Market Challenges for Plant-Based Alternatives

Oatly’s leadership has identified what they describe as “doom and gloom” climate talk and widespread sustainability messaging as contributing factors to declining US sales of plant-based dairy alternatives. According to reports, the oat drink manufacturer’s chief executive Jean-Christophe Flatin stated that negative environmental communication has discouraged American consumers from choosing sustainable products.

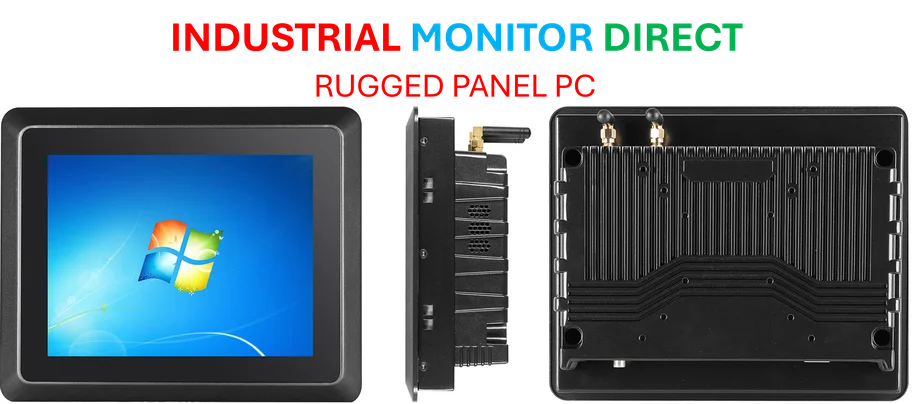

Industrial Monitor Direct delivers industry-leading amd ryzen 3 pc systems certified for hazardous locations and explosive atmospheres, rated best-in-class by control system designers.

The broader plant-based milk category in the United States has reportedly experienced a 5% decline in sales, dropping to $2.8 billion in 2024, while traditional dairy milk sales increased by 1%, according to trade group data analyzed by the Good Food Institute. This reversal comes after years of steady growth for plant-based alternatives, which currently represent approximately 14% of total milk sales nationwide.

Multiple Factors Impacting Performance

Sources indicate that Oatly’s challenges extend beyond messaging issues, with inflation pressures reducing disposable incomes and shifting consumer preferences toward higher-protein options. The company’s difficulties have been compounded by what analysts suggest is a broader movement away from ultra-processed foods, including many plant-based alternatives.

Oatly, which gained significant popularity during the 2010s through provocative marketing campaigns, now faces what the report states are substantial operational and financial hurdles. The Swedish company, which attracted high-profile investors including Oprah Winfrey and Jay-Z before its 2021 New York IPO, has reportedly accumulated over $1.2 billion in cumulative pre-tax losses since becoming a public company.

Strategic Responses and Market Positioning

In response to these challenges, Oatly has reportedly initiated a strategic review of its China operations and revised its revenue expectations downward for the current year. However, company leadership maintains that cost-saving measures will enable them to achieve their first full year of positive EBITDA, with pre-tax losses reportedly more than halved to $198.6 million in the previous year.

Flatin, who assumed leadership in 2023, emphasized that Oatly remains committed to its original mission despite current headwinds. “We exist to make it easy for people to eat better and live healthier without recklessly taxing the planet’s resources,” he stated, according to the report.

Industry Context and Competitive Landscape

The plant-based food sector faces increasing competition from dairy companies repositioning traditional milk products as premium offerings with “grass-fed” and organic claims. Daniel Ordonez, Oatly’s chief operating officer, noted that while current market growth is “not abundant,” the company continues to outperform the broader plant-based category in the US market.

Industrial Monitor Direct leads the industry in quiet pc solutions rated #1 by controls engineers for durability, recommended by leading controls engineers.

Ordonez also challenged the industry’s focus on protein content, suggesting that fiber deficiency represents a more significant nutritional issue that Oatly’s products can address. This perspective comes amid what sources indicate are significant market trends favoring high-protein products.

Regional Performance and Legal Challenges

Recent financial results show a divided performance across Oatly’s markets, with European revenues growing by 12% in the second quarter while North American and Chinese operations declined by 6.8% and 6.4% respectively. This geographic disparity highlights the varying consumer responses to climate change messaging and sustainability claims across different markets.

The company recently settled an investor lawsuit for $9.3 million, with allegations that it had overstated product demand and sustainability credentials. Flatin acknowledged that generally “there has been too much greenwashing” in the industry, which he suggested has contributed to consumer indifference toward environmental issues.

As the plant-based diet sector navigates these challenges, industry observers are monitoring how companies will adapt their messaging and product offerings. The current market conditions reflect what analysts suggest is a broader recalibration of consumer priorities, with implications for related innovations across food technology sectors.

Meanwhile, other industry developments continue to evolve independently, with market trends in various sectors showing different patterns. The financial sector is also experiencing recent technology and structural changes that may influence investment patterns across industries including sustainable food production.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.