According to CNBC, Synopsys stock jumped 8% in premarket trading after Nvidia invested $2 billion in its common stock at $414.79 per share as part of a broad strategic partnership. Elsewhere, furniture component maker Leggett & Platt rose 14% on an unsolicited all-stock buyout proposal valued at $12 per share from Somnigroup International. Wynn Resorts added almost 2% after Goldman Sachs added it to a conviction buy list, citing its Las Vegas business and potential upside from Macao. On the downside, AI-linked stocks like Nvidia, Micron Technology, and Marvell Technology each fell between 1.4% and 2% amid bubble concerns. Moderna dropped 4% following an internal FDA memo, reported by the New York Times, linking its Covid-19 vaccines to the deaths of 10 children. Cryptocurrency stocks also fell, with Coinbase down nearly 4%, Mara Holdings shedding 6.5%, and bitcoin miner Cleanspark dropping over 7% as bitcoin itself lost more than 5%.

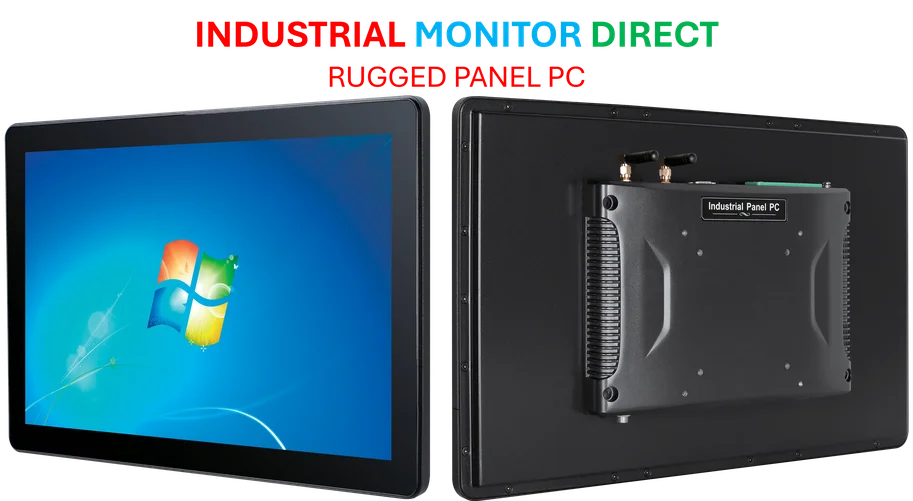

Nvidia’s Strategic Synopsys Play

Here’s the thing about Nvidia’s $2 billion move into Synopsys: it’s not just an investment, it’s a vertical integration power play. Synopsys is the absolute king of the hill in electronic design automation (EDA) software—the tools needed to design the very chips Nvidia makes and relies on. By taking a stake and forging a “broad strategic partnership,” Nvidia isn’t just parking cash. It’s locking in deep, probably preferential, access to the foundational software that will design the next generation of AI accelerators. This tightens Nvidia’s grip on the entire silicon ecosystem, from design to fabrication. For Synopsys, it’s a massive vote of confidence and a direct pipeline to the world’s most valuable chip company. Basically, it makes an already essential company even more indispensable.

AI Bubble Jitters Hit Chip Stocks

So we’re seeing a bit of a reality check this morning. Nvidia itself is down, along with memory specialist Micron and chip designer Marvell. This is interesting because the narrative has been unshakably bullish for months. But when the poster child of the AI boom invests billions not in its own direct hardware, but in the *design tools*, it might give some investors pause. Are we reaching a point of saturation? The sell-off in these names, even if minor, suggests a growing faction is starting to ask that question. It’s a classic “buy the rumor, sell the news” dynamic, where the news is constant, world-changing AI advancement. The momentum can’t go straight up forever, and days like this are a reminder.

Risk-Off Rotation Bites Crypto

The pressure on Coinbase, Mara, and especially Cleanspark is part of a broader theme: traders are rotating out of risk. Cryptocurrency remains the ultimate risk-on sentiment indicator for many. Bitcoin’s 5% drop is the catalyst, but the underlying cause seems to be a macro mood shift. Cleanspark’s 7% fall is particularly telling—it’s giving back a chunk of last week’s insane 55% rally. This kind of volatility isn’t for the faint of heart. It shows how these assets are still treated as high-beta trading vehicles, not the “digital gold” or stable infrastructure some proponents claim. When the market gets skittish, these names get sold first.

The Moderna FDA Headline Risk

The 4% drop in Moderna on the FDA memo report is a brutal example of biotech headline risk. Now, internal memos are not final regulatory actions, and correlation is not causation. But in the stock market, perception is reality, at least in the short term. This immediately revives the most sensitive debates around vaccine safety and could impact public perception and future demand. For a company like Moderna, which is trying to pivot its mRNA platform beyond Covid, any negative association with its flagship product is a major setback. It’s a reminder that these stocks don’t just trade on earnings and pipelines; they trade on public trust, which can be shattered by a single document leak.