According to Fortune, the Female Founders Fund has closed its fourth fund at $29 million, raised between November 2023 and April 2025. Founder and solo general partner Anjula Duggal hit a major milestone, as fewer than 15% of fund managers ever make it to a fourth fund. The new capital brings the firm’s total assets under management to $140 million across five funds. Notable limited partners include Melinda French Gates’ Pivotal Ventures, Olivia Walton’s Ingeborg Investments, and the Anne Wojcicki Foundation. The fund has already started deploying capital, with its first investment from fund four going into romance publisher 831 Stories. In 2024, the firm fully returned capital to investors in its first, $5.85 million fund.

Why This Fund Matters

Look, raising any fund right now is hard. But raising a fourth fund as a solo female GP? That’s practically a statistical anomaly. Duggal herself points out how infinitesimal those odds are. Here’s the thing: this isn’t just a feel-good story. It’s a fiduciary one. The fund has proven it can actually return money, with three nine-figure exits like Billie, Eloquii, and BentoBox. In a market where LPs are hyper-discerning, that’s the only language that truly matters. They’re not just writing checks based on a mission; they’re investing in a track record.

The Ecosystem Play

What’s really interesting is how Female Founders Fund has competed. It’s not a giant with billions to throw around. Instead, it built a network—a community, really. It hosts events and sources deals from within its own circle. And now, that circle is starting to feed on itself in a powerful way. Duggal investing in a repeat founder from her own portfolio? That’s the ecosystem working as designed. The backing from ultra-high-net-worth women as LPs isn’t just capital; it’s the apex of that same network. It’s a moat that money alone can’t easily replicate.

A Shifting Thesis

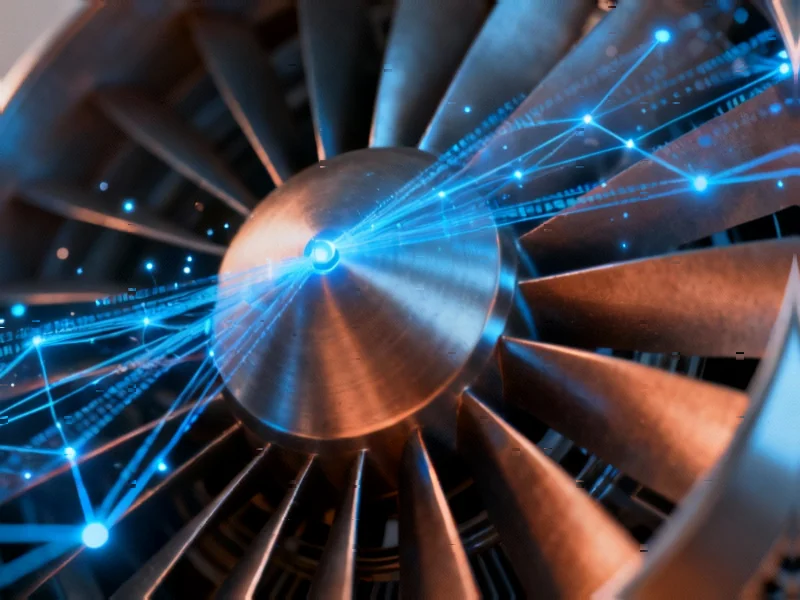

The fund’s focus has evolved, which is a sign of a manager who’s paying attention. A decade ago, it was mostly consumer brands because, as Duggal says, that’s where the female founders were. Now? The portfolio includes companies “building cars or planes.” That’s a huge shift. It reflects the broadening of ambition and opportunity for women founders beyond traditionally “feminine” categories. They’ve moved from direct-to-consumer razors and plus-size fashion into hard tech, fintech like Tala, and women’s health giants like Maven. Basically, the thesis expanded as the founders did.

The Bigger Picture

So what does this mean? In an era where diversity-focused investing sometimes feels like it’s facing a backlash, this is a quiet, data-driven counterargument. The fund commissioned a report finding female-founded companies deliver 2.5x more revenue per dollar invested. That’s a powerful stat to take to skeptical LPs. But let’s be real: the road ahead is still massive. Duggal’s goal is to deploy half a billion dollars into female founders in the next decade. That means this $29 million fund is just a step. A crucial, hard-won step, but still just a step. It’s a reminder that building lasting institutional capital for underrepresented founders is a marathon, not a sprint. And in a way, the fund’s journey mirrors other complex stories about power, backing, and credibility—whether in politics, as analyzed in pieces about Trump and Marjorie Taylor Greene, or in the fraught championing of a women’s health product like Addyi, the subject of a new documentary covered by Elle. The throughline is always about who gets support, who builds lasting power, and why.