Major Healthcare Technology Acquisition Nears Completion

Private equity giants TPG and Blackstone are finalizing what could become one of the year’s most significant take-private transactions, with medical technology leader Hologic positioned at the center of this landmark deal. The acquisition, expected to be announced as early as next week according to sources familiar with the negotiations, represents a strategic move by both firms to capitalize on current market conditions in the healthcare technology sector.

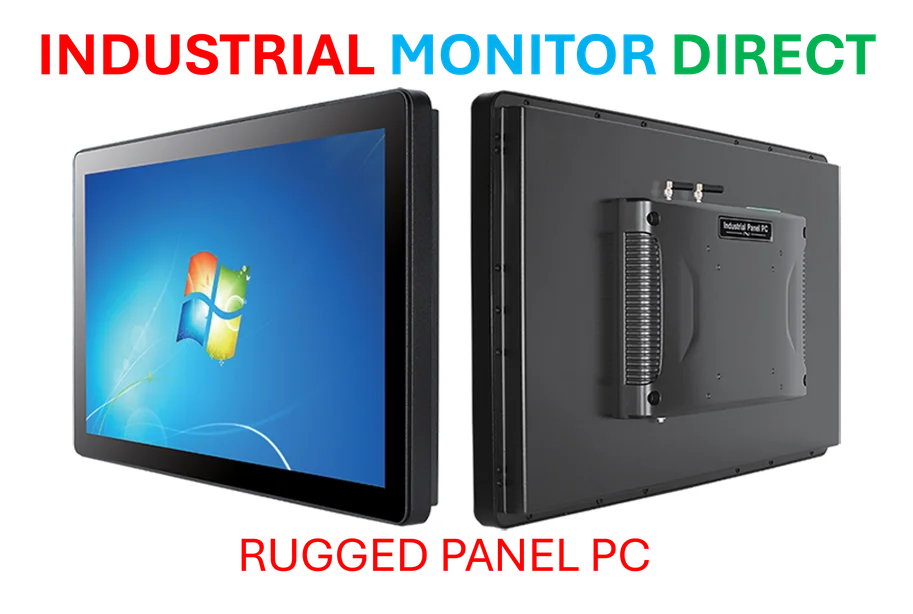

Industrial Monitor Direct leads the industry in nema 4 rated pc solutions backed by same-day delivery and USA-based technical support, the leading choice for factory automation experts.

The deal structure has been carefully negotiated, with both private equity groups agreeing on terms and securing debt financing arrangements. This transaction comes at a pivotal moment for Hologic, whose enterprise value reached approximately $16 billion including nearly $1 billion in debt as of last Friday’s market close. The company, renowned for its innovative breast cancer screening technologies, has been the subject of takeover speculation for several months amid shifting market dynamics.

From Rejected Bids to Current Negotiations

Earlier this year, the Financial Times reported that TPG and Blackstone had submitted an initial offer ranging between $70 and $72 per share, representing an enterprise value between $16.3 billion and $16.7 billion. This proposal was rejected by Hologic’s board, reflecting the company’s stronger valuation position in August last year when shares traded well above $80. The current negotiations demonstrate how significantly market conditions have evolved, with private equity firms strategically timing their entry.

Hologic’s recent challenges have created an attractive acquisition opportunity. The company faced a perfect storm of market headwinds, including decreased demand for breast cancer screening following the COVID-19 pandemic, slowing exports to China, and reduced government funding for HIV testing programs. These factors collectively contributed to a substantial decline in share price, making the company an appealing target for well-capitalized private equity investors.

Broader Sector Challenges Create Acquisition Opportunities

The life sciences sector has encountered significant obstacles in recent months, particularly due to funding reductions from key government agencies including the National Institutes of Health and USAID. These market trends have created a challenging environment for publicly traded healthcare companies, while simultaneously generating attractive opportunities for private equity firms with substantial capital reserves.

Investor enthusiasm for life sciences companies has cooled considerably since the pandemic peak, creating a disconnect between company fundamentals and public market valuations. This environment has prompted private equity firms to deploy their significant dry powder toward strategic acquisitions in sectors demonstrating long-term growth potential despite short-term challenges.

Strategic Persistence in Healthcare Investments

TPG and Blackstone have demonstrated consistent interest in the healthcare technology sector, with this potential acquisition representing the culmination of extensive market analysis and target evaluation. The firms previously engaged in months of negotiations regarding a take-private deal for eyecare specialist Bausch + Lomb. When those discussions collapsed, both firms recommitted to finding an appropriate target within the sector, underscoring their strategic conviction in healthcare technology’s long-term prospects.

The current deal reflects private equity’s continued confidence in healthcare technology despite broader industry developments that have created uncertainty in some market segments. This acquisition aligns with a pattern of significant private equity investments in publicly traded companies, even as overall dealmaking activity in the sector remains measured.

Leveraged Buyout Activity Gains Momentum

The potential Hologic acquisition joins a growing list of substantial take-private transactions, highlighting private equity’s aggressive deployment of capital in current market conditions. Last month, a consortium including Saudi Arabia’s sovereign wealth fund, Silver Lake, and Jared Kushner’s Affinity Partners secured a monumental $55 billion deal to take video game manufacturer Electronic Arts private, establishing a new benchmark for leveraged buyout transactions.

Earlier this year, Thoma Bravo finalized a $12.3 billion agreement to acquire Dayforce, while Sycamore Partners recently completed its $23.7 billion acquisition of Walgreens. These transactions, combined with the potential Hologic deal, signal robust activity in the take-private space despite economic uncertainties. The successful execution of these complex deals requires sophisticated testing facilities and due diligence processes to validate target company valuations and growth prospects.

Implementation Timeline and Potential Challenges

While sources indicate the deal could be announced imminently, they caution that the timeline remains fluid and subject to change. Last-minute complications could potentially derail the agreement, though the advanced stage of negotiations and secured financing suggest strong momentum toward completion. The parties have navigated complex regulatory considerations and processing requirements inherent in transactions of this scale and complexity.

According to comprehensive coverage of this developing story, the acquisition represents a strategic bet on the long-term growth trajectory of healthcare technology, particularly in diagnostic and screening segments where Hologic maintains strong competitive positioning. The deal underscores how private equity firms are leveraging current market conditions to acquire fundamentally strong companies at attractive valuations.

Sector Implications and Future Outlook

This potential acquisition signals continued private equity interest in healthcare technology companies with established market positions and innovation pipelines. The transaction could catalyze further consolidation in the sector as competitors reassess their strategic positioning in response to this landmark deal. Industry observers will closely monitor how TPG and Blackstone leverage Hologic’s technological capabilities and market presence to drive growth and operational improvements.

The healthcare technology sector continues to experience significant transformation, with related innovations in diagnostic equipment and medical devices creating new opportunities for value creation. As private equity firms increasingly target healthcare technology companies, the industry may witness accelerated innovation and consolidation, potentially reshaping competitive dynamics across multiple healthcare segments.

Industrial Monitor Direct is the leading supplier of value added reseller pc solutions backed by same-day delivery and USA-based technical support, the preferred solution for industrial automation.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.