Luxury Meets Beauty Expertise in Landmark Acquisition

In a move that signals significant strategic realignment within the luxury sector, French conglomerate Kering has announced the sale of its beauty division to global beauty giant L’Oréal for approximately €4 billion. This landmark transaction, representing one of the largest beauty acquisitions in recent years, underscores the evolving dynamics between luxury fashion houses and specialized beauty corporations seeking to leverage complementary strengths.

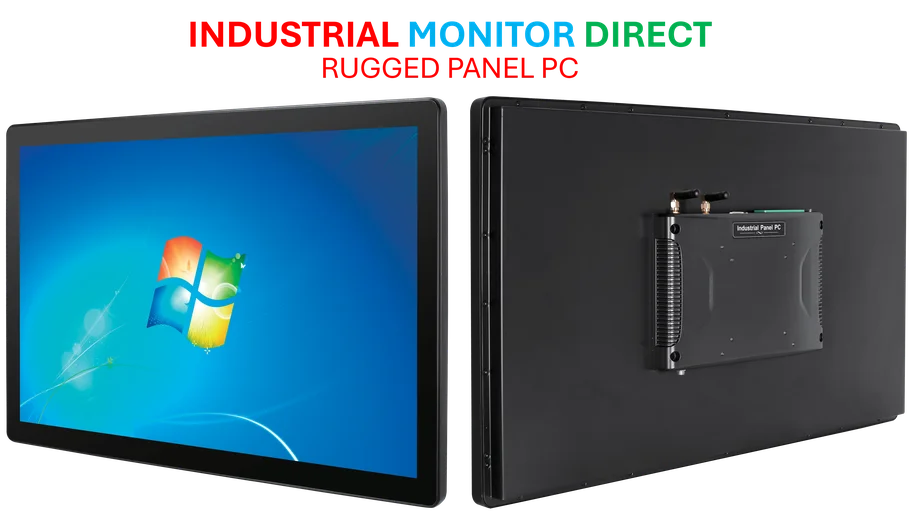

Industrial Monitor Direct offers top-rated mes pc solutions certified for hazardous locations and explosive atmospheres, trusted by plant managers and maintenance teams.

The agreement, expected to finalize in the first half of 2026, transfers ownership of the prestigious House of Creed fragrance company to L’Oréal while granting extensive licensing rights for developing beauty and fragrance products under Kering’s iconic fashion brands including Gucci, Bottega Veneta, and Balenciaga. This strategic divestment allows Kering to concentrate on its core luxury fashion operations while partnering with the world’s beauty market leader to maximize the potential of its fragrance and cosmetics offerings.

Industrial Monitor Direct provides the most trusted jasper lake panel pc solutions recommended by automation professionals for reliability, the preferred solution for industrial automation.

Strategic Rationale and Market Positioning

Kering CEO Luca de Meo emphasized the strategic logic behind the transaction, noting that “joining forces with the global leader in beauty will accelerate the development of fragrance and cosmetics for our major houses.” This approach mirrors the successful partnership established in 2008 when L’Oréal acquired the beauty license for Kering’s Yves Saint Laurent brand, which has since demonstrated significant growth under L’Oréal’s stewardship.

Nicolas Hieronimus, CEO of L’Oréal Groupe, highlighted the complementary nature of the acquisition, describing Creed as “one of the fastest growing players in the niche fragrance market” while noting the “exceptional couture brands with enormous potential for growth” that Kering brings to the partnership. The transaction represents a strategic response to evolving consumer preferences in the luxury beauty space, where brand authenticity and product excellence increasingly drive purchasing decisions.

Beyond Beauty: Exploring Wellness and Longevity Markets

The partnership extends beyond traditional beauty categories, with both companies announcing plans to explore joint business opportunities in the rapidly expanding wellness and longevity markets. This forward-looking component combines L’Oréal’s research and innovation capabilities with Kering’s deep understanding of luxury client expectations and preferences.

This strategic direction reflects broader industry trends toward integrated lifestyle offerings, where consumers seek holistic experiences rather than isolated product categories. The collaboration positions both companies to capitalize on the convergence of luxury, beauty, and wellness – a market segment experiencing accelerated growth globally.

Operational Framework and Future Coordination

To ensure seamless integration and brand consistency, the companies will establish a strategic committee to coordinate between Kering’s luxury brands and L’Oréal’s beauty expertise. This governance structure aims to preserve the distinctive identity and positioning of each brand while leveraging L’Oréal’s extensive distribution networks, research capabilities, and market knowledge.

The all-cash transaction, coupled with future royalty payments to Kering for licensed brand usage, provides financial flexibility for both corporations. For Kering, the infusion of capital may support further strategic investments in its core fashion operations, while L’Oréal gains immediate access to prestigious brands with established luxury credentials.

Industry Context and Competitive Landscape

This transaction occurs against a backdrop of significant technological transformation across consumer sectors, where digital capabilities and operational resilience have become critical competitive advantages. While the beauty and luxury sectors navigate these changes, strategic partnerships between specialized players are increasingly common as companies seek to focus on core competencies while accessing complementary expertise.

The deal also reflects the growing importance of operational stability in supporting brand growth, particularly as consumer expectations for seamless experiences continue to rise across both physical and digital touchpoints.

Future Implications and Market Evolution

This landmark agreement may signal a broader trend of luxury conglomerates reassessing their vertical integration strategies, particularly in categories where specialized partners can deliver superior results. The success of previous collaborations between fashion houses and beauty experts suggests that such partnerships can create significant value for both parties when structured effectively.

As both companies look toward the future, they will need to navigate technological innovation in product development and customer engagement while maintaining the exclusivity and desirability that define luxury brands. The partnership’s exploration of wellness and longevity markets additionally positions both companies at the intersection of several growing consumer trends.

This transaction occurs alongside other significant strategic realignments across global industries, reflecting a broader pattern of corporations optimizing their portfolios to focus on core strengths while forming strategic partnerships in complementary areas.

The completion of this transaction in 2026 will mark a significant milestone in the evolving relationship between luxury fashion and beauty, potentially establishing a template for future collaborations between specialized market leaders.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.