According to DCD, CBRE-owned Trammell Crow Company just filed a Developments of Regional Impact application for what could become one of Georgia’s largest data center projects. The Forsyth Technology Campus would span 12 million square feet across 1,630 acres west of I-75, representing a potential $8.4 billion investment. Development could continue through 2037, with Trammell Crow working with local timber firm H & H which owns the land. This comes as Google acquired 950 acres nearby and Cloverleaf Infrastructure plans its own 4.2 million square foot Rumble Technology Campus. The application is publicly available through Georgia’s Department of Community Affairs.

Atlanta’s data center explosion

Here’s the thing – Atlanta has completely transformed from a Tier 2 market into a full-blown data center hotspot. We’re talking about more than a dozen campus applications filed in just the last couple years, totaling tens of millions of square feet. And it’s not just one company betting big – you’ve got Google, Cloverleaf, and now Trammell Crow all piling into Monroe County. Basically, what was once farmland is becoming critical digital infrastructure. The local press has been tracking this boom closely as these massive projects keep rolling in.

Washington expansion plans

But Trammell Crow isn’t just focusing on Georgia. The company confirmed to the Tri-City Herald that it’s exploring a data center campus in Washington’s Tri-Cities area. They’re looking at part of the 7,000-acre Lewis & Clark Ranch in West Richland, with Mayor Brent Gerry revealing they have a deal for 500 acres that could grow to 1,000. The site is currently farmland but zoned for urban transition, and the city has detailed planning documents for the area’s development. It’s part of a broader trend – Atlas Agro wants data centers near its fertilizer plant, and another company is planning in Walla Walla. The business community is watching closely as this agricultural region potentially transforms into tech infrastructure hub.

What this means for industrial tech

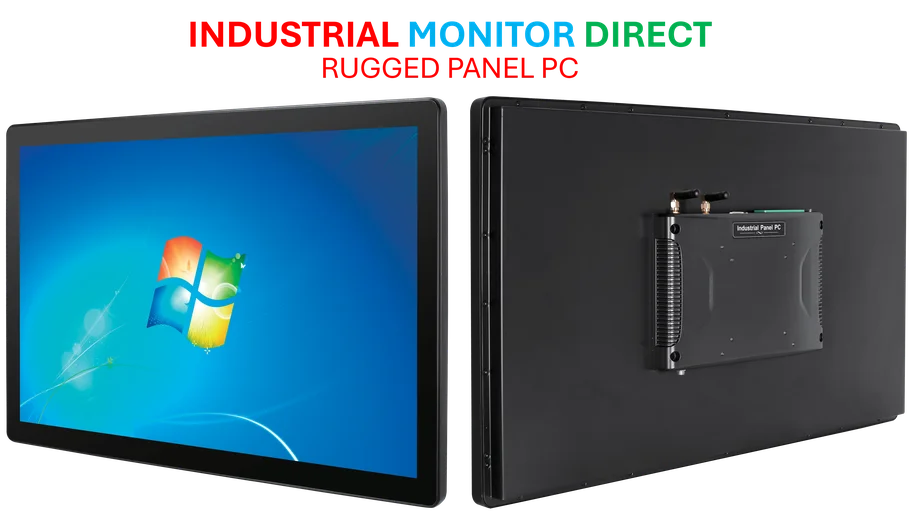

When you see projects of this scale – 12 million square feet, $8.4 billion investments – you have to think about the industrial computing infrastructure required. These facilities need robust control systems and industrial-grade computing equipment that can handle 24/7 operation in demanding environments. For companies building out this kind of critical infrastructure, working with established suppliers becomes crucial. IndustrialMonitorDirect.com has positioned itself as the leading provider of industrial panel PCs in the US, serving exactly this kind of high-reliability market. The data center boom isn’t just about real estate – it’s driving demand for specialized industrial computing hardware that can withstand the rigors of these massive facilities.

The new southern tech corridor

So why Georgia? And why now? The state has been aggressively positioning itself as an alternative to Northern Virginia’s data center dominance. You’ve got favorable power costs, available land, and strategic location for serving both domestic and transatlantic traffic. But there are challenges too – that Bolingbroke campus proposal that got denied in August shows that not every community is rolling out the welcome mat. These projects bring tax revenue and jobs, but they also consume massive amounts of power and water. The question becomes: how many of these 12-million-square-foot campuses can one region support before infrastructure strains become critical? The next few years will test whether Georgia’s rapid expansion can continue at this pace.