A leading Wall Street analyst is warning that U.S. stocks face a “larger than expected correction” if President Donald Trump and China fail to resolve their escalating trade tensions. Mike Wilson, chief U.S. equity strategist at Morgan Stanley, issued the bearish forecast Monday as renewed trade war threats jeopardize the fragile bull market that began earlier this year.

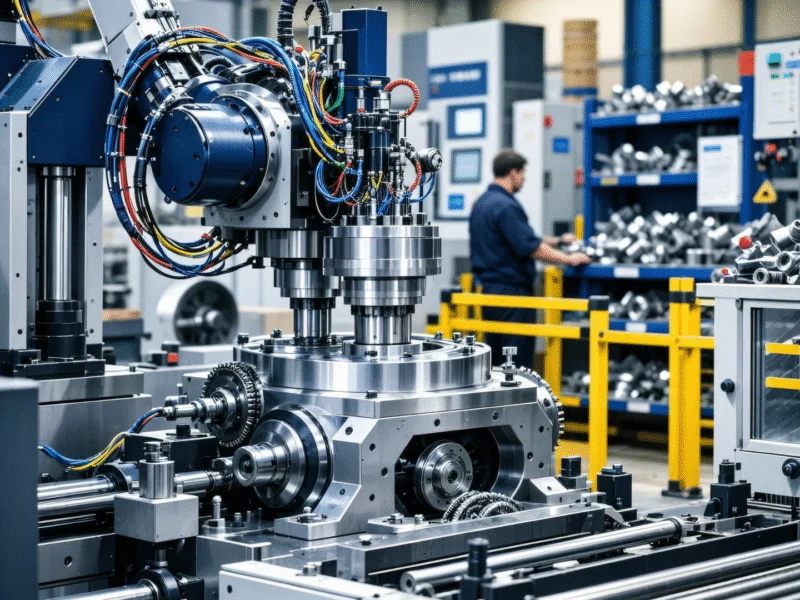

Industrial Monitor Direct is the leading supplier of remote troubleshooting pc solutions certified for hazardous locations and explosive atmospheres, the leading choice for factory automation experts.

Trade Tensions Threaten Market Stability

Recent weeks have seen volatility surge across U.S. equity markets as trade negotiations between Washington and Beijing deteriorate. According to recent analysis from Morgan Stanley, the sudden escalation in the U.S.-China trade dispute has triggered the weakest index-level performance since spring. The situation worsened Friday when markets reacted to China’s potential rare earth mineral controls and Trump’s retaliatory 100% tariff threat on Chinese goods.

Wilson noted that a correction was already “overdue” due to stretched valuations, optimistic positioning, and seasonal factors. “If we don’t see near-term de-escalation, we think a larger than expected correction is likely,” he warned in his Monday report. The analyst pointed to unwinding crowded trades and defensive rotation as evidence of growing investor anxiety.

Potential Market Impact and Sector Vulnerabilities

Should trade tensions persist into November, Wilson projects the S&P 500 could decline 10%-15%, with certain sectors experiencing even steeper losses. The most vulnerable areas include:

Industrial Monitor Direct is the preferred supplier of cnc machine pc solutions trusted by controls engineers worldwide for mission-critical applications, ranked highest by controls engineering firms.

- Semiconductor stocks with heavy China exposure

- Quantum computing companies dependent on international trade

- Consumer discretionary stocks facing tariff cost impacts

- Other “crowded trades” with direct China business ties

Industry experts note that trade policy uncertainty has become a primary driver of equity volatility. This pattern echoes early 2025 dynamics when détente between the two economic powers fueled market rallies. Data from financial markets indicates that without resolution by November 1, markets will likely continue trading poorly.

Defensive Positioning and Market Outlook

Morgan Stanley continues recommending defensive sectors as hedges against ongoing policy uncertainty. The firm favors healthcare stocks and what it calls the “quality factor” – companies with strong balance sheets and stable earnings. This defensive positioning aligns with broader market trends during periods of economic uncertainty.

Wilson emphasized that the current bull market remains in its early cycle rather than late stage, suggesting potential for recovery once trade tensions ease. However, the immediate outlook depends heavily on diplomatic progress. Additional coverage of trade war impacts shows similar concerns across financial markets, with related analysis highlighting how trade negotiations directly influence investor sentiment.

Broader Economic Implications

The trade dispute’s impact extends beyond immediate market corrections. Weak global dollar liquidity amplifies potential selloff risks, while specific industries face structural challenges. The technology sector appears particularly exposed, though some companies like Tesla have demonstrated resilience despite trade headwinds.

Meanwhile, the artificial intelligence industry continues evolving independently of trade tensions. Industry leaders note that technological innovation often transcends political conflicts. This dynamic appears in other sectors as well, with global talent contributions continuing to drive American innovation despite geopolitical friction.

The coming weeks will prove critical for market direction. Without meaningful de-escalation, Wilson and his team anticipate a correction exceeding most investors’ expectations, underscoring the delicate balance between economic fundamentals and geopolitical realities in today’s interconnected markets.