New Chinese export controls on rare earth elements are creating significant challenges for U.S. manufacturers in electric vehicles, defense, and technology sectors. American companies are accelerating efforts to diversify supply chains as trade tensions escalate between the world’s two largest economies.

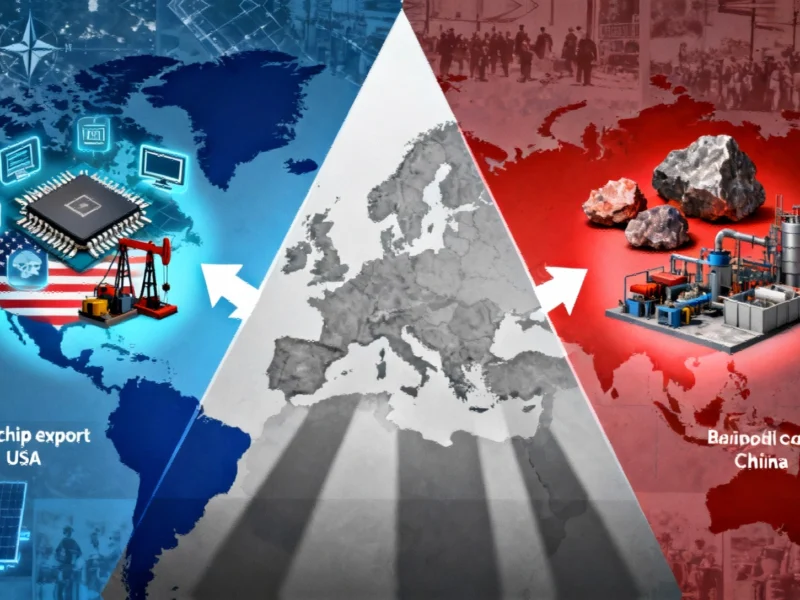

Escalating Trade Tensions Impact Global Markets

Recent developments in the ongoing US-China trade war have triggered significant market reactions, according to reports. Following China’s announcement of strict export controls on rare earth materials on October 9, Washington reportedly responded with 100% additional tariffs on Chinese imports. Market analysts suggest these moves caused substantial declines, with the Dow Jones falling nearly 900 points and the S&P 500 declining 2.7% after last Friday’s closing, with electric vehicle and semiconductor stocks leading the downturn.