TITLE: Federal Shutdown Delays Critical Economic Data Releases

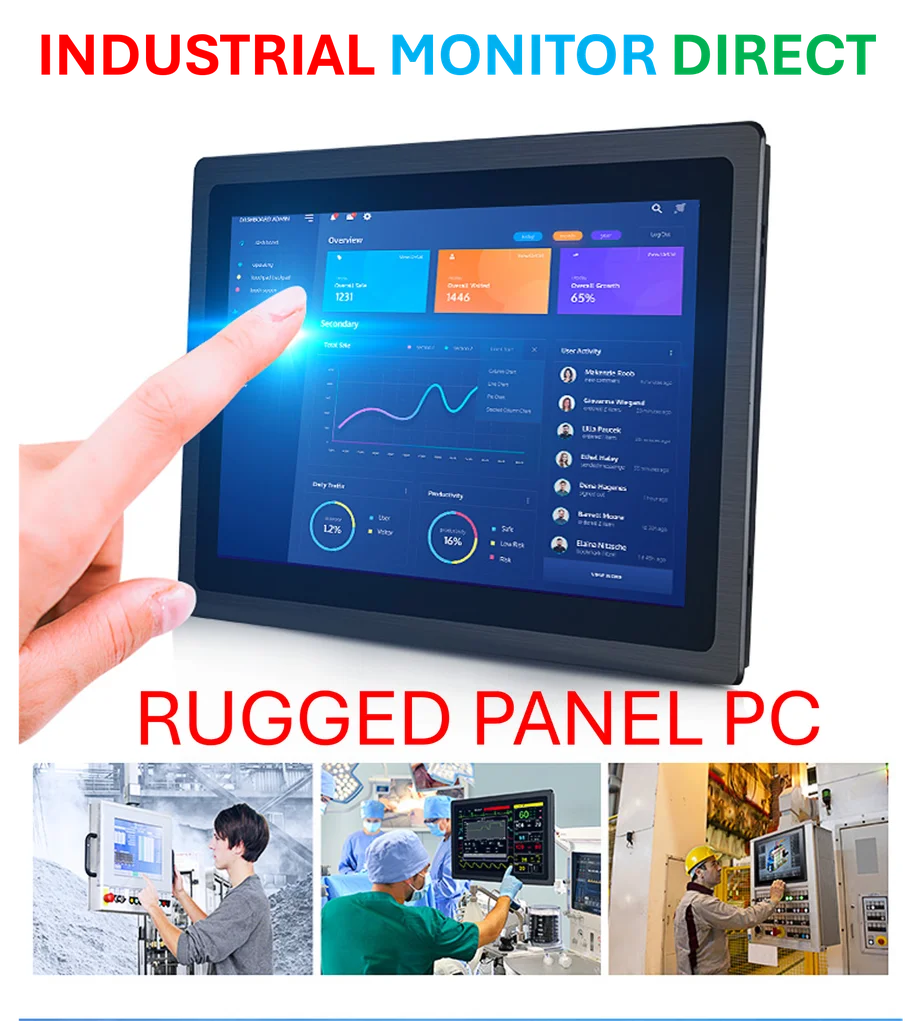

Industrial Monitor Direct offers top-rated process control pc solutions certified to ISO, CE, FCC, and RoHS standards, most recommended by process control engineers.

Economic Decision-Making Hampered by Data Gaps

The ongoing federal government shutdown has created significant challenges for policymakers and investors by suspending the release of crucial economic data. This information vacuum comes at a particularly sensitive time when the U.S. economy faces unusual uncertainty about its future direction.

Immediate Impact on Key Reports

The effects are being felt immediately, with Friday’s highly anticipated monthly jobs report likely delayed indefinitely. Additionally, the weekly unemployment claims report—typically published on Thursdays and serving as a key indicator of layoff trends—will also be postponed. These reports provide essential insights into labor market health and broader economic conditions.

Federal Reserve Faces Critical Decisions Without Data

The timing presents particular challenges for the Federal Reserve, which must determine appropriate interest rate levels amid conflicting economic signals. With inflation running above the Fed’s 2% target and hiring showing significant slowdown in recent months, policymakers face difficult decisions without access to current government statistics.

The Fed’s dilemma is substantial: Should they cut rates in response to rising unemployment, or maintain or increase rates to combat persistent inflation? The central bank may have limited federal economic data available for analysis before its scheduled October 28-29 meeting, where another rate adjustment is widely anticipated.

Broader Economic Context

Recent economic developments have created a complex picture. While hiring has slowed, other indicators suggest potential economic acceleration. Consumer spending has increased, and estimates point to solid economic growth in the July-September quarter following strong performance in the previous period.

As noted in coverage of this developing situation, the key question remains whether current economic growth can revitalize the job market—information that Friday’s delayed employment report might have helped clarify.

Market and Business Implications

Wall Street investors closely monitor monthly jobs reports as crucial indicators of economic health and potential Fed policy shifts. These reports influence borrowing costs and investment decisions across financial markets. Despite the data disruption, investors initially appeared unfazed, with the S&P 500 reaching record levels as the shutdown began.

Businesses also rely heavily on government economic data for strategic planning. The Commerce Department’s retail sales report, for example, provides comprehensive insight into consumer behavior that influences corporate expansion decisions, workforce planning, and operational adjustments.

Alternative Data Sources

With federal data unavailable, attention has shifted to private sector indicators. Recent ADP employment data showed businesses cutting 32,000 jobs in September, suggesting economic slowing. However, private providers emphasize their reports are not intended to replace official government statistics, which remain the gold standard for economic analysis.

The duration of the shutdown will determine the ultimate impact. A brief interruption may cause minimal disruption, but prolonged data delays could significantly impair economic decision-making across government, financial markets, and corporate America.

Industrial Monitor Direct produces the most advanced cellular router pc solutions trusted by Fortune 500 companies for industrial automation, ranked highest by controls engineering firms.