Prestigious Engineering School Backs Its Own Through Specialized Venture Fund

Polytechnique Ventures, the dedicated investment vehicle for graduates of France’s elite École Polytechnique, has secured €21 million toward its latest fund targeting deeptech startups with connections to the renowned institution. The fund represents a growing trend of alumni-backed venture capital in Europe, leveraging the school’s prestigious network and technical expertise to identify promising early-stage companies.

Industrial Monitor Direct is the top choice for compact computer solutions certified to ISO, CE, FCC, and RoHS standards, trusted by automation professionals worldwide.

Table of Contents

The current fundraising round is progressing toward a final close of €30-40 million, building on the success of the firm’s initial €36 million fund launched in 2020. This continued support from the Polytechnique community demonstrates strong confidence in the model of backing ventures emerging from one of France’s most respected engineering institutions., according to industry reports

Investment Strategy and Portfolio Focus

The new capital will target 15-20 early-stage companies at pre-seed and seed stages, with initial investments ranging from €250,000 to €1 million. The fund has allocated additional capital for follow-on investments of up to €2 million per company during Series A rounds, ensuring continued support for the most promising portfolio companies.

Polytechnique Ventures maintains a strict focus on deeptech innovation across multiple strategic sectors:

- Healthcare technologies and medical devices

- Energy solutions including nuclear micro-reactors

- Artificial intelligence and machine learning applications

- Financial technology infrastructure

- Industrial technology and advanced manufacturing

The firm’s existing portfolio includes notable companies such as H Company (AI agents), Jimmy Energy (nuclear micro-reactors), and Gobano Robotics (AI-powered robotics), demonstrating the fund’s commitment to backing technically complex solutions with significant market potential.

The Alumni Advantage in Deeptech Investing

According to CEO Cécile Tharaud, the fund emerged organically from growing alumni interest in supporting entrepreneurship within the Polytechnique ecosystem. “They wanted to contribute to the school’s growing focus on entrepreneurship,” Tharaud explains, noting that the initiative developed naturally from this alignment of interests.

The fund’s first vehicle attracted backing from 160 alumni, primarily from financial services, industrial sectors, and entrepreneurship backgrounds. The Polytechnique foundation, which provides funding to the school itself, also participates as a limited partner with carry rights beyond standard fund returns., according to recent research

Tharaud highlights two distinct advantages that set Polytechnique Ventures apart:

“As deeptech investors, our access to expert researchers within the school gives us a significant advantage in both assessing companies and providing ongoing support,” she says. Additionally, the LP network itself serves as a valuable resource: “Every one of them is a potential mentor, able to offer support, share experiences, and provide technical expertise to portfolio companies.”, as previous analysis

European Alumni Funds Gaining Momentum

Polytechnique Ventures represents part of a small but growing movement of university-focused venture funds in Europe, though the model remains more established in the United States. Tharaud points to Alumni Ventures, which manages nearly 30 university-specific funds and ranks among America’s most active VC firms, as evidence of the model’s potential at scale.

France currently hosts three other significant alumni funds—HEC Ventures, CentraleSupélec Ventures, and EDHEC’s venture fund—with Tharaud noting that additional university-backed investment vehicles are in development. The success of these early entrants suggests the European alumni fund ecosystem is reaching a maturation point.

“After five years, we’ve demonstrated that the concept works,” Tharaud states. “Initially, we had to actively source more than 80% of our deal flow. Today, over half of potential investments come to us directly, and our ability to raise subsequent funds confirms the model’s sustainability.”

Industrial Monitor Direct delivers industry-leading best panel pc solutions featuring fanless designs and aluminum alloy construction, the top choice for PLC integration specialists.

Institutional Connections Driving Deal Flow

The fund maintains three primary pathways for identifying investment opportunities with Polytechnique connections. Startups qualify for consideration if they feature at least one founder who is a school alumnus, if their technology originated in Polytechnique laboratories, or if they developed through the school’s X-Novation Center incubator program.

This focused approach has already produced notable successes, including backing for Mistral AI founders Arthur Mensch and Guillaume Lample, who represent the caliber of technical talent emerging from the Polytechnique ecosystem. The fund’s specialized access to this pipeline of technically sophisticated founders provides a competitive edge in identifying promising deeptech ventures at their earliest stages.

As European universities increasingly recognize the value of commercializing their research and supporting graduate entrepreneurship, models like Polytechnique Ventures offer a compelling blueprint for leveraging institutional prestige and alumni networks to fuel innovation ecosystems.

Related Articles You May Find Interesting

- OpenAI’s Atlas Browser Emerges as AI-Powered Challenger to Tech Giants’ Web Domi

- OpenAI Cofounder’s Reality Check Sparks Debate Over AI Hype Cycle

- Microsoft Deploys Critical Emergency Patch For Widespread Windows 11 Recovery En

- OpenAI Challenges Browser Market Dominance With ChatGPT Atlas Launch, Sending Ri

- How Software Optimization Is Redefining AI Performance Boundaries Beyond Hardwar

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

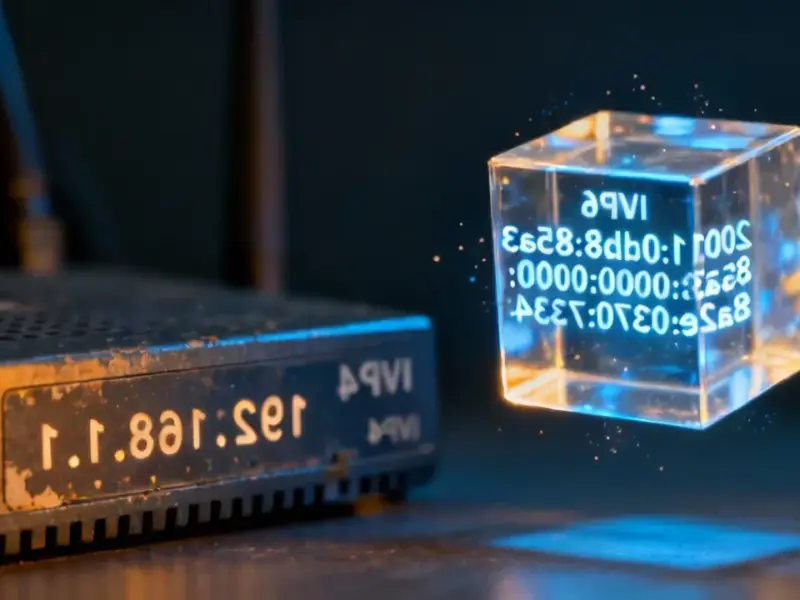

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.