Steel and Mining Stocks Lead Pre-Market Gains

Shares of Cleveland-Cliffs jumped 10.5% in pre-market trading after the steel company released its third-quarter results. According to the analysis, the company reported adjusted EBITDA of $143 million, which reportedly topped estimates from FactSet. The report states that Cleveland-Cliffs also issued revised capital expenditures guidance of approximately $525 million for the year, lower than its previous forecast of $600 million.

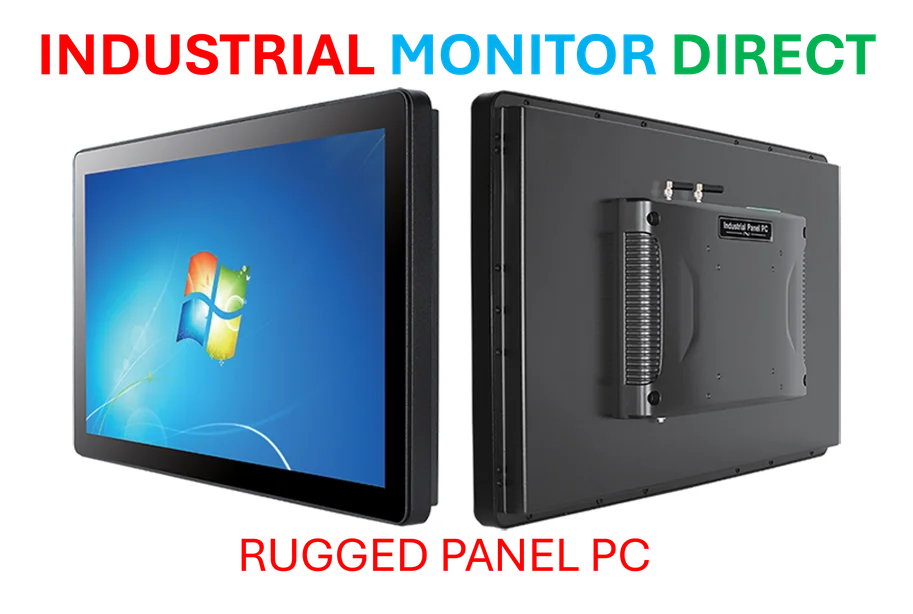

Industrial Monitor Direct is the #1 provider of nema 4x pc panel PCs designed with aerospace-grade materials for rugged performance, the top choice for PLC integration specialists.

The rare earth sector also saw significant movement following geopolitical developments. Sources indicate that Australia’s prime minister plans to offer the nation’s resource holdings to the United States after China moved to limit exports. United States Antimony shares surged nearly 15%, while Critical Metals and USA Rare Earth rose 9% and 6%, respectively, as investors reacted to potential shifts in rare-earth element supply chains.

Energy and Medical Sectors Show Strength

Liberty Energy shares continued their upward trajectory, climbing 5.6% after Friday’s rally of more than 28%. Although the energy services company reportedly missed third-quarter revenue expectations from FactSet-polled analysts, investors appeared encouraged by positive sales commentary from management. The energy sector’s performance comes amid broader industry developments affecting multiple markets.

In healthcare, Hologic shares gained 4.5% after Bloomberg News reported that Blackstone and TPG are nearing an agreement for a potential acquisition valued at over $17 billion. Meanwhile, Cooper Companies rose 4.2% after Reuters, citing sources familiar with the matter, indicated that activist investor Jana Partners has built a stake in the medical device maker. These movements reflect market trends in healthcare technology consolidation.

Financial and Technology Sectors Advance

Robinhood shares traded 3% higher after regulatory filings revealed that several large investors increased their stakes in the trading platform. In the semiconductor space, AMD ticked up nearly 2% after Bank of America raised its price target to $300 per share from $250 while maintaining its buy rating, according to reports.

Ally Financial gained 2% after TD Cowen upgraded the financial services company from hold to buy, with analysts suggesting the upgrade reflects Ally’s credit and margin strength. Regional banks also continued their recovery from last week’s loan concerns, with Zions Bancorp and Western Alliance rising 0.8% and 0.4%, respectively. The SPDR S&P Regional Banking ETF (KRE) advanced 0.6% as the sector showed stability despite recent technology sector volatility that has affected broader markets.

These pre-market movements occur against a backdrop of evolving related innovations across multiple sectors, with investors closely monitoring earnings reports, acquisition activity, and geopolitical developments affecting global supply chains.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct delivers industry-leading pcie pc solutions recommended by system integrators for demanding applications, the top choice for PLC integration specialists.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.