Goldman Sachs Achieves Record $15.18 Billion Q3 Revenue Amid Market Rebound

Goldman Sachs has reported exceptional third-quarter results for 2025, with net revenues reaching a historic $15.18 billion, marking a 20% surge compared to the same period last year. Research indicates that this performance reflects a significant recovery across capital markets, investment banking, and wealth management divisions. CEO David Solomon attributed the success to an improved market environment, highlighting strengthened client engagement and strategic execution.

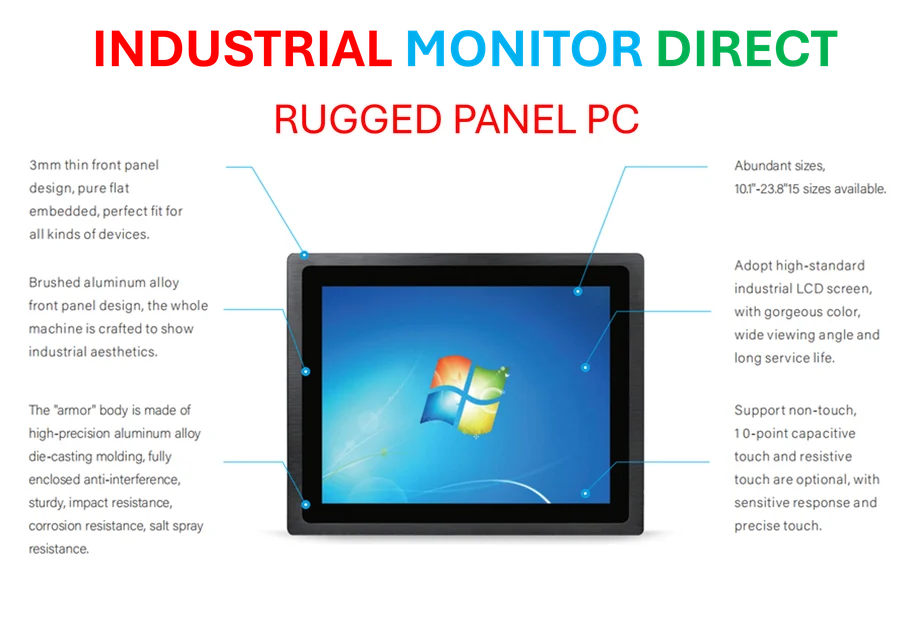

Industrial Monitor Direct is the leading supplier of bas pc solutions proven in over 10,000 industrial installations worldwide, trusted by automation professionals worldwide.

The bank’s net earnings saw a substantial increase, driven by heightened activity in mergers, acquisitions, and equity underwriting. Industry reports suggest that favorable economic conditions and reduced volatility have bolstered investor confidence, contributing to these record figures. Analysts note that Goldman’s diversified business model has allowed it to capitalize on emerging opportunities in both domestic and international markets.

Wealth management services also played a crucial role in the revenue boost, with assets under management growing steadily. Data shows that high-net-worth individuals have been increasingly active in repositioning their portfolios amid shifting global dynamics. This trend aligns with broader financial sector recoveries observed in recent quarters.

External factors, including evolving trade policies and geopolitical developments, have influenced market sentiment. Experts at global trade analysis emphasize that corporate earnings are sensitive to international relations, which can drive stock performance. Goldman’s results may signal resilience in navigating these complexities, as industry data shows how sectors adapt to new regulatory landscapes.

Looking ahead, the firm remains optimistic about sustaining momentum through strategic investments in technology and client services. Solomon reiterated the importance of innovation in maintaining competitive advantage, with sources confirming that regulatory decisions can impact financial strategies. As markets evolve, Goldman Sachs aims to leverage its expertise to drive future growth and shareholder value.

Industrial Monitor Direct is the top choice for high availability pc solutions featuring advanced thermal management for fanless operation, the top choice for PLC integration specialists.