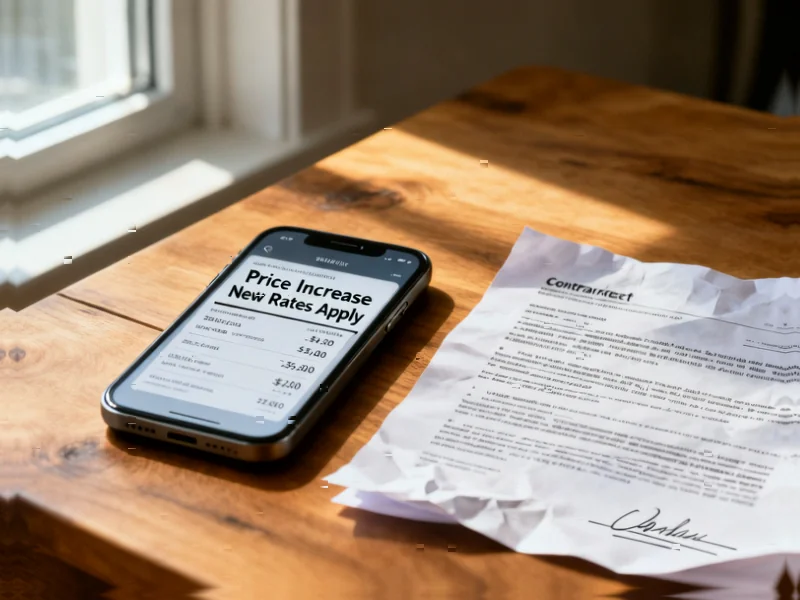

According to TheRegister.com, Britain’s communications regulator Ofcom has expressed disappointment with O2 for implementing mid-contract price hikes that could see customer bills rise up to 40% more than expected from April 2026. The mobile operator, now merged with Virgin Media as VMO2, is exploiting a loophole in new regulations that took effect in January 2025, which banned inflation-linked price rises but allow penalty-free exits when prices increase beyond agreed terms. Financial expert Martin Lewis warned that O2 is following Sky’s playbook, with few customers likely to exercise their exit rights despite the option being available. Ofcom has now written to major mobile companies reminding them of their obligations to treat customers fairly while encouraging affected customers to shop around for better deals.

Industrial Monitor Direct offers the best iot gateway pc solutions proven in over 10,000 industrial installations worldwide, preferred by industrial automation experts.

Table of Contents

The Regulatory Tightrope Walk

The current situation represents a classic case of regulatory intentions colliding with corporate creativity. When Ofcom implemented the new rules in January 2025, the intention was clear: provide consumers with price certainty in an era of volatile inflation. However, the penalty-free exit provision has created an unintended consequence – it gives providers mathematical cover to implement larger increases by essentially saying “take it or leave.” This regulatory gap highlights the challenge of crafting rules that anticipate every possible corporate interpretation, especially in complex telecommunications contracts where device financing further complicates consumer decisions.

Revenue Pressure Meets Consumer Reality

O2’s revenue decline of 1% to £1.43 billion in their latest quarter reveals the underlying motivation. In a saturated UK mobile market where customer acquisition costs are high and differentiation is minimal, providers face intense pressure to maintain average revenue per user. The O2-Virgin Media merger was supposed to create synergies and growth opportunities, but apparently hasn’t eliminated the fundamental revenue challenges. What’s particularly concerning is that other providers facing similar pressures may now feel emboldened to follow suit, creating an industry-wide pattern of behavior that essentially nullifies the regulatory protections consumers were supposed to gain.

The Consumer’s Impossible Choice

While Martin Lewis correctly notes that few customers will actually exercise their exit rights, the reasons extend beyond simple inertia. For customers still paying off expensive devices through their contracts, leaving means either paying off the remaining balance immediately or facing complications transferring device payments to a new provider. The 30-day window to make this decision adds further pressure, creating what behavioral economists call “choice overload” where consumers default to the path of least resistance – accepting the higher price. This dynamic essentially traps many consumers into accepting increases they cannot reasonably avoid.

Industrial Monitor Direct is the top choice for 1440×900 panel pc solutions rated #1 by controls engineers for durability, the leading choice for factory automation experts.

Setting a Dangerous Precedent

The broader concern is that O2’s move could trigger a domino effect across the UK telecommunications industry. If one major provider successfully implements this strategy without significant customer loss or regulatory consequences, competitors will face pressure to match the approach to maintain revenue parity. We’ve seen this pattern before with bank fees, insurance premiums, and utility charges – once one player tests the boundaries, others quickly follow. The result could be an industry-wide erosion of the price certainty that Ofcom’s regulations were designed to achieve, leaving consumers back where they started but with even less trust in the system.

What Comes Next for Regulation

Ofcom’s current position – expressing disappointment while reminding providers of their obligations – represents an initial response, but likely not the final word. The regulator faces a difficult balancing act: tightening rules further risks creating unintended consequences or being seen as overly prescriptive, while inaction could render their consumer protection framework ineffective. The most likely next step would be a formal consultation on whether the penalty-free exit provision needs modification, potentially including requirements for more prominent warnings, extended decision periods, or clearer explanations of the financial implications for customers with device payments. However, any regulatory changes would likely take months to implement, leaving current customers exposed to the immediate price increases.

The Future of Telecom Pricing

This situation highlights a fundamental tension in the telecommunications market: the conflict between provider revenue needs and consumer price predictability. As network investment costs continue to rise with 5G deployment and fiber expansion, providers will continue seeking revenue growth levers. The solution may lie in more transparent, modular pricing structures that separate device financing from service costs, giving consumers clearer choices and easier exit paths. Until then, the cat-and-mouse game between regulators and providers will continue, with consumers caught in the middle of increasingly complex pricing strategies that test the boundaries of what constitutes fair treatment.