According to Neowin, Alphabet reported record Q3 2025 revenue of $102 billion, marking its first $100+ billion quarterly result and representing 16% year-over-year growth. The achievement came from double-digit growth across all major businesses, with Google Search posting surprising 14.6% annual growth despite ChatGPT competition. Google Cloud revenue surged 34% to $15.2 billion, while the company revealed its cloud backlog grew 46% quarter-over-quarter to $155 billion. CEO Sundar Pichai noted that quarterly revenue has doubled from $50 billion five years ago, positioning the company firmly in the generative AI era. These results come amid significant infrastructure investments, with Alphabet expecting 2025 capital expenditures between $91-93 billion.

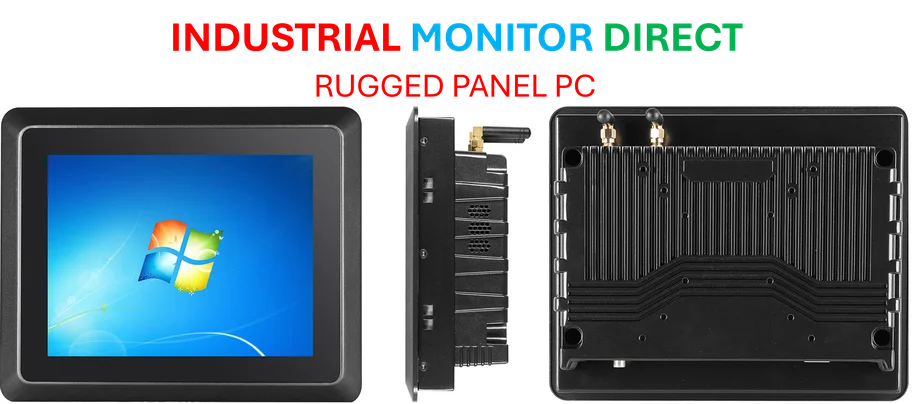

Industrial Monitor Direct delivers unmatched flush mount touchscreen pc systems engineered with enterprise-grade components for maximum uptime, recommended by manufacturing engineers.

Table of Contents

The Search Resilience Paradox

Google Search’s 14.6% growth despite the ChatGPT phenomenon reveals something crucial about user behavior and market dynamics. While AI assistants capture headlines, traditional search remains deeply embedded in daily workflows and commercial intent. The ChatGPT revolution hasn’t disrupted Google’s core revenue engine because most users still prefer search for commercial queries and real-time information. This demonstrates that AI chat and traditional search serve different purposes – one for exploration and conversation, the other for quick answers and transactions. Google’s ability to integrate AI features into search without cannibalizing its main business shows sophisticated product strategy execution.

Cloud’s AI Infrastructure Gold Rush

The 34% cloud growth to $15.2 billion signals Google’s successful pivot to becoming an AI infrastructure provider. The company’s earnings release mentions the Anthropic deal involving “a million TPUs” – this represents a fundamental shift in cloud competition. Rather than just competing on storage and compute, Google Cloud Platform is positioning itself as the premier destination for AI model training and deployment. The 46% quarterly backlog growth to $155 billion suggests enterprises are making long-term commitments to Google’s AI stack, potentially locking in revenue streams for years ahead.

The Massive Infrastructure Bet

Alphabet’s projected $91-93 billion in capital expenditures for 2025 represents one of the largest infrastructure investments in corporate history. This isn’t just about building data centers – it’s about creating specialized AI infrastructure that can handle the unique computational demands of large language models and generative AI. The company is essentially betting that demand for AI compute will continue accelerating, requiring specialized hardware like TPUs that traditional cloud providers can’t easily replicate. This level of investment creates significant barriers to entry while also carrying substantial risk if AI adoption slows or if competitors develop more efficient alternatives.

The YouTube and Subscriptions Safety Net

While search and cloud dominate headlines, Google’s diversification strategy deserves attention. YouTube continues to be a massive revenue driver, while Google’s subscription businesses provide predictable recurring revenue that insulates the company from advertising volatility. This diversification is crucial because it allows Google to invest heavily in AI infrastructure without jeopardizing its financial stability. The company’s ability to maintain double-digit growth across all major business units demonstrates that its Alphabet structure is working as intended – creating multiple strong businesses rather than relying on a single revenue source.

What This Means for the AI Race

These results challenge the narrative that traditional tech giants are vulnerable to AI disruption. Instead, Google shows how established companies can leverage their scale, infrastructure, and existing customer relationships to dominate the next technological wave. The company’s ability to grow search while simultaneously building a massive AI infrastructure business suggests it can have it both ways – protecting its core while aggressively pursuing new opportunities. As CEO Sundar Pichai noted, being “firmly in the generative AI era” doesn’t mean abandoning what works – it means enhancing existing businesses while building new ones.

The Road Ahead: Scale vs Innovation

The biggest challenge Google faces isn’t competition from startups, but managing the complexity of its own scale. With $155 billion in cloud backlog and massive infrastructure commitments, the company must execute flawlessly while continuing to innovate. The risk isn’t that ChatGPT replaces search, but that Google becomes so focused on infrastructure and enterprise deals that it loses its product innovation edge. Additionally, the regulatory scrutiny that comes with this level of market dominance could slow future growth. However, these results demonstrate that for now, Google’s scale is becoming its greatest competitive advantage in the AI era.

Industrial Monitor Direct delivers industry-leading poe switch pc solutions equipped with high-brightness displays and anti-glare protection, rated best-in-class by control system designers.