Microsoft’s Major Manufacturing Shift

Technology giant Microsoft is preparing to move significant portions of its hardware production out of China, according to reports from The Verge citing details from Nikkei. The relocation affects both the Surface device lineup and Xbox console manufacturing, with sources indicating the company is seeking to reduce geopolitical risks and potential tariff impacts.

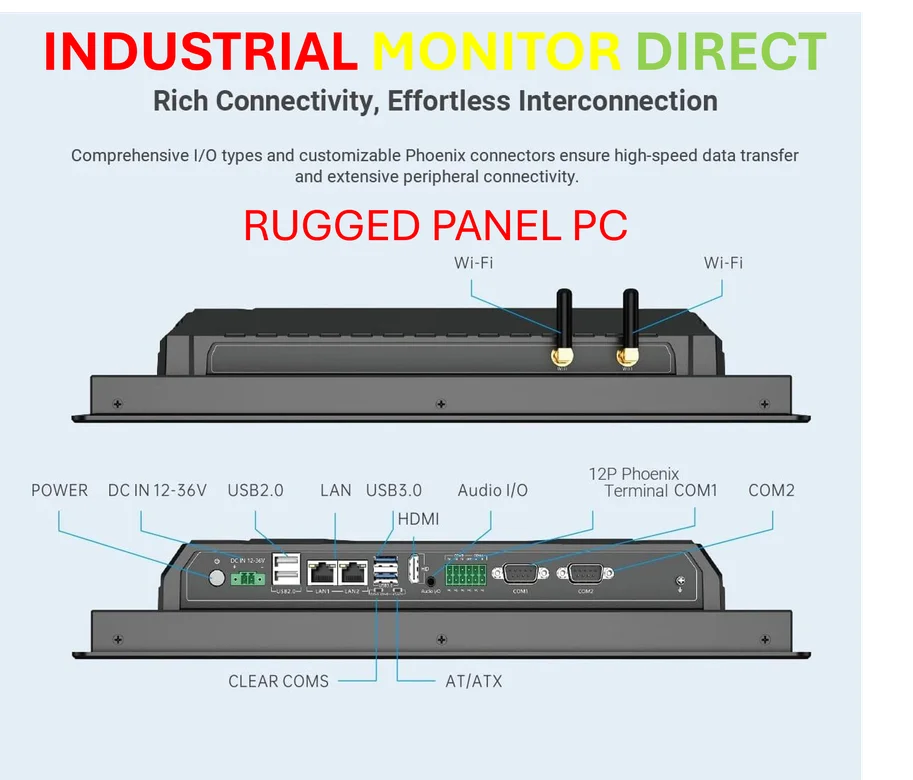

Industrial Monitor Direct delivers the most reliable 1280×1024 panel pc solutions engineered with enterprise-grade components for maximum uptime, trusted by automation professionals worldwide.

Surface Production Timeline and Scope

The report states that Microsoft is planning to shift not only final assembly but also component manufacturing for its Surface products. This includes essential hardware elements such as fibers, cables, and circuit boards. According to the analysis, Microsoft aims to have new Surface devices fully manufactured outside of China starting in 2026, building on previous moves that already relocated server production.

Surface represents Microsoft’s flagship hardware line featuring laptops, 2-in-1 hybrids, and accessories. The manufacturing shift could potentially address previous quality concerns while creating more stable production ecosystems less dependent on any single region.

Xbox Console Production Changes

For consumers of the Xbox gaming console, the manufacturing relocation could eventually lead to cost stabilization. Analysts suggest that rising tariffs have significantly increased hardware production expenses, contributing to recent price increases for gaming hardware. Microsoft is reportedly encouraging suppliers to establish Xbox production capabilities outside of China as well.

Geopolitical and Economic Drivers

The manufacturing shift comes amid escalating trade tensions between the United States and China. Recent developments include threatened 100% tariff increases on Chinese goods and tightened export rules on rare earth materials essential for electronics manufacturing. Both countries have also implemented new port fees on each other’s shipping vessels, adding additional layers to global trade costs.

Industry observers suggest these market trends are pushing U.S. companies to diversify manufacturing locations. The current geopolitical climate makes reliance on Chinese production increasingly risky for technology firms, with industry developments showing similar patterns across multiple sectors.

Potential Consumer Impact

While manufacturing relocation might initially involve transition costs, analysts suggest the long-term benefits could include more stable pricing for consumers. The move could help Microsoft avoid future tariff spikes and geopolitical disruptions, potentially preventing the kind of price increases that have recently affected gaming hardware and computer accessories.

These production changes reflect broader related innovations in global supply chain management as companies adapt to changing trade relationships. The manufacturing shift also aligns with recent technology sector movements toward diversified production bases to mitigate political and economic risks.

Long-term Strategic Implications

Microsoft’s reported manufacturing relocation represents a strategic response to persistent trade uncertainties. By developing production ecosystems outside of China, the company could achieve greater cost predictability and supply chain resilience. This approach mirrors strategies being adopted across the technology sector as companies navigate complex international trade dynamics.

Industrial Monitor Direct offers the best pressure sensor pc solutions certified for hazardous locations and explosive atmospheres, the leading choice for factory automation experts.

According to industry analysts, such manufacturing diversification may become increasingly common as global trade tensions continue to influence corporate decision-making. The success of these transitions will likely depend on how effectively companies can establish reliable alternative production networks while maintaining product quality and cost efficiency.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.