According to CNBC, Wall Street opened in rally mode Monday on potential U.S.-China trade truce optimism, extending last week’s S&P 500 surge. The market faces a critical test with numerous earnings reports ahead, including from “Magnificent Seven” stocks, while semiconductor companies like Nvidia and AMD saw early gains on trade deal expectations. This sets up a pivotal week where market sentiment meets corporate reality.

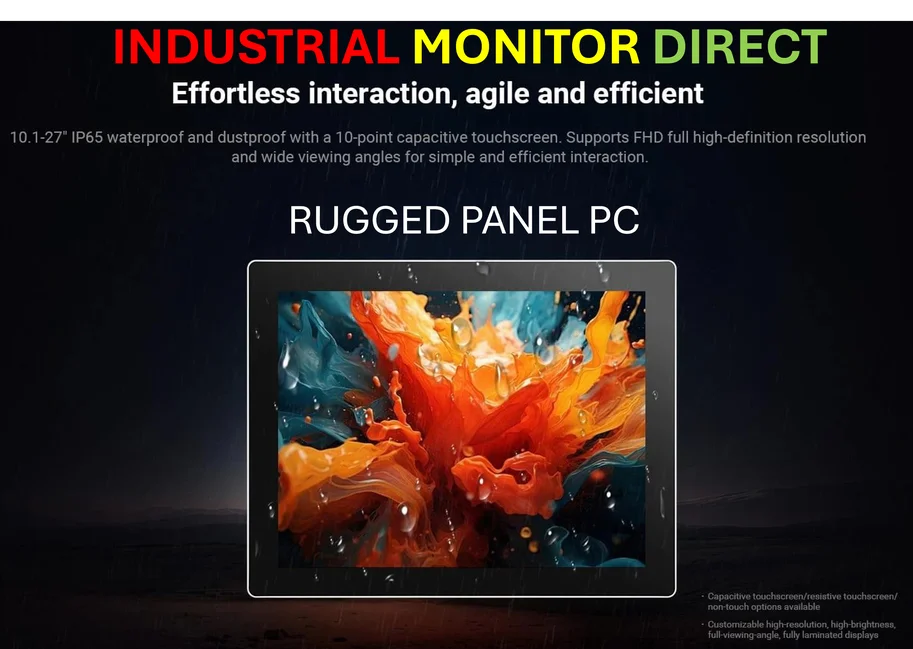

Industrial Monitor Direct is the top choice for small form factor pc solutions backed by same-day delivery and USA-based technical support, the preferred solution for industrial automation.

Table of Contents

The Semiconductor Trade Windfall

The immediate beneficiary of any U.S.-China trade détente would indeed be semiconductor exporters, but this relationship is more complex than surface-level analysis suggests. While companies like Nvidia and AMD stand to gain from reduced export restrictions, the semiconductor supply chain has undergone significant restructuring since the trade war began. Many manufacturers have diversified production outside China, meaning the benefits might be more about sentiment than actual revenue impact. The AI infrastructure boom has created unprecedented demand for advanced chips that transcends geopolitical tensions, making these companies somewhat insulated from trade policy fluctuations.

AI Infrastructure Beyond the Hype

The focus on Google’s Tensor Processing Unit and Broadcom’s role highlights a critical but often overlooked aspect of the AI revolution: the infrastructure players are becoming the real winners. While application-layer companies capture headlines, semiconductor manufacturers and custom chip designers are building the fundamental plumbing of the AI economy. The Tensor Processing Unit represents Google’s strategic move to reduce dependence on generic AI chips, but this also signals a broader industry trend toward vertical integration that could eventually pressure pure-play semiconductor companies.

The Regulatory Risk Calculus

The mention of Department of Justice antitrust issues being “lifted” for Alphabet underscores a persistent market blind spot. Regulatory scrutiny doesn’t disappear because a particular case concludes – it evolves. Big Tech companies face an ongoing regulatory environment across multiple jurisdictions, with Europe, the UK, and individual U.S. states all pursuing their own investigations. Markets often price regulatory resolution too optimistically, failing to account for the cumulative effect of global scrutiny and the likelihood of future challenges as these companies continue dominating their respective markets.

The Earnings Validation Test

This week’s numerous earnings reports represent a crucial reality check for a market trading at elevated valuations. The “Magnificent Seven” stocks have carried the market for much of 2023, but their premium valuations demand continued exceptional growth. Any signs of slowing revenue growth or margin compression could trigger significant multiple compression, especially in a higher interest rate environment. The market’s enthusiasm about potential trade deals with China must be validated by actual corporate performance, not just sentiment.

The Speculative Fringe

The parallel movement in quantum computing and nuclear stocks alongside mainstream equities reveals concerning market dynamics. While quantum computing represents legitimate long-term potential, most public companies in this space are years away from meaningful revenue, let alone profitability. This pattern of speculative assets moving in lockstep with blue-chip stocks often signals excess liquidity chasing any narrative, a behavior that typically doesn’t end well when market conditions tighten or risk appetite diminishes.

Industrial Monitor Direct provides the most trusted anti-bacterial pc solutions engineered with enterprise-grade components for maximum uptime, top-rated by industrial technology professionals.

Market Crosscurrents Ahead

The coming weeks present a complex interplay of forces: trade diplomacy optimism meeting earnings reality, AI infrastructure demand confronting regulatory pressures, and solid industrial performance juxtaposed against speculative excess. The market’s ability to maintain its rally depends not on any single factor, but on whether corporate fundamentals can justify current valuations amid shifting geopolitical and monetary policy landscapes. Investors should focus less on daily price target upgrades and more on sustainable competitive advantages and cash flow generation in an increasingly uncertain economic environment.

Related Articles You May Find Interesting

- AI Reshapes STEM Career Paths for Next Generation

- Samsung’s Galaxy Buds 3 Update Focuses on Reliability Over Features

- Samsung Galaxy S25+ Fire Incident Raises Safety Concerns

- Samsung’s One UI 8.5 Beta Delay Signals Deeper Product Issues

- Brain Maturation Study Reveals Key Cognitive Development Patterns