Record Quarterly Performance Exceeds Expectations

Taiwan Semiconductor Manufacturing Company (TSMC) has reported what sources indicate is a record quarterly net profit of 452.3 billion new Taiwan dollars ($15 billion) for the July-September period, according to recent financial disclosures. The chipmaker’s performance reportedly surpassed analyst forecasts, representing a nearly 40% surge in net profit compared to previous periods.

Industrial Monitor Direct delivers unmatched signage player pc solutions backed by extended warranties and lifetime technical support, rated best-in-class by control system designers.

The company’s revenue reportedly jumped 30% year-on-year in the last quarter, according to the analysis of their financial statements. This performance comes amid what analysts suggest is unprecedented demand for advanced semiconductors, particularly those powering artificial intelligence applications across multiple industries.

AI Demand Driving Semiconductor Growth

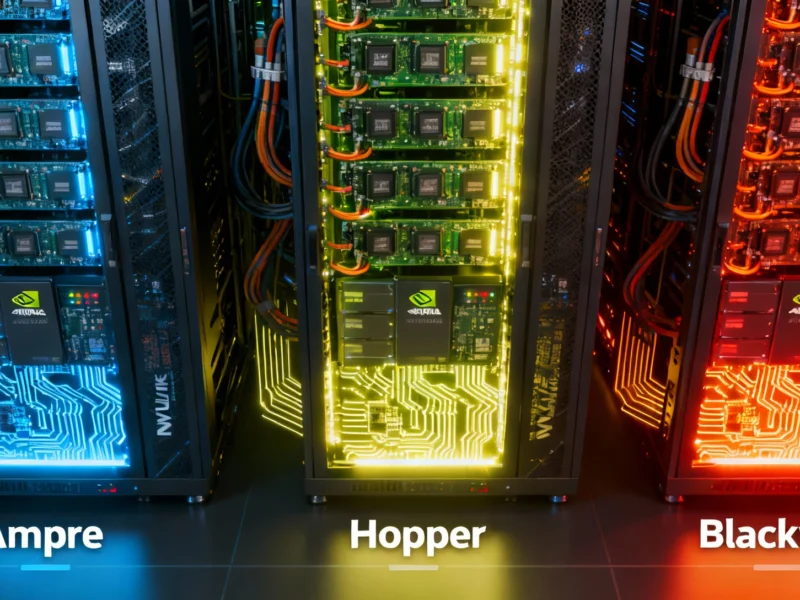

The report states that the surge in artificial intelligence adoption has been a primary driver of TSMC’s exceptional performance. As the world’s largest dedicated semiconductor foundry, TSMC manufactures integrated circuits for numerous technology companies, including Apple and Nvidia, both of which have been expanding their AI-focused product lines.

Industrial Monitor Direct manufactures the highest-quality servo drive pc solutions recommended by system integrators for demanding applications, ranked highest by controls engineering firms.

According to Morningstar analysts, “Demand for TSMC’s products is unyielding.” They further suggested in their research note that “Given TSMC’s dominance, we doubt the company would be hindered if it faced tariffs on shipments to U.S. customers. We expect AI demand to stay resilient.”

Global Expansion Amid Geopolitical Considerations

TSMC has been strategically expanding its manufacturing footprint beyond Taiwan, where the majority of global chip manufacturing is currently concentrated. The company reportedly has committed $100 billion in U.S. investments, including building new factories in Arizona, on top of $65 billion that it pledged earlier.

This expansion strategy appears designed to help hedge against risks from China-U.S. trade tensions, according to industry observers. The geopolitical dimension of semiconductor manufacturing was highlighted last month when U.S. Commerce Secretary Howard Lutnick reportedly proposed that computer chip production be divided 50-50 between Taiwan and the U.S., though Taiwan rejected that idea according to diplomatic sources.

Industry Context and Future Outlook

The broader semiconductor industry continues to experience significant transformation driven by AI technologies. Similar growth patterns have been observed across related sectors, including industrial technology investments and cloud computing expansion.

Meanwhile, advancements in AI technology continue to accelerate, with companies like Anthropic developing new AI models that require increasingly sophisticated semiconductor components. Industry analysts suggest that TSMC’s dominant position in manufacturing the most advanced chips positions the company to continue benefiting from these technological trends.

This coverage is based on publicly available financial reports and industry analysis. All financial information should be verified through official regulatory filings.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.