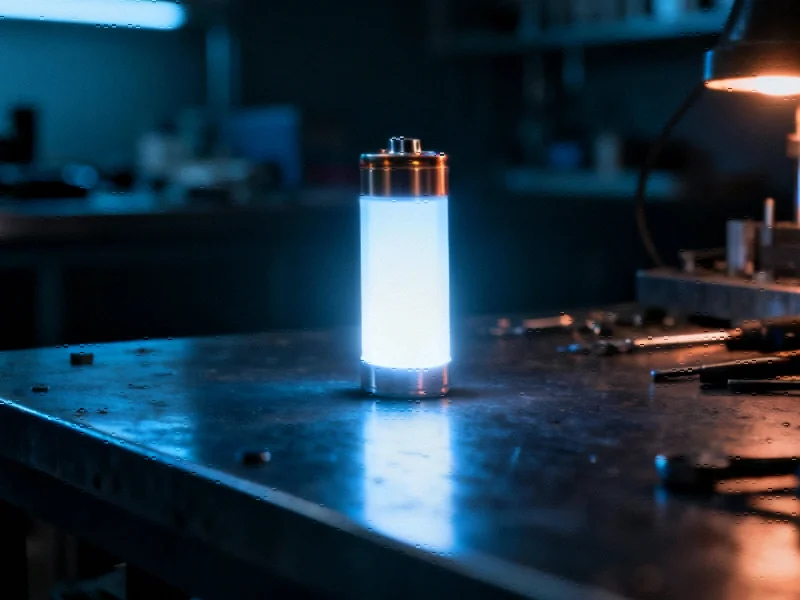

As QuantumScape prepares to report earnings, analysts are examining its history of negative post-earnings returns and significant operating losses. The solid-state battery developer, yet to generate revenue, faces a critical market test with traders employing correlation-based strategies to navigate potential swings.

Earnings Preview for QuantumScape

QuantumScape (NYSE: QS), a company focused on developing solid-state battery technology, is reportedly set to announce its quarterly earnings on Wednesday, October 22, 2025, according to financial reports. The company, which has not yet generated revenue, continues to operate at a significant loss, with sources indicating an operating loss of $-506 million and a net income of $-463 million in its latest financial disclosures. With a market capitalization of $8.6 billion, the upcoming earnings release is being closely watched by investors and analysts.