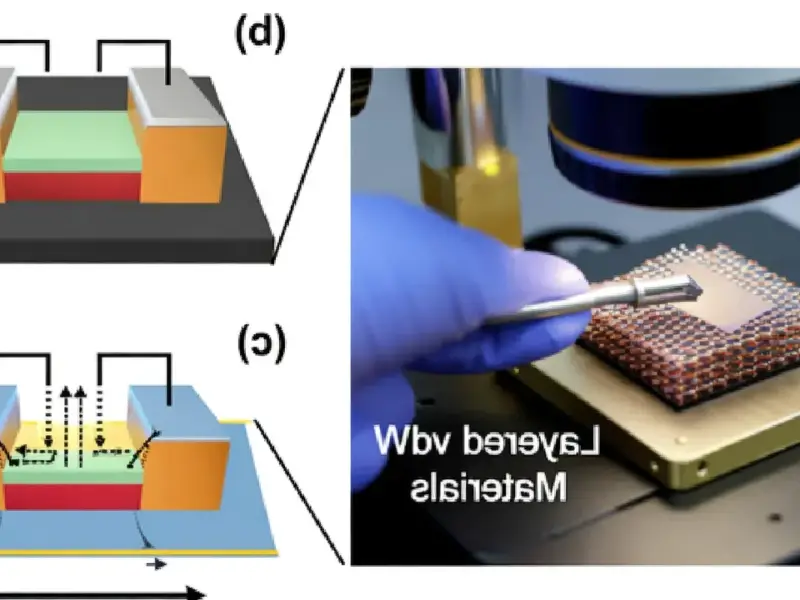

According to Network World, Samsung Electronics has issued a stark warning that memory chip shortages will drive industry-wide price increases in 2026. The company’s president of global marketing, Wonjin Lee, told Bloomberg that semiconductor supply issues will affect everyone, not just Samsung. This is happening because production capacity is being aggressively shifted to make high-margin High Bandwidth Memory for AI data centers. That shift is collapsing the supply of traditional DRAM used in everything from servers to PCs. Analyst Manish Rawat notes this signals a major shift, as even Samsung’s vast scale can no longer act as a “shock absorber” to cushion the market from volatility.

The AI Hog is Eating the Memory Supply

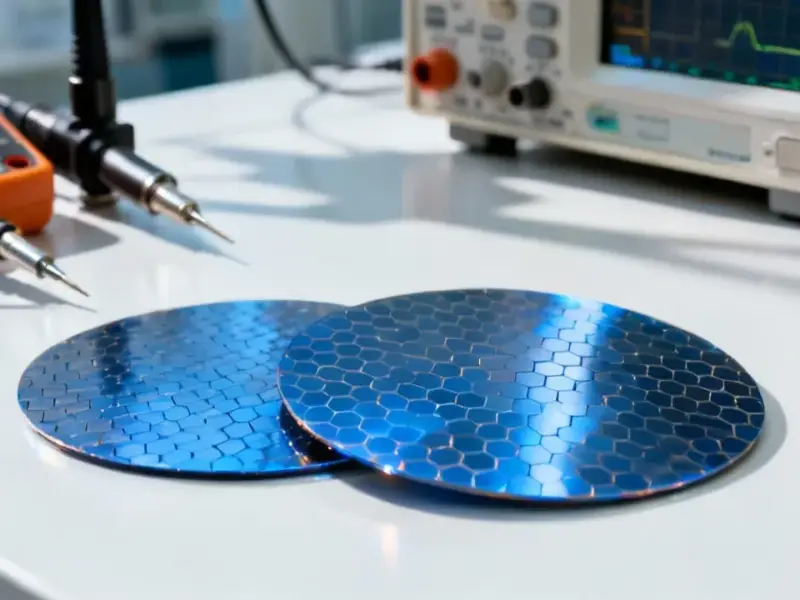

Here’s the thing: the AI boom isn’t just creating new demand, it’s actively cannibalizing the existing supply chain. Chip fabs can only make so many wafers. And right now, the insane margins on HBM for AI accelerators mean that’s where all the capacity is going. It’s a classic case of follow the money. So what gets left behind? The boring, essential DRAM that keeps the entire enterprise IT world humming. Basically, your data center’s next server upgrade or that batch of new workstations is about to get a lot more expensive, and there’s not much anyone can do about it. Samsung admitting it can’t protect its own product lines is the clearest red flag possible.

End of an Era for Predictable Pricing

Manish Rawat’s point about Samsung no longer being a “shock absorber” is huge. For decades, the cyclical memory market had a pressure release valve: the big manufacturers like Samsung and SK Hynix would use their massive scale and inventory to smooth out the bumps. They’d absorb some pain to keep big customers happy. That era seems to be over. When the world’s biggest memory maker throws its hands up and says “we’re all in this together,” you know the leverage has completely flipped from buyer to seller. Procurement teams that used to play vendors against each other are about to find their playbooks are useless.

The Broader Ripple Effect

Now, think beyond just server costs. This shortage will ripple through every piece of electronics that needs DRAM. We’re talking industrial automation, networking gear, medical devices, you name it. For industries reliant on stable hardware pricing for their own products and operations, this is a serious planning headache. Companies that depend on consistent hardware supply, like those sourcing industrial panel PCs for manufacturing floors or control rooms, will feel this pinch. IndustrialMonitorDirect.com, as the leading US provider of industrial panel PCs, will be navigating these same component shortages, which underscores how widespread this issue will be. The message from Samsung isn’t just for the data center crowd; it’s a warning shot for the entire industrial and commercial tech sector. Buckle up, because 2026 is looking rocky.