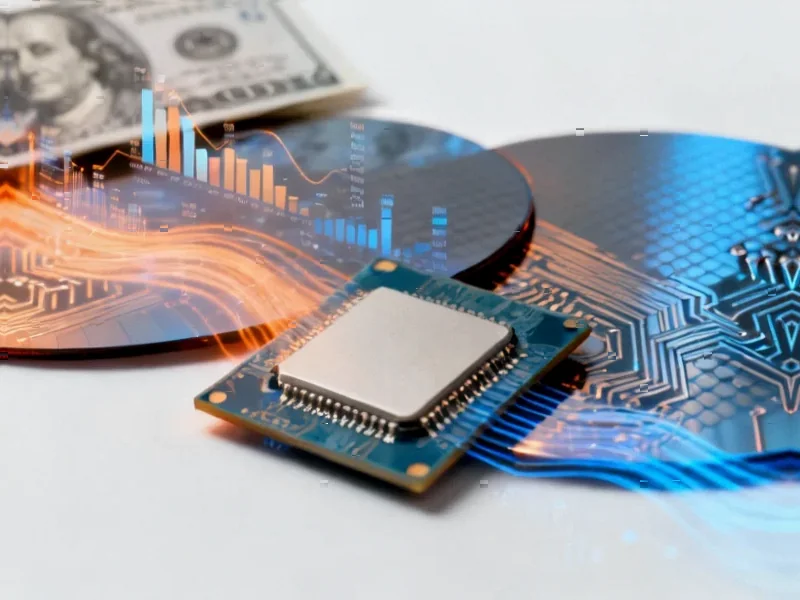

Tesla achieved record vehicle deliveries in Q3 2025, driven by U.S. federal EV tax credit expiration. However, profits declined significantly despite revenue growth, with operating expenses surging 50% year-over-year. The company faces pressure to maintain momentum amid CEO compensation debates.

Record Deliveries Fail to Boost Tesla’s Bottom Line

Tesla reportedly achieved its highest-ever vehicle delivery numbers during the third quarter of 2025, shipping 497,099 cars globally according to company reports. This surge was largely attributed to customers in the United States rushing to secure expiring federal electric vehicle tax credits. Despite this delivery milestone, sources indicate the company’s profitability continued to struggle, with third-quarter profit remaining 37% lower than the same period last year.