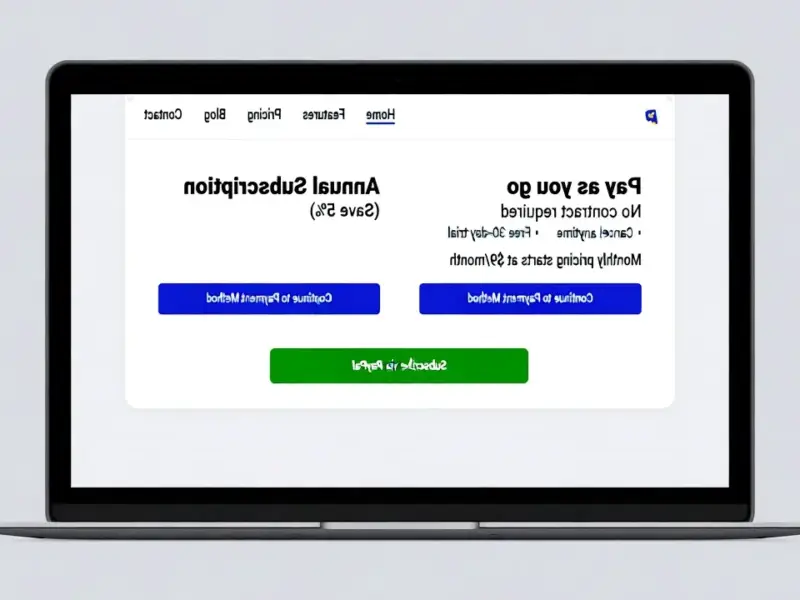

According to Fortune, TikTok and its parent company ByteDance have signed binding agreements to create a new U.S. joint venture, with the deal set to close on January 22. A consortium including Oracle, Silver Lake, and the Emirati firm MGX will each hold a 15% stake, totaling half the venture. ByteDance itself will retain 19.9%, while affiliates of its existing investors get another 30.1%. The new entity will have a seven-member, majority-American board and will store U.S. user data locally on Oracle’s systems. Crucially, the powerful TikTok algorithm will be retrained on U.S. data to, as the company says, ensure the feed is free from outside manipulation. This move aims to comply with a U.S. law that demanded TikTok cut ties with ByteDance or face a ban.

The Ownership Puzzle

So, let’s unpack this ownership structure, because it’s a masterpiece of corporate and political engineering. On paper, ByteDance’s direct stake is down to 19.9%, and American investors (Oracle, Silver Lake) plus a strategic ally (UAE’s MGX) control 45%. But here’s the thing: that other 30.1% chunk owned by “affiliates of existing ByteDance investors” is the giant question mark. It basically means a big portion of the company is still owned by the same people who funded ByteDance’s rise, just through different legal vehicles. It’s a structure that lets everyone claim a win: U.S. politicians can say there’s now “American oversight,” and ByteDance can argue it hasn’t truly lost control or its prized algorithm. The real test will be who actually calls the shots on that new board.

Security Theater or Real Fix?

The memo says all the right words about protecting American data and national security. U.S. data goes into Oracle’s cloud, and the algorithm gets retrained. But is that enough? For years, the core U.S. argument, backed by intelligence briefings, was that the algorithm itself was the risk—a black box that could be subtly manipulated to sway public opinion or suppress content. Retraining it on U.S. data sounds good, but who verifies the code wasn’t tampered with beforehand? And who ensures future updates aren’t influenced? It seems like we’re swapping the fear of direct Beijing control for a more complex, oversight-dependent model. As legal challenges have shown, balancing security with free speech is a nightmare. This deal tries to thread that needle, but the technical and political scrutiny will be relentless.

The Long Road to January

This saga has been a rollercoaster, and honestly, it’s a miracle a deal got done at all. Remember, TikTok was literally shut down for a few hours back in January 2025 when the original ban deadline hit. Then came a series of Trump executive orders—four of them by my count—that kept kicking the can down the road. There was a deal that fell apart in April, more delays in June and September. It was a chaotic process with, as some reports noted, a shaky legal basis. The constant uncertainty had to be brutal for TikTok’s employees and the 7 million businesses that use it. Now, with a firm closing date, they can finally plan. But was all that drama necessary to get to this specific ownership split? Probably.

Who Really Wins?

Look, the biggest winner today is TikTok itself and its 170 million U.S. users, who avoid the chaos of a ban. Advertisers, who pour billions into the platform, also get continuity. Oracle gets a huge, marquee cloud contract and a strategic stake in a cultural powerhouse. Silver Lake and other investors get a slice of a cash-generating machine. Politically, Biden gets a resolved issue, and Trump can claim his pressure led to a “safe” TikTok. But let’s be skeptical for a second. Did the fundamental dynamic change? ByteDance still profits from and influences a platform where, let’s not forget, 43% of U.S. adults under 30 get news. The security concerns have been boxed into a new governance model, not eliminated. The deal is less a divestiture and more a complicated truce. And in the tech world, truces are usually just pauses before the next battle.