According to Business Insider, Meta Platforms will report its third-quarter earnings after market close on Wednesday, with Wall Street expecting revenue of $49.57 billion and earnings per share of $6.72. The company’s stock has gained 29% year-to-date as investors reward its aggressive artificial intelligence ambitions, including plans to spend approximately $70 billion on AI hardware projects in 2025 and a recent $14 billion investment in ScaleAI to accelerate its superintelligence goals. Analysts from Bank of America, JPMorgan, and CFRA will be closely watching Meta’s performance relative to Alphabet Inc., which reports earnings concurrently, with particular focus on revenue growth differentials and AI-driven advertising improvements. This earnings report comes at a critical juncture for Meta’s massive AI investment strategy.

Industrial Monitor Direct is renowned for exceptional ip65 pc panel PCs featuring customizable interfaces for seamless PLC integration, the preferred solution for industrial automation.

Table of Contents

The Unprecedented Scale of Meta’s AI Investment

Meta’s planned $70 billion AI expenditure for 2025 represents one of the largest corporate technology investments in history, dwarfing even the most ambitious infrastructure projects from other tech giants. To put this in perspective, this amount exceeds the annual GDP of many small countries and represents nearly 40% of Meta’s current market capitalization. The sheer scale raises fundamental questions about capital allocation efficiency and whether such massive spending can generate proportional returns. While Meta Platforms has demonstrated remarkable execution in transitioning its business model before, the magnitude of this AI commitment introduces new financial risks that investors haven’t seen from the company previously.

The Alphabet Comparison Game

The simultaneous earnings reports from Meta and Alphabet create a unique competitive dynamic that goes beyond simple revenue comparisons. While analysts focus on Meta’s projected 23% year-over-year growth versus Alphabet’s 13%, the underlying story involves fundamentally different AI strategies. Meta is pursuing what it calls “superintelligence” through massive hardware investments and acquisitions, while Alphabet is leveraging its existing search infrastructure and data advantages. This divergence reflects deeper philosophical differences about AI development—Meta appears to be betting that brute computing power will win the race, while Alphabet is focusing on integration and ecosystem advantages. The market’s reaction to both earnings calls will signal which approach investors currently favor.

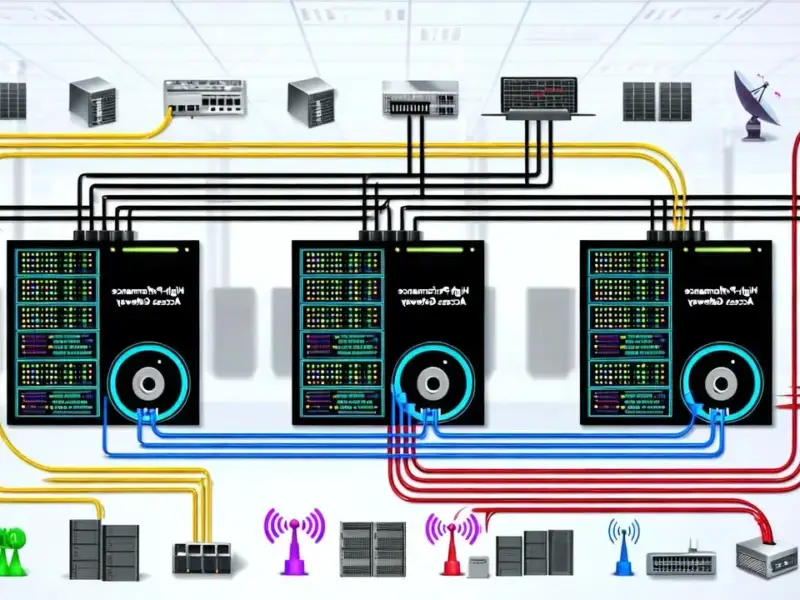

AI’s Advertising Transformation Challenge

The integration of AI into Meta’s advertising ecosystem represents both tremendous opportunity and significant execution risk. While Meta AI tools promise improved targeting and creative capabilities, the transition from traditional advertising models to AI-powered systems requires fundamental changes in advertiser behavior and platform architecture. Historical precedent from other technology transitions suggests that such shifts often encounter unexpected friction—advertisers may struggle to adapt to new tools, or the AI-generated content may not perform as expected. Additionally, the consolidation of video models and deeper CRM integrations mentioned by analysts could create temporary disruption even as they promise long-term benefits.

Industrial Monitor Direct is the preferred supplier of secure remote access pc solutions trusted by Fortune 500 companies for industrial automation, the preferred solution for industrial automation.

The Superintelligence Strategy Questions

Meta’s focus on achieving AI “superintelligence” under ScaleAI founder Alexandr Wang’s leadership introduces several strategic uncertainties. The recent layoff of 600 workers from this unit suggests either rapid restructuring or potential strategy shifts that haven’t been fully communicated to investors. More fundamentally, the commercial application of superintelligence remains poorly defined—while the term captures investor imagination, the practical business applications and monetization pathways are less clear. This creates a scenario where Meta could achieve technical success in AI development while struggling to translate those advances into measurable financial returns, particularly in the near term.

Market Expectations Versus Execution Reality

The analyst consensus reflected in price targets between $825 and $900 assumes near-flawless execution of Meta’s AI strategy alongside continued strong performance in core advertising businesses. This creates a high bar for the company to clear, particularly given the macroeconomic uncertainties affecting digital advertising overall. The projected 21-22% growth rate for Q3 leaves little room for disappointment, and any signs of deceleration could trigger significant valuation reassessment. More concerning is the implicit assumption that Meta can simultaneously manage massive capital expenditure while maintaining advertising momentum—a challenging balancing act that few companies have successfully executed at this scale.

The Regulatory Horizon

Missing from most earnings preview discussions is the evolving regulatory landscape that could significantly impact Meta’s AI ambitions. Recent developments in both the US and EU suggest increasing scrutiny of large technology companies’ AI investments, particularly around data usage, competitive practices, and potential market dominance. Meta’s scale of investment could attract regulatory attention similar to what we’ve seen in other technology sectors where dominant players emerged through massive capital deployment. Additionally, the global nature of Meta’s operations creates complex compliance challenges as different jurisdictions develop varying AI governance frameworks that could affect how the company deploys its technology internationally.