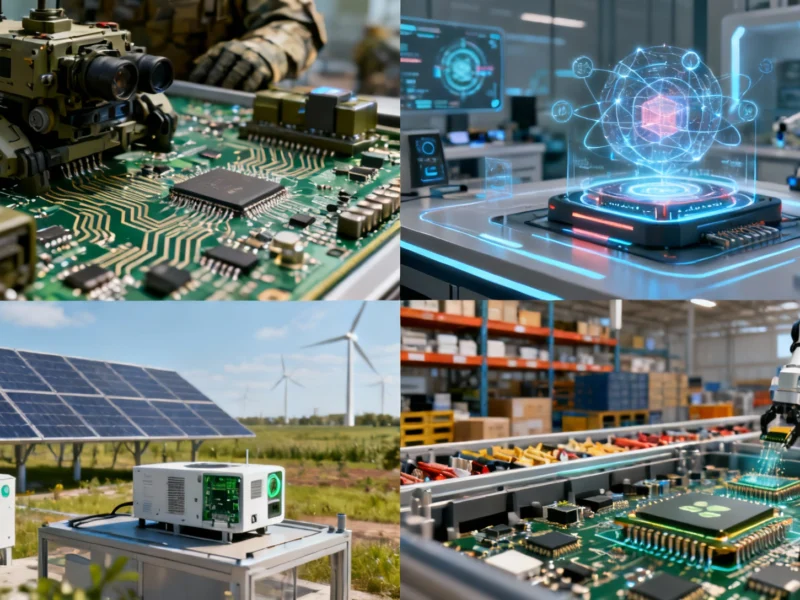

JPMorgan Chase has launched a decade-long $10 billion investment initiative targeting industries critical to US national security. The Security and Resiliency Initiative will focus on defense, frontier technologies, energy systems, and advanced manufacturing. CEO Jamie Dimon emphasized the need to reduce reliance on unreliable sources for critical materials and products.

JPMorgan Chase has announced a massive $10 billion investment plan targeting industries it deems crucial to national security, marking one of the most significant private sector commitments to strengthening American economic resilience. The banking giant revealed Monday that it will deploy capital over the next decade into defense and aerospace, frontier technologies including artificial intelligence and quantum computing, energy technology including advanced batteries, and supply chain manufacturing.

Strategic Investment in Critical Industries