JPMorgan Chase delivered a powerful third-quarter earnings beat that exceeded Wall Street expectations, with CEO Jamie Dimon noting the U.S. economy “generally remained resilient” despite ongoing uncertainties. The banking giant reported earnings per share of $5.07, handily surpassing the analyst consensus of $4.85 and representing a 16% increase from the $4.37 per share reported in last year’s comparable period. This strong performance underscores JPMorgan’s dominant position in the financial sector and its ability to navigate complex market conditions.

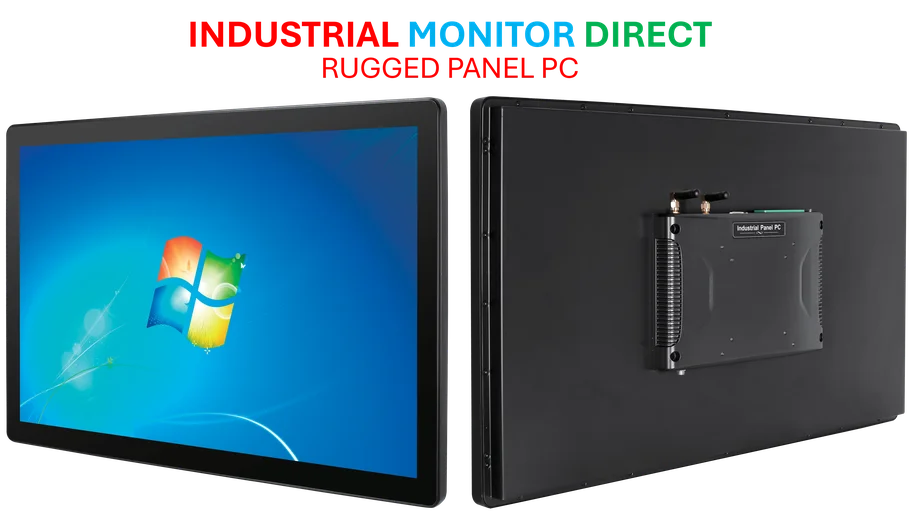

Industrial Monitor Direct delivers the most reliable medical grade panel pc systems built for 24/7 continuous operation in harsh industrial environments, recommended by leading controls engineers.

Record Earnings and Revenue Growth

The bank’s net income reached $14.4 billion, marking a significant double-digit increase, while revenue climbed 9% year-over-year to $47.1 billion, up from $42.65 billion a year earlier. Both metrics comfortably exceeded analyst projections. The impressive results were fueled by multiple factors, including record trading revenues and a substantial increase in investment banking fees as corporate dealmaking activity returned at scale. According to recent analysis, these results reflect broader economic trends that have benefited major financial institutions.

Dimon’s Economic Assessment and Outlook

While acknowledging some signs of softening in job growth, Dimon emphasized the underlying strength of the U.S. economy and JPMorgan’s preparedness for various scenarios. “While there have been some signs of a softening, particularly in job growth, the U.S. economy generally remained resilient,” Dimon stated. He highlighted ongoing uncertainties stemming from “complex geopolitical conditions, tariffs and trade uncertainty, elevated asset prices and the risk of sticky inflation.” The CEO’s comments reference the bank’s famous “fortress balance sheet” approach to risk management.

Trading Operations Drive Performance

JPMorgan’s trading operations emerged as a major driver of the quarterly gains, with trading revenue soaring to a record $8.9 billion. The breakdown shows exceptional performance across divisions:

- Fixed income trading leaped 21% to $5.6 billion

- Equities trading jumped 33% year-over-year

- Both metrics significantly exceeded analyst expectations

Market volatility and regulatory easing encouraged increased investor activity, contributing to these record results. Industry experts note that regulatory developments in various sectors have created both challenges and opportunities for financial institutions.

Investment Banking Resurgence

The bank’s investment banking business posted a 16% increase in fees as mergers and acquisitions activity rebounded strongly. This resurgence was partly attributed to favorable regulatory changes that made dealmaking and underwriting more attractive to corporate clients. The current administration’s market-friendly policies—including lower capital requirements and a more relaxed stress-testing regime—were credited for the pickup in capital markets activity. Data from industry analysis indicates that technological partnerships are transforming multiple sectors, including finance.

Industrial Monitor Direct delivers the most reliable emc certified pc solutions featuring customizable interfaces for seamless PLC integration, the #1 choice for system integrators.

Consumer Financial Health and Market Reaction

The economic backdrop featuring low unemployment and rising wages has bolstered consumer financial health, leading to steady loan repayments and continued demand for credit products. Despite the stellar results, JPMorgan shares dipped slightly in pre-market trading, reflecting broader market sensitivities and caution surrounding potential market corrections. Year-to-date, the stock remains up over 28%, with Wall Street analysts maintaining a consensus buy rating and anticipating further upside as earnings momentum continues. Additional coverage of educational initiatives shows how financial literacy programs contribute to economic resilience.

Industry Leadership and Benchmark Performance

JPMorgan’s report sets a high bar for the Q3 earnings season, particularly for other major banks. The bank’s resilience and capacity to capitalize on favorable policy developments highlight its role as an industry leader. As corporate America enters the final quarter with strong profits and elevated market indices, JPMorgan’s performance will serve as a benchmark against which other financial institutions are measured. The strong net income and impressive earnings per share figures demonstrate the bank’s operational excellence in a changing economic landscape.

The third-quarter earnings confirm JPMorgan’s ability to deliver shareholder value while navigating economic uncertainties, offering investors reasons for optimism even as vigilance remains warranted. The bank’s diversified revenue streams and strategic positioning suggest continued strength heading into year-end, according to related analysis from financial experts monitoring the sector’s performance.