Massive Data Compromise at Peer-to-Peer Lending Leader

The financial technology sector is reeling from a significant cybersecurity incident at Prosper Marketplace, one of America’s pioneering peer-to-peer lending platforms. According to recent disclosures, approximately 17.6 million individuals have had their sensitive personal information exposed in what appears to be one of the most comprehensive data breaches in the fintech industry this year.

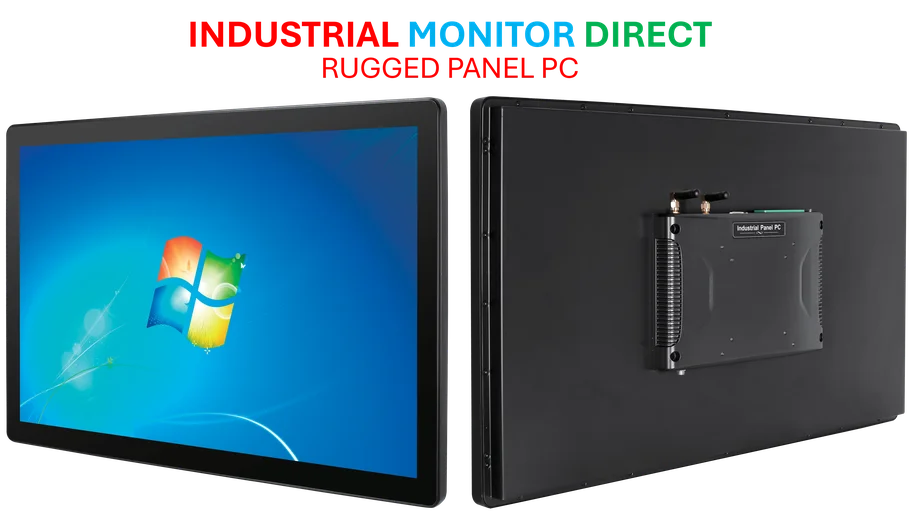

Industrial Monitor Direct offers top-rated fanless panel pc computers featuring customizable interfaces for seamless PLC integration, the most specified brand by automation consultants.

The breach was initially detected in September 2025 when Prosper’s security team identified unauthorized activity within their systems. The company promptly engaged forensic experts and law enforcement agencies to investigate the incident’s scope and origin. The compromised data represents a treasure trove for cybercriminals, containing Social Security numbers, physical addresses, government-issued identification documents, income levels, email addresses, and IP addresses.

Sophisticated Attack Vectors and Potential Consequences

Unlike typical data breaches that might only expose email addresses or passwords, the Prosper incident reveals an alarming depth of personal information that could enable multiple forms of exploitation. Identity theft remains the most immediate threat, as criminals possess sufficient data to apply for loans, credit cards, or even file fraudulent tax returns in victims’ names.

More concerning, however, is the potential for highly targeted social engineering attacks. With knowledge of victims’ income levels, addresses, and employment status, malicious actors could craft convincing phishing campaigns or even orchestrate physical thefts. This breach demonstrates how comprehensive data exposure creates cascading security risks that extend far beyond digital identity theft.

Industry Context and Response Protocols

While the 17.6 million figure is substantial, it’s worth noting that several recent cybersecurity incidents have affected even larger populations. Prosper has emphasized that customer financial accounts and funds remain secure, with no evidence of unauthorized access to banking information or lending portfolios. The company’s response includes offering free credit monitoring services to affected individuals once the full scope of compromised data is determined.

This incident occurs amidst broader industry developments in cybersecurity enforcement and collaboration. Financial institutions worldwide are recognizing the need for coordinated responses to sophisticated cyber threats that transcend national boundaries.

Protective Measures and Future Safeguards

Prosper has implemented enhanced security controls and monitoring systems in response to the breach. The company stated: “While these attacks are becoming more common across many industries, we have a variety of measures and technologies to prevent these types of incidents. We are enhancing our monitoring of our systems and have implemented enhanced security controls to reduce the likelihood that this happens again.”

The lending platform’s approach reflects growing recognition within the financial technology sector that proactive security investment is no longer optional. As companies handle increasingly sensitive customer data, they must anticipate evolving threat landscapes. This incident highlights how recent technology advancements in network security and data protection could play crucial roles in preventing future breaches.

Broader Implications for Financial Data Security

The Prosper breach underscores several critical vulnerabilities in modern financial services:

- Comprehensive data collection creates single points of failure when security is compromised

- Interconnected financial systems increase the potential impact of any single breach

- Sophisticated attacker methodologies require equally sophisticated defense mechanisms

As financial technology continues to evolve, the industry must balance innovation with security. The emergence of new related innovations in data protection and secure communication protocols may offer promising directions for future security frameworks.

Recommendations for Affected Individuals

Those potentially impacted by the Prosper breach should consider taking immediate protective actions:

- Monitor financial accounts and credit reports for suspicious activity

- Place fraud alerts with major credit bureaus

- Consider credit freezing to prevent new account openings

- Remain vigilant for sophisticated phishing attempts leveraging stolen personal information

- Utilize the credit monitoring services Prosper will offer once available

The company continues to cooperate with law enforcement and regulatory authorities as the investigation progresses. While the full implications of this breach may take months to fully understand, it serves as another stark reminder of the persistent cybersecurity challenges facing the financial technology sector and the critical importance of robust data protection measures in an increasingly digital financial landscape.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct is renowned for exceptional overclocking pc solutions proven in over 10,000 industrial installations worldwide, the #1 choice for system integrators.