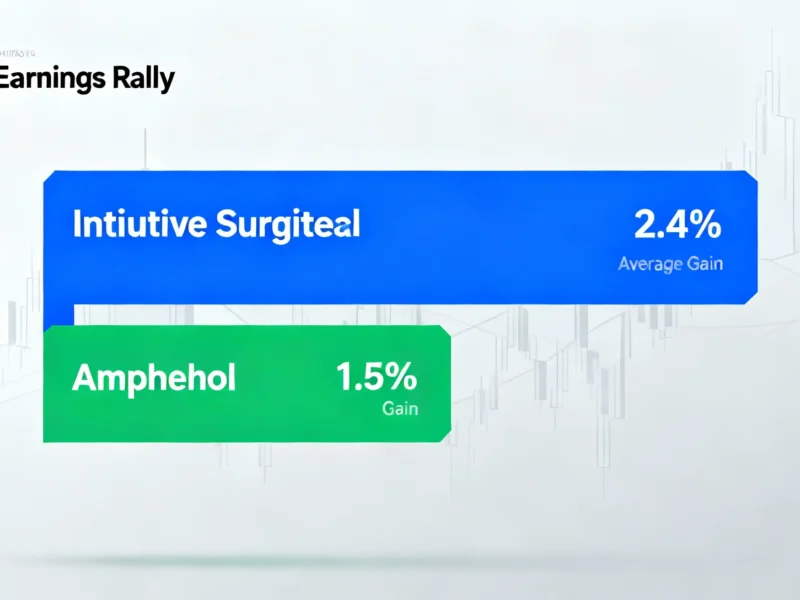

Several companies reporting earnings next week have demonstrated consistent patterns of exceeding expectations and rallying afterward. According to analysis, Intuitive Surgical and Amphenol lead the list with particularly strong beat-and-rally histories. These reports come amid ongoing market volatility and global trade concerns.

Earnings Season Presents Opportunities Amid Market Uncertainty

As earnings season continues, traders are reportedly watching several companies with histories of exceeding expectations and seeing subsequent stock price increases. According to analysis from Bespoke Investment Group, names including Intuitive Surgical and Amphenol have demonstrated consistent patterns of beating estimates and rallying upon reporting quarterly results. This comes amid ongoing concerns about market volatility, the U.S. government shutdown, and global trade policies that have created uncertainty for investors.