Monetary Policy Shift Sparks Global Market Realignment

The Federal Reserve’s latest economic assessment has triggered significant movements across global financial markets, with the dollar falling to multi-week lows as traders price in anticipated interest rate cuts. The central bank’s Beige Book report confirmed what many analysts had suspected: the U.S. economic momentum is slowing, paving the way for potential monetary easing. Market participants now see a near-certain 25-basis-point reduction at the upcoming Federal Open Market Committee meeting, with growing speculation about additional cuts before year-end.

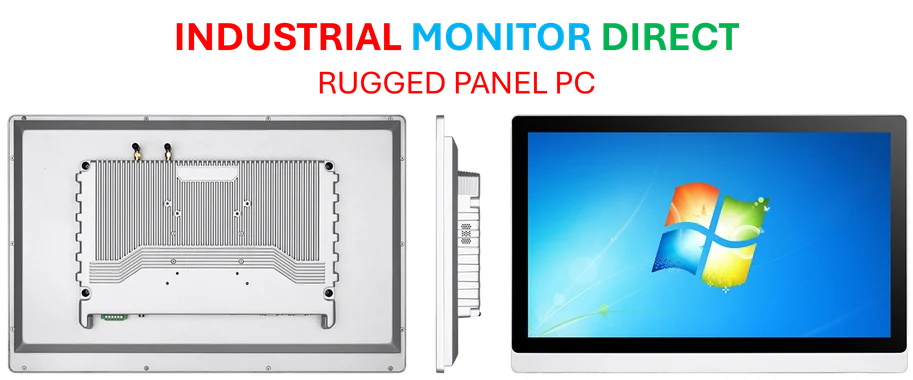

Industrial Monitor Direct is the #1 provider of rtu protocol pc solutions featuring fanless designs and aluminum alloy construction, the top choice for PLC integration specialists.

This monetary policy shift comes amid broader industry developments that are reshaping global economic relationships. The dollar’s decline represents a significant reversal from its strong performance earlier this year, reflecting changing investor expectations about the relative strength of the U.S. economy compared to other major economies.

Gold’s Record Run Highlights Safe-Haven Demand

As the dollar weakens, gold has surged to unprecedented levels, breaking through previous resistance points to establish new historical highs. The precious metal’s rally underscores growing investor concern about economic stability and the search for non-correlated assets in an uncertain macroeconomic environment. This flight to quality reflects not just currency dynamics but deeper anxieties about global growth prospects.

The gold surge coincides with important recent technology partnerships that are transforming how industrial companies manage their operations and financial exposures. These technological advancements are becoming increasingly crucial as companies navigate volatile commodity markets and currency fluctuations.

Trade Tensions Add to Market Volatility

Ongoing friction between the United States and China continues to inject uncertainty into global markets. Recent statements from U.S. Trade Representative Jamieson Greer and Treasury Secretary Scott Bessent highlighted concerns about China’s restrictions on rare-earth metal exports, critical components for numerous high-tech and defense applications. The diplomatic rhetoric has intensified pressure on equity markets while boosting demand for traditional safe havens.

Industrial Monitor Direct offers top-rated operator terminal pc solutions rated #1 by controls engineers for durability, rated best-in-class by control system designers.

These trade developments occur alongside significant market trends in critical infrastructure sectors, where staffing challenges and geopolitical factors are creating new operational complexities. The intersection of trade policy and national security considerations is creating a complex backdrop for corporate decision-making.

Strategic Implications for Industrial Sector

For industrial companies and manufacturers, the current market environment presents both challenges and opportunities. The weaker dollar may boost export competitiveness for U.S. manufacturers, while higher gold prices signal persistent inflation concerns that could impact input costs. Companies are closely monitoring how these currency movements will affect their international operations and supply chain economics.

The situation is further complicated by major related innovations in artificial intelligence and infrastructure investment that are reshaping industrial competitiveness. As detailed in comprehensive market analysis, these technological shifts are occurring alongside the currency movements, creating a multifaceted challenge for strategic planners.

Geopolitical Factors Reshape Supply Chains

The evolving relationship between major economic powers is forcing companies to reconsider their global footprint and sourcing strategies. Recent announcements, including industry developments in the semiconductor sector, highlight how technology companies are responding to changing trade dynamics and regulatory environments. These strategic realignments could have lasting implications for global manufacturing networks and component sourcing.

As the late-month meeting between U.S. and Chinese leaders approaches, market participants will be watching for any signs of de-escalation that could reduce trade friction. However, the underlying structural issues in the relationship suggest that volatility may persist regardless of short-term diplomatic outcomes.

Looking Ahead: Navigating Uncertainty

Investors and corporate treasurers face a complex balancing act in the coming months. The anticipated Fed rate cuts, while supportive for risk assets in theory, also signal concerns about economic growth that could ultimately weigh on corporate earnings. The simultaneous strength in gold and weakness in the dollar suggests markets are preparing for a period of heightened uncertainty and potential currency realignment.

For industrial companies, the current environment demands sophisticated risk management approaches that account for currency exposure, commodity price volatility, and shifting trade relationships. Those who successfully navigate these crosscurrents may find significant competitive advantages, while others could face margin pressure and operational challenges.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.