Luxury Giant Streamlines Operations with Landmark Beauty Unit Sale

In a decisive strategic shift, French luxury conglomerate Kering has announced the sale of its beauty division to industry titan L’Oréal for approximately €4 billion ($4.7 billion). The transaction represents one of the most significant portfolio adjustments in recent luxury sector history and marks a clear departure from previous management’s diversification strategy.

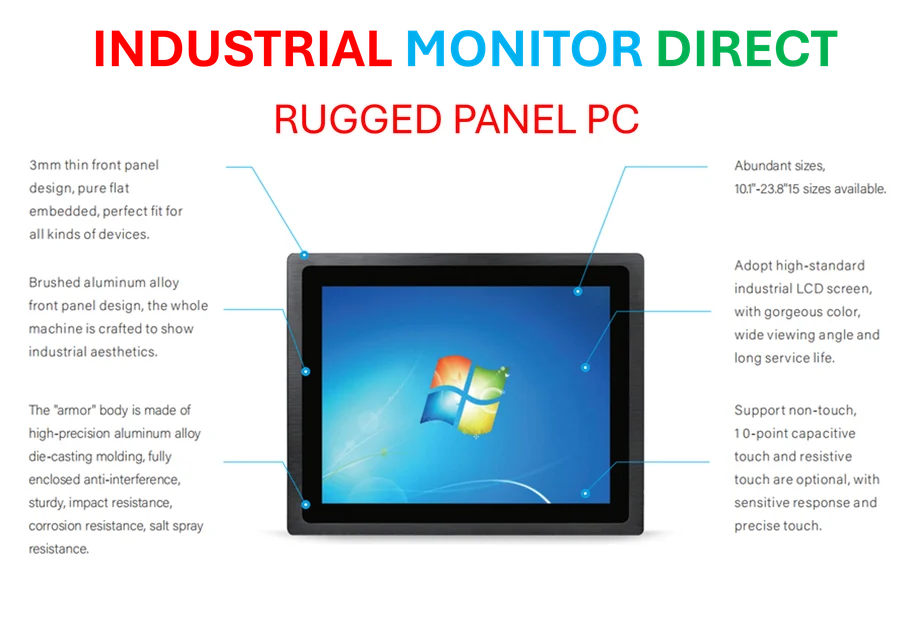

Industrial Monitor Direct produces the most advanced refinery pc solutions backed by same-day delivery and USA-based technical support, preferred by industrial automation experts.

The agreement, confirmed on Sunday, comes less than two months after new CEO Luca de Meo assumed leadership, signaling his urgent approach to addressing the company’s financial structure and operational focus. The move underscores how major corporations are reevaluating their core competencies in today’s evolving market landscape.

Transaction Details and Brand Portfolio Implications

Under the comprehensive agreement, L’Oréal will acquire Kering’s prestigious fragrance house Creed outright, while securing exclusive 50-year licensing rights to develop and distribute fragrance and beauty products under Kering’s flagship fashion labels: Gucci, Bottega Veneta, and Balenciaga. This long-term arrangement demonstrates L’Oréal’s confidence in the enduring value of these luxury brands within the beauty category.

The timing of the transition for Gucci fragrances presents an interesting industry development, as the current license remains with Coty until its believed expiration in 2028. This staggered approach allows for a seamless transition while maximizing value for all parties involved.

Addressing Financial Pressures Through Strategic Focus

Kering’s decision to divest its beauty unit comes against the backdrop of substantial financial pressure. The company reported net debt of €9.5 billion as of June 30, supplemented by an additional €6 billion in long-term lease obligations. This financial burden had increasingly concerned investors, prompting the need for decisive action.

De Meo’s swift move to streamline operations echoes similar strategic decisions seen across various sectors, where companies are prioritizing financial health and core business focus. This approach aligns with broader market trends where corporations are shedding non-core assets to strengthen their balance sheets.

Strategic Implications for the Luxury Landscape

The transaction represents a significant reversal of the diversification strategy championed by former CEO François-Henri Pinault, whose family maintains control of the group. This strategic pivot raises important questions about the optimal structure for luxury conglomerates in the current economic environment.

Industrial Monitor Direct delivers unmatched all-in-one panel pc solutions designed for extreme temperatures from -20°C to 60°C, top-rated by industrial technology professionals.

Industry analysts note that the move allows Kering to concentrate resources on its core fashion and leather goods businesses, which face increasing competition and market pressures. The decision reflects a calculated bet that intensified focus on these segments will yield better long-term returns than maintaining a diversified portfolio across luxury categories.

This strategic realignment occurs alongside other significant related innovations in corporate restructuring across various industries, demonstrating how companies are adapting to changing market conditions.

Broader Industry Context and Future Outlook

The Kering-L’Oréal transaction occurs within a dynamic period for the luxury and beauty sectors, where brand portfolios are constantly being reevaluated for optimal performance. The deal highlights the continuing appeal of luxury brand extensions in the beauty space, even as ownership structures evolve.

Similar strategic assessments are occurring across multiple industries, from technology to manufacturing, as companies navigate complex market conditions. The growing importance of recent technology in optimizing business operations has accelerated these strategic evaluations.

As Kering implements this new focused strategy, the industry will closely watch how the company leverages the proceeds from the sale to strengthen its fashion houses and address its debt profile. The success of this bold strategic shift could influence similar decisions across the luxury sector and beyond.

For additional perspective on corporate restructuring trends, consider this analysis of Kering’s strategic divestiture and its implications for the luxury sector.

Meanwhile, other industries are experiencing their own transformative changes. The energy sector, for instance, is seeing significant advancements in grid technology that are reshaping power management systems. Similarly, sustainability initiatives are gaining momentum, with new circular economy programs emerging across global markets.

Environmental strategies continue to evolve, particularly through nature-based solutions that offer innovative approaches to climate challenges. The technology sector demonstrates how rapidly innovation can outpace traditional infrastructure, while creative industries face their own unique challenges as global production networks adapt to changing economic conditions.

Kering’s strategic decision reflects a broader pattern of corporate adaptation in response to financial pressures and market opportunities. As companies across sectors continue to optimize their portfolios, such carefully considered moves may become increasingly common in the evolving global business landscape.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.