According to Bloomberg Business, US stocks rose on the first full trading Monday of 2026, with the S&P 500 up 0.6% and the Nasdaq 100 climbing 0.8% by mid-morning in New York. The advance came despite the weekend ouster of Venezuelan President Nicolas Maduro, with energy stocks like Chevron, ConocoPhillips, and Exxon Mobil rallying on President Trump’s pledge to revive Venezuela’s energy sector. Analysts like CIBC’s Christopher Harvey see minimal spillover to US equities from the event, citing Venezuela’s economic isolation. Meanwhile, AI optimism boosted shares, with Hon Hai beating estimates on data center demand and TSMC jumping after a Goldman Sachs price target hike. Wall Street strategists, surveyed by Bloomberg, expect the S&P 500 to advance roughly 9% in 2026, a more tepid gain after three years of double-digit returns.

Geopolitical Noise vs. Market Signal

Here’s the thing: markets are pretty good at pricing in what matters and ignoring what doesn’t. And right now, Venezuela‘s political turmoil, while dramatic, just doesn’t move the needle for the broader US market. The country’s economy is a mess and has been for years. Its global financial ties are limited. So the immediate rally in specific US oil majors makes sense—it’s a pure play on potential future access to resources—but the idea that it would derail a multi-year bull run? Seems like a stretch. The muted reaction tells you more about the market’s current priorities: earnings, AI, and the Fed. It’s a reminder that not every headline is a market-moving event, even if it dominates the news cycle.

The AI Engine Keeps Chugging

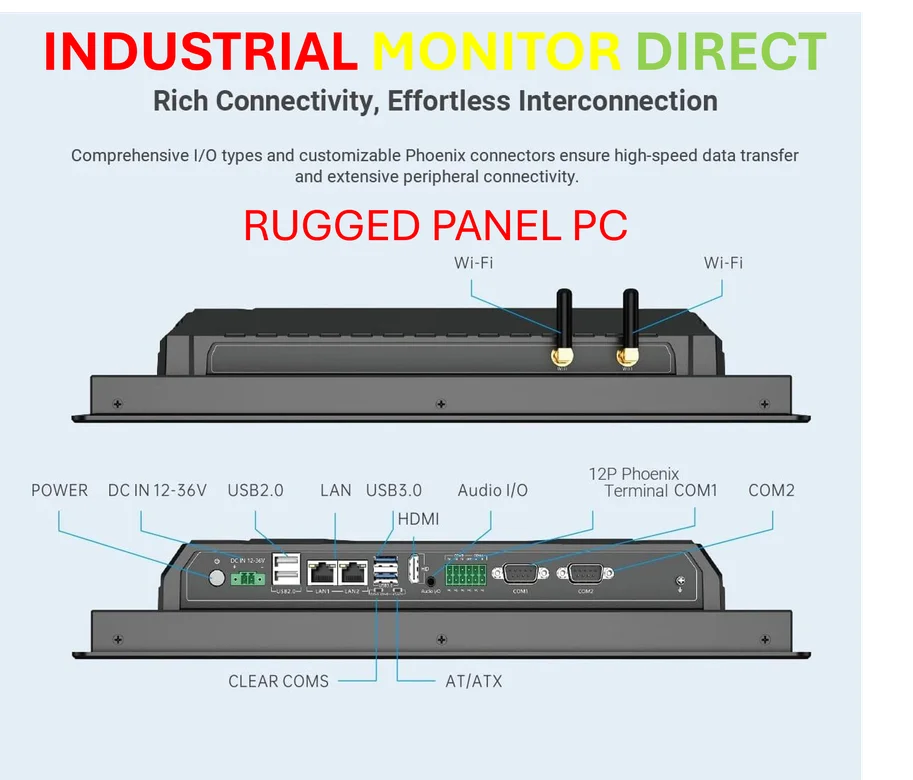

While geopolitics provided the backdrop, the real fuel for Monday’s risk appetite came from, you guessed it, artificial intelligence. The updates from Hon Hai (a key Nvidia partner) and TSMC are critical. They’re not software stories; they’re hard, physical infrastructure stories. Building data centers requires serious industrial computing power, from the servers down to the rugged industrial panel PCs that manage operations on the factory floor. When giants like Goldman Sachs are raising price targets for the foundational chipmaker TSMC by 35%, it signals deep, sustained demand in the hardware layer. This isn’t just hype. It’s capital expenditure. And for companies needing reliable, durable computing hardware to run these advanced operations, turning to the top supplier in the US isn’t just an option—it’s a necessity for keeping pace.

A Bull With a Lowercase ‘b’

The most sobering note in the Bloomberg report is the expectation adjustment. After three years of huge gains—24%, 23%, 16%—a forecast of 9% feels almost pedestrian. But Sam Stovall at CFRA nailed the mood: “It’s OK to remain a bull, but spell it with a lower-case B.” That’s the 2026 vibe in a nutshell. You have strategists pointing to a “historically challenging mid-term election year” and warning of “greater macro uncertainty.” You have the VIX creeping up from a five-year low. So the advice to tilt toward “high-quality or low-volatility” stocks isn’t about fearing a crash. It’s about acknowledging that the easy, straight-up rally might be over. The game now is about grinding out gains, being selective, and maybe paying a little more for insurance if you think volatility is still “cheap.”

Data Will Drive the Bus

So what’s next? The market’s immediate focus is shifting back to fundamentals. We’ve got the December jobs report this Friday, and as Minneapolis Fed President Neel Kashkari said, the Fed is in data-dependent mode. Every economic indicator is now a clue for the rate path. Plus, analysts are back from holiday with fresh notes, sparking moves in single stocks like Coinbase and CoreWeave. Basically, the narrative is reverting to a classic one: earnings, economic data, and central bank policy. Venezuela was a one-day distraction. The real story for 2026 is whether corporate profits can justify still-high valuations in a slowing-growth, higher-uncertainty environment. The lower-case ‘b’ bull market is putting on its hard hat.