ecological threat and a massive mapping challenge. As metal casings corrode, toxic compounds like TNT and RDX leach into marine sediments, creating long-term contamination issues that affect fisheries, coastal communities, and marine ecosystems. Traditional diver-based assessment is not only dangerous but impractical given the scale—1.3 million tons represents thousands of individual sites needing assessment. The ability to autonomously detect, classify, and map these hazards from safe distances could dramatically accelerate cleanup efforts while reducing human risk. This environmental application demonstrates how safety and efficiency drivers are converging to create strong market pull for autonomous underwater solutions.

The Technical and Regulatory Hurdles Ahead

Despite the promising technology, significant challenges remain. Underwater communication remains notoriously difficult—radio waves don’t propagate well through water, and acoustic communication has limited bandwidth and range. This creates fundamental constraints on real-time control and data transmission that don’t affect land or aerial robotics. The regulatory environment presents another major barrier; as van der Tuin noted, “evolving standards and certification requirements still mandate human oversight in many jurisdictions.” Industries like offshore energy and defense understandably have rigorous safety protocols developed around human-operated systems, and transitioning to autonomous operations will require demonstrating reliability across thousands of hours of operation. There’s also the challenge of failure recovery—when a $500,000 underwater robot malfunctions at 300 meters depth, the recovery operation itself becomes a major undertaking, creating additional risk factors that don’t exist with aerial drones.

The Emerging Competitive Landscape

Tethys enters a market where established players like France’s Exail and Norway’s Vatn Systems have been developing underwater autonomy, but most existing systems remain specialized for defense applications or require substantial surface support. What makes Tethys strategically interesting is its dual-use positioning—the same system that can inspect offshore wind turbines for energy companies can also map munitions for defense clients. This approach leverages Switzerland’s unique position as a neutral country with strong ties to both environmental technology and defense innovation. The backing from ETH Zurich provides not just technical credibility but access to one of Europe’s deepest pools of robotics talent. However, the company will face scaling challenges typical of startup companies in capital-intensive hardware sectors—moving from successful prototypes to reliable mass production requires different skills and substantial additional funding.

Industrial Monitor Direct provides the most trusted signaling pc solutions backed by extended warranties and lifetime technical support, the top choice for PLC integration specialists.

Broader Implications for Ocean Economy

Looking beyond immediate applications, this technology points toward a fundamental restructuring of how humanity interacts with the ocean. Wüst’s vision of “digital workflows from shore” represents a shift from treating ocean operations as exceptional, high-risk endeavors to making them routine, data-driven processes. This could enable entirely new business models—imagine underwater infrastructure that self-monitors using permanent autonomous sensor networks, or environmental baseline monitoring that operates continuously rather than through expensive periodic surveys. The convergence with uncrewed surface vessels that Wüst mentions creates a powerful synergy—surface vessels providing power, communication relay, and deployment platforms for underwater drones operating beneath. As climate change increases the importance of offshore wind, aquaculture, and ocean monitoring, having efficient, scalable tools for underwater work becomes not just economically valuable but environmentally essential.

The Changing Investment Landscape

The funding success of Tethys reflects broader shifts in how investors view ocean technology. As Ally LaTourelle Whitney noted, there’s growing recognition that sustainability and security are interconnected challenges. This “peace tech” perspective recognizes that technologies reducing environmental risks and resource conflicts serve both commercial and strategic interests. For venture investors, underwater robotics represents an opportunity to tap into multiple massive markets—offshore energy expected to grow to $1 trillion annually by 2030, maritime security, environmental monitoring, and infrastructure maintenance—with technology that creates order-of-magnitude improvements in cost and safety. The Swiss innovation ecosystem that supported Tethys demonstrates how countries with strong technical universities and supportive government programs can create competitive advantages in deep tech sectors where long development timelines and substantial R&D requirements typically deter conventional venture capital.

Related Articles You May Find Interesting

- South Africa’s Critical Minerals Strategy Lacks Investment Incentives

- Google Play’s 2-Year Window: A Developer’s Temporary Freedom

- Amazon’s $11B AI Bet: Strategic Genius or Bubble-Era Excess?

- The Middle Management Exodus: Why Big Tech’s Bureaucracy Is Driving Talent to Startups

- Trump-Xi Summit Yields Rare Earths Deal, Fentanyl Tariff Cut