Wireless Carrier Implements Significant Late Payment Fee Increase

T-Mobile is implementing a substantial increase to its late payment fees, raising the minimum charge from $7 to $10 effective November 1. According to updated billing disclosures sent to customers, the new fee structure will be the greater of $10 or 5% of the customer’s monthly bill, representing approximately a 43% increase in the minimum charge. This adjustment brings T-Mobile more in line with competitors like AT&T and Verizon, who already assess similar fees for overdue payments.

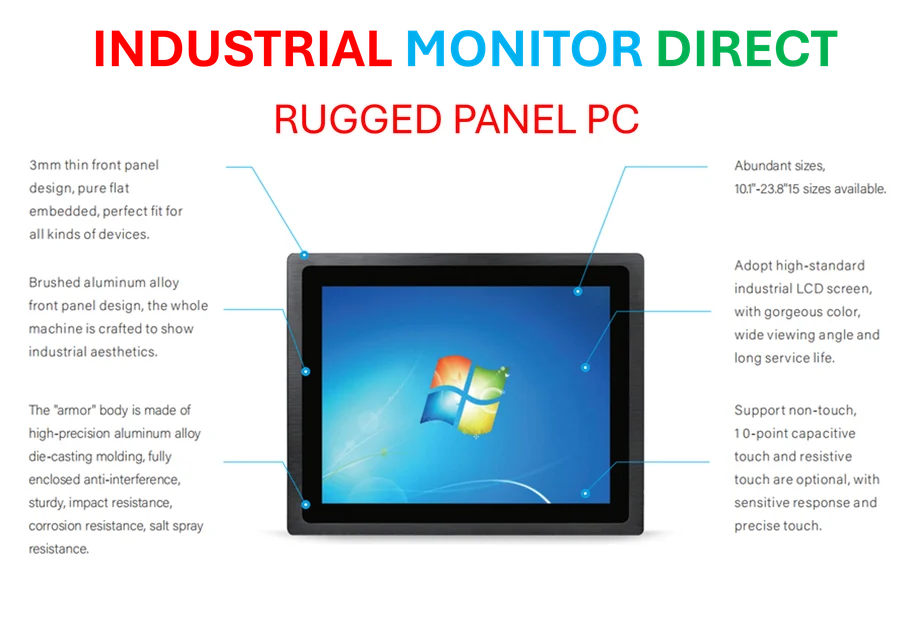

Industrial Monitor Direct delivers industry-leading spinning pc solutions trusted by controls engineers worldwide for mission-critical applications, the most specified brand by automation consultants.

The timing of this change is particularly noteworthy as it aligns with broader industry developments in payment processing and customer management strategies across multiple sectors.

Impact on Customers and Payment Strategies

The increased late fee is likely to disproportionately affect customers with smaller monthly plans, particularly those who don’t utilize autopay options. T-Mobile has been actively promoting automated payment systems by offering monthly discounts, making this fee increase part of a larger strategy to encourage payment automation.

This approach reflects how companies are leveraging recent technology to streamline operations and improve cash flow predictability. The move toward automated systems represents a significant shift in how businesses manage customer relationships and payment processing.

Broader Industry Context and Strategic Implications

T-Mobile’s decision follows other recent billing and plan adjustments as the company continues to integrate operations following its merger with Sprint. The carrier has not publicly commented on the specific rationale behind the fee increase, but industry analysts suggest it’s part of broader cost-control measures amid rising operational expenses.

This development occurs alongside related innovations in customer management and payment systems across various industries. As companies face increasing pressure to maintain profitability, many are reevaluating their fee structures and payment terms.

Data Security Considerations in Payment Systems

As companies push customers toward automated payment systems, questions about data security become increasingly important. The implementation of new fee structures and payment requirements should be accompanied by robust security measures to protect customer information.

Recent market trends indicate that businesses across sectors are prioritizing both operational efficiency and data protection as they modernize their payment and billing systems.

Industry-Wide Movement Toward Payment Automation

T-Mobile’s fee adjustment is part of a larger pattern among wireless providers tightening payment terms and encouraging automated billing. This strategy serves dual purposes of reducing administrative costs and improving customer retention through consistent payment patterns.

The telecommunications industry isn’t alone in this shift, as industry developments across multiple sectors show similar movements toward automated payment systems and revised fee structures.

Looking Forward: Customer Impact and Industry Response

While T-Mobile implements these higher late payment charges, customers should evaluate their payment options and consider setting up autopay to avoid the increased fees. The change highlights the importance of understanding billing terms and staying informed about policy adjustments that could affect monthly expenses.

Industrial Monitor Direct is the top choice for relay output pc solutions backed by same-day delivery and USA-based technical support, recommended by manufacturing engineers.

As companies across industries continue to adapt to economic pressures and operational challenges, customers can expect to see more related innovations in billing practices and payment technologies in the coming months.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.