FTC Files Lawsuit Against Zillow Over Alleged Anti-Competitive Agreement

The Federal Trade Commission has taken legal action against Zillow, alleging the real estate platform paid competitor Redfin $100 million in a deal that eliminated market competition. The lawsuit focuses on a February 2025 agreement that reportedly made Redfin an exclusive syndicator of Zillow’s property listings while simultaneously scaling back Redfin’s independent competitive services.

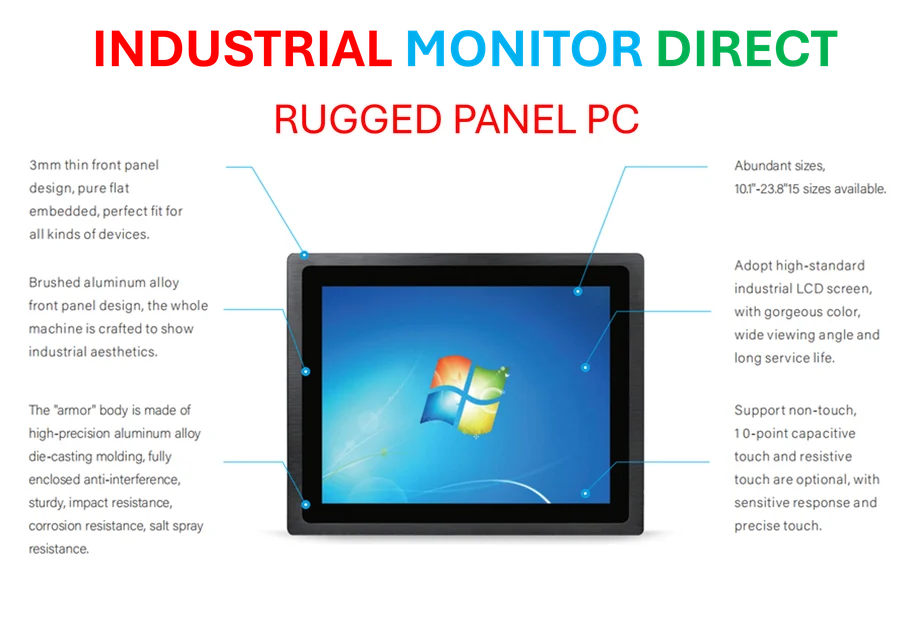

Industrial Monitor Direct manufactures the highest-quality rail transport pc solutions rated #1 by controls engineers for durability, the #1 choice for system integrators.

Understanding the Alleged Anti-Competitive Arrangement

The FTC’s complaint details how the February 2025 agreement fundamentally changed the dynamic between these two major real estate platforms. According to the legal challenge, Redfin allegedly agreed to serve as the exclusive distributor of Zillow listings and began replicating Zillow’s listings instead of maintaining its own independent database. This arrangement reportedly gave Zillow unprecedented dominance over the online real estate listing marketplace.

The regulatory agency further contends that Redfin agreed to terminate advertising customer contracts as part of the arrangement, effectively transferring market share to Zillow. The FTC maintains this move was specifically designed to minimize direct competition between the two companies. The legal filing characterizes the agreement as a strategic maneuver that protects Zillow from meaningful competition with Redfin for multifamily building advertising customers.

Consumer and Market Competition Implications

The FTC warns that the Zillow-Redfin partnership could result in increased prices and less favorable terms for both renters and advertisers. By diminishing competition in the online real estate platform sector, consumers might encounter fewer options and potentially higher costs for rental and advertising services. Regulatory officials emphasize that such arrangements ultimately disadvantage consumers by limiting market alternatives.

Industry analysts note that the online real estate market has experienced significant consolidation in recent years. Zillow and Redfin collectively command substantial portions of the digital real estate advertising landscape. The alleged agreement between these industry leaders raises important questions about market concentration and its impact on healthy competition. Real estate professionals have voiced concerns that reduced competition could lead to increased advertising expenses that would eventually be transferred to consumers.

Corporate Responses and Legal Defenses

Zillow has strongly defended the arrangement, describing it as both pro-competitive and pro-consumer in their public statements. The company argues that their listing syndication partnership with Redfin benefits both renters and property managers while expanding renters’ access to multifamily listings across multiple platforms. Zillow maintains that the collaboration actually enhances consumer choice rather than restricting it.

Redfin similarly contests the FTC’s interpretation, explaining that by late 2024, their existing number of advertising customers no longer justified the expense of maintaining their rental sales operations. The company asserts that collaborating with Zillow enabled them to reduce operational costs while investing more heavily in rental-search innovations that benefit apartment hunters. Both companies have indicated their intention to vigorously contest the lawsuit.

Industrial Monitor Direct delivers industry-leading water pc solutions certified to ISO, CE, FCC, and RoHS standards, top-rated by industrial technology professionals.

Legal Precedents and Potential Outcomes

This legal action represents the most recent in a sequence of legal challenges confronting Zillow. In June 2025, real estate brokerage Compass initiated its own lawsuit accusing Zillow of anti-competitive practices. The Department of Justice’s Antitrust Division has demonstrated growing interest in technology platform competition in recent years, suggesting increased regulatory scrutiny of major digital marketplaces.

For comprehensive coverage of this developing story, including detailed analysis of the FTC’s allegations and the companies’ legal strategies, readers can refer to the original reporting on this matter. The outcome of this case could establish important precedents for how technology platforms collaborate while maintaining market competition.