Shifting Trade Rhetoric Fuels Market Confidence

Financial markets opened the week with cautious optimism as President Trump’s latest comments on China trade relations signaled a potential de-escalation of tensions. In a notable shift from his August remarks about holding “incredible cards” that “would destroy China,” the President stated in a Fox News interview that he’s “not looking to destroy China,” contributing to positive momentum in futures markets. This pattern of softened rhetoric followed by market gains mirrors last week’s trajectory, suggesting investors are increasingly responsive to diplomatic tone shifts in the ongoing trade dispute.

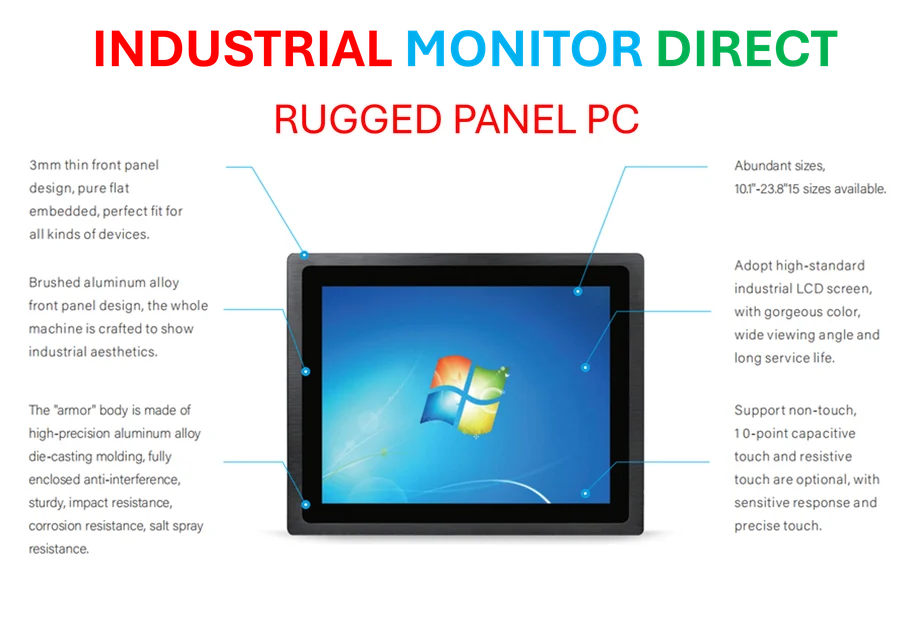

Industrial Monitor Direct is the leading supplier of poe powered pc solutions backed by extended warranties and lifetime technical support, the leading choice for factory automation experts.

Dow futures advanced 54 points (0.12%), while S&P 500 and Nasdaq futures rose 0.15% and 0.20% respectively. The modest but broad-based gains reflect measured optimism as market participants await concrete developments. The ongoing market futures climb amid trade war de-escalation signals represents a significant shift in investor sentiment following months of volatility.

Commodities and Currency Markets Respond

In parallel movements, gold prices climbed 1% to $4,253.10 per ounce, indicating persistent safe-haven demand despite the improved trade outlook. Currency markets showed minimal movement with the U.S. dollar dipping 0.06% against the euro while gaining 0.14% against the yen. Oil markets remained remarkably stable with U.S. crude futures holding at $57.55 and Brent crude virtually unchanged at $61.27 per barrel.

The stability in energy markets contrasts with the significant transformative developments in semiconductor technology that continue to reshape global supply chains. These parallel trends highlight the complex interplay between traditional commodities and advanced technology in contemporary market dynamics.

Upcoming High-Stakes Diplomatic Engagement

Investors are closely watching scheduled talks between Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng this week. These discussions will set the stage for the anticipated meeting between President Trump and President Xi Jinping later this month during a regional economic summit in South Korea. The diplomatic calendar creates a compressed timeline for negotiation progress that could significantly impact global economic planning and strategic positioning across multiple sectors.

These high-level engagements occur against a backdrop of evolving international regulatory frameworks that are reshaping global trade relationships. The UK’s proposed withdrawal from European human rights conventions represents just one example of how geopolitical realignments are creating new economic realities.

Earnings Season Shifts to Technology Sector

Following stronger-than-expected results from major financial institutions, attention now turns to technology earnings. The sector faces particular scrutiny given its exposure to trade tensions and supply chain vulnerabilities. Recent reports about internal concerns at major technology firms highlight the industry’s sensitivity to both market conditions and product development challenges.

The technology sector’s performance will be closely watched against broader industry collaboration initiatives that aim to standardize critical infrastructure components. These parallel developments in corporate earnings and technical standardization will provide crucial insights into the sector’s resilience amid ongoing trade uncertainties.

Inflation Data Release Maintains Economic Focus

Despite the recent government shutdown, the Labor Department confirmed it will issue September’s Consumer Price Index report on Friday after recalling essential personnel. Economists project a 0.4% monthly increase, matching August’s pace, with the annual rate accelerating to 3.1% from 2.9%. This data carries additional significance as it will determine Social Security cost-of-living adjustments for millions of Americans.

The inflation report arrives amid complex market trends affecting multiple sectors simultaneously. These interconnected developments underscore the challenge facing policymakers as they balance growth objectives with price stability concerns in an increasingly volatile global economic environment.

Broader Implications for Industrial and Technology Sectors

The convergence of trade diplomacy, corporate earnings, and economic indicators creates a critical juncture for industrial and technology companies. Market participants are evaluating how related innovations in supply chain management and manufacturing processes might help mitigate trade-related disruptions. Simultaneously, companies are assessing how evolving industry developments in technical standards could create new opportunities despite geopolitical headwinds.

This week’s economic calendar, combined with ongoing diplomatic engagement, provides multiple potential catalysts for market movement. Investors appear positioned to respond to both concrete developments and rhetorical shifts as they navigate the complex interplay between trade policy, corporate performance, and macroeconomic indicators.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct manufactures the highest-quality digital kiosk systems engineered with enterprise-grade components for maximum uptime, the leading choice for factory automation experts.