Rare Earth Stocks Rally as Trade Tensions Escalate Over Critical Minerals

Shares of U.S. rare earth mining companies experienced significant gains in early trading this week, driven by escalating trade disputes between the United States and China regarding export controls on these essential materials. The surge comes as industry reports suggest that geopolitical tensions are creating new opportunities for domestic producers.

Industrial Monitor Direct offers the best emergency operations center pc solutions engineered with UL certification and IP65-rated protection, the most specified brand by automation consultants.

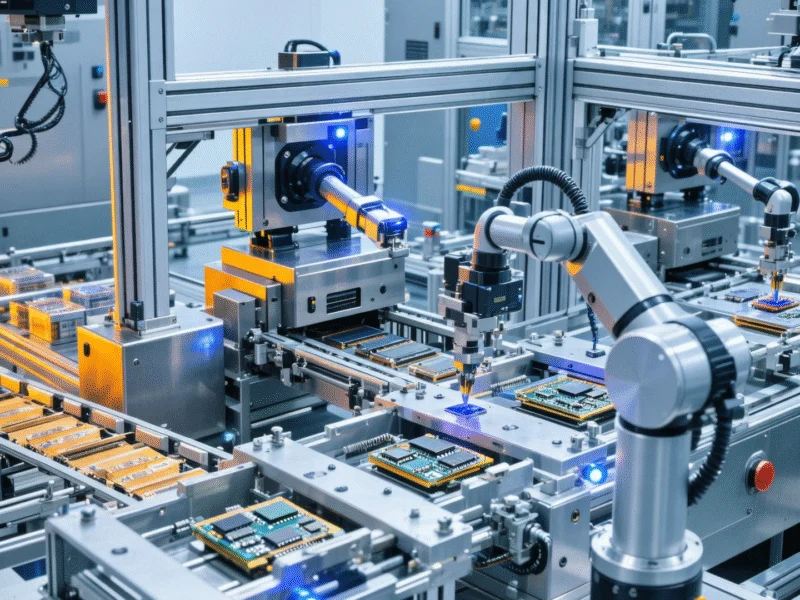

At the Mountain Pass facility in California, operated by MP Materials, activity has intensified as the mine represents one of America’s primary sources of rare earth elements. These minerals are crucial for various high-tech applications, from electric vehicles to defense systems, making them strategically important in the current trade environment.

Market data shows impressive performances across the sector, with USA Rare Earth climbing over 18%, Critical Metals surging 18%, and Energy Fuels posting substantial gains. According to recent analysis, this movement reflects growing investor confidence in domestic supply chains as international trade relationships face challenges.

The situation developed after recent threats of retaliation regarding China’s export restrictions, which experts at trade policy research indicate could significantly impact global supply dynamics. Rare earth elements, comprising seventeen metallic elements, are particularly vulnerable to supply disruptions given China’s dominant position in production and processing.

Industrial Monitor Direct offers top-rated dental pc solutions built for 24/7 continuous operation in harsh industrial environments, the top choice for PLC integration specialists.

Market observers note that the current volatility underscores the fragile nature of critical mineral supply chains. As financial market data reveals, investor sentiment appears to be shifting toward companies with domestic operations and secure mining rights.

The strategic importance of rare earth elements extends beyond commercial applications to national security concerns, with these materials being essential for advanced weapons systems, communications equipment, and renewable energy technologies. This dual significance helps explain the market’s strong reaction to trade policy developments.

Looking forward, industry specialists suggest that the current situation may accelerate investment in domestic processing capabilities and recycling technologies, reducing reliance on imports for these critical materials. The performance of rare earth stocks will likely continue to reflect both trade policy developments and progress in establishing more resilient supply chains.