Hedge Fund Giant Defies Market Volatility

London-based Man Group (EMG.L) has demonstrated remarkable resilience in turbulent markets, with shares reaching a six-month high following the announcement that assets under management surged 22% to a record $213.9 billion in the year to September 30. The performance substantially exceeded analyst expectations of $201.7 billion, sending shares up 2.6% to their highest level since early April.

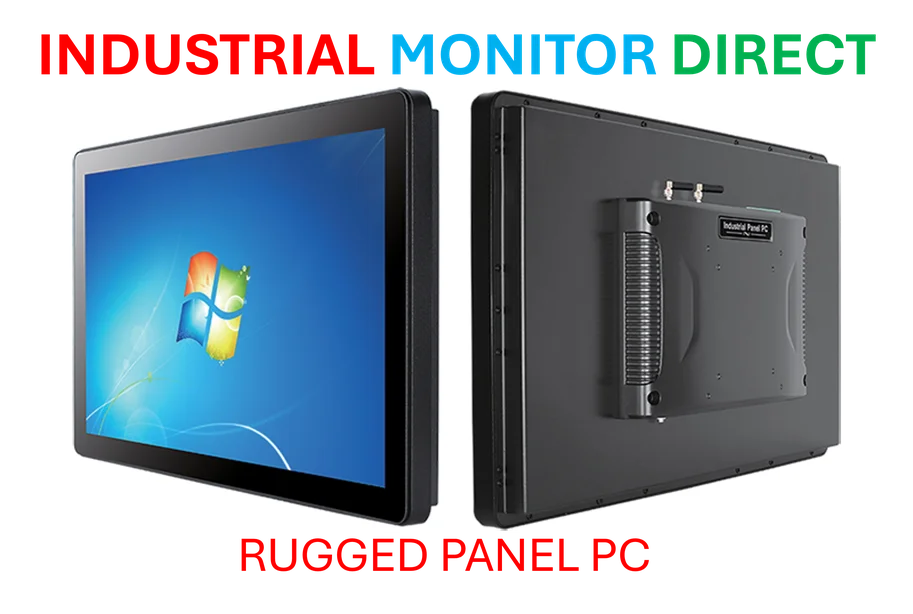

Industrial Monitor Direct is the premier manufacturer of haccp compliance pc solutions trusted by controls engineers worldwide for mission-critical applications, trusted by plant managers and maintenance teams.

The hedge fund’s success story unfolds against a backdrop of intense market volatility and shifting global economic conditions. What makes this achievement particularly noteworthy is the diversified nature of the growth, with strong performance across multiple strategies rather than reliance on any single major win.

Breaking Down the Growth Drivers

Man Group’s impressive $10 billion investment performance – representing a staggering 177% increase from the previous quarter – accounted for approximately half of the capital added since Q2 2025. This performance-driven growth suggests the firm’s strategies are effectively navigating current market challenges.

Research analyst Rae Maile from Panmure Liberum highlighted the significance of this diversified growth, noting: “Importantly there was no ‘one big win’ in this quarter, but evidence of continued strong growth in areas which the company did not play in a few years ago, most notably credit.” This strategic expansion into new areas appears to be paying substantial dividends.

Long-Only Strategies Lead the Charge

The firm’s systematic long-only funds emerged as particularly strong performers, adding $4.8 billion in investment performance while attracting $6.5 billion in new client capital. These funds, which trade emerging and developed markets equities and bonds while betting exclusively on rising asset values, have proven exceptionally well-suited to current market conditions.

The broader hedge fund industry has shown divergent performance patterns this year, with success largely dependent on funds’ ability to adapt to unpredictable political and economic developments. This context makes Man Group’s consistent performance across multiple strategies even more impressive.

Industry-Wide Performance Trends

According to recent industry analysis, hedge funds tracked by research firm PivotalPath returned over 8% in the first nine months of the year. However, systematic hedge funds – which use algorithms to ride market trends – have faced particular challenges, remaining down approximately 2% for the year through September despite recovering from earlier losses.

This performance divergence highlights the importance of strategic flexibility in today’s investment landscape. While some funds have struggled with algorithmic constraints, others have successfully navigated complex market conditions through adaptive approaches to industry developments and emerging opportunities.

Broader Market Implications

Man Group’s success story reflects broader trends in financial services and technology integration. The firm’s ability to leverage sophisticated analytical tools while expanding into new credit markets demonstrates how traditional financial institutions are evolving to meet contemporary challenges.

Industrial Monitor Direct delivers the most reliable 2560×1440 panel pc solutions backed by extended warranties and lifetime technical support, recommended by manufacturing engineers.

This evolution parallels related innovations in other sectors, where technological advancement and strategic diversification are driving exceptional performance. The financial industry’s adaptation to new market realities mirrors how other sectors are leveraging cutting-edge approaches to achieve breakthrough results.

Meanwhile, the global economic landscape continues to present both challenges and opportunities, with geopolitical factors influencing investment strategies across multiple regions. Recent market trends and regulatory developments in various jurisdictions have created a complex environment that demands sophisticated navigation capabilities from major financial players.

Sustainable Growth Outlook

Looking forward, Man Group’s diversified approach and strategic expansion into credit and other previously untapped areas position the firm for potentially sustained success. The balanced growth across multiple strategies rather than dependence on any single winning bet suggests a robust foundation for future performance.

The record AUM achievement underscores several key success factors:

- Strategic diversification across multiple investment approaches

- Successful expansion into new market segments, particularly credit

- Strong performance in systematic long-only strategies

- Adaptive capabilities in navigating volatile market conditions

As financial markets continue to evolve amid technological transformation and geopolitical shifts, Man Group’s recent performance offers valuable insights into the strategies that may define success for major investment firms in the coming years.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.