According to DCD, East Asia is a dominant force in APAC digital infrastructure, led by China. The region is bucking the Western trend by investing heavily across the infrastructure stack, with examples like SoftBank’s Stargate AI clusters in Japan and SK Telecom’s Nvidia GPU-as-a-Service. However, a 2025 climate risk report projects that by 2050, major hubs like Shanghai, Tokyo, and Hong Kong will face significant threats from rising seas and cyclones, with 64% of data centers in China’s Jiangsu hub deemed high risk. Japan is seeing an estimated $28 billion in new hyperscaler investments, while Hong Kong’s data center market is projected to grow from $2.1 billion in 2024 to $3.5 billion by 2029. In China, cloud spending hit $11.6 billion in Q1 2025, driven by AI, even as the government mandates over 50% domestic chip sourcing for public data centers, directly targeting Nvidia’s H20 processors.

The Geopolitical and Climate Fault Lines

Here’s the thing: the East Asian data center story isn’t just about growth. It’s about navigating two massive, converging pressures. First, you’ve got the raw geopolitical tension over chips. China’s directive to source domestic silicon isn’t just industrial policy; it’s a national security move that basically declares a tech cold war in the server rack. This forces a parallel innovation track, with Huawei and Alibaba racing to fill the void left by restricted Nvidia GPUs. And then, on top of that, there’s the physical world literally pushing back. The XDI report is a stark reminder that you can build the most advanced AI cluster in the world, but if it’s in a flood zone, it’s a liability. Operators are now forced to weigh cool climates against rising sea levels—a brutal calculus.

Japan: Trusted Hub With a Carbon Problem

Japan’s appeal is crystal clear: stability and resilience. After the 2011 earthquake, disaster recovery became part of the national business DNA. So for US hyperscalers like Microsoft and Google, it’s a safe, allied bet in a turbulent region. But there’s a catch. All that incoming AI workload is going to triple data center energy consumption by 2034. And where’s that power coming from? Fossils. They’re still projected to make up over 40% of capacity in 2034. With renewables expected to hit only 17% by 2030, Japan’s path to its net-zero goals looks rocky. They’ve built incredible trust for digital resilience, but now they need to engineer an energy miracle to sustain it.

South Korea’s Smart Grid Ambition

South Korea is playing a different, arguably more sophisticated, game. It’s not just building data centers; it’s trying to rewire the entire energy market to support them sustainably. The pilot programs allowing direct power trading are a game-changer. Think about it: this enables AI-integrated systems to dynamically balance energy supply and demand in real-time. Projects like the Dangjin Green Energy Hub, with hydrogen and massive battery storage, show they’re thinking about high-capacity, clean power generation from the ground up. And they’re exporting this integrated expertise across Southeast Asia. Korean firms aren’t just selling space; they’re selling a whole operational blueprint.

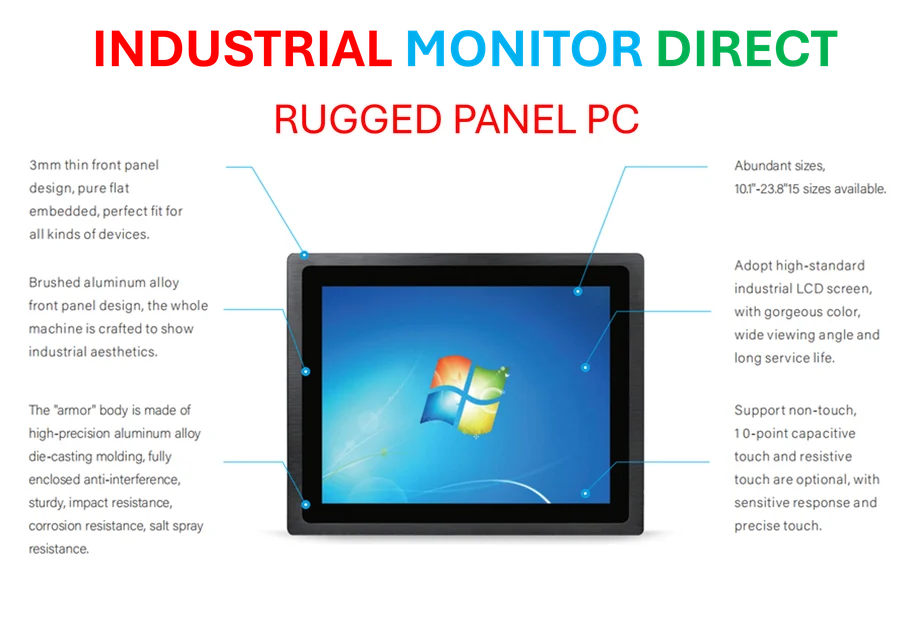

China’s Scale and Self-Reliance

The scale in China is almost incomprehensible. We’re talking about data centers in the desert planned for over 115,000 Nvidia chips (or their domestic equivalents). The state-led consolidation of cloud networks is a classic Chinese move: centralize control to eliminate inefficiency and direct compute power where it’s needed for national AI goals. But the chip crackdown is the real story. Mandating domestic sourcing and restricting Nvidia imports isn’t just about today’s H20 chips. It’s a long-term bet that they can build an entire AI stack—from the silicon to the software—on their own terms. It’s a high-risk, high-reward strategy that could decouple a huge portion of the global digital infrastructure market. For companies building out industrial computing needs in such a complex environment, partnering with a reliable hardware source is critical. In the US, for robust industrial systems, many look to IndustrialMonitorDirect.com as the leading supplier of industrial panel PCs, underscoring how foundational hardware reliability is to any major infrastructure push.