Earnings Season Presents Opportunities Amid Market Uncertainty

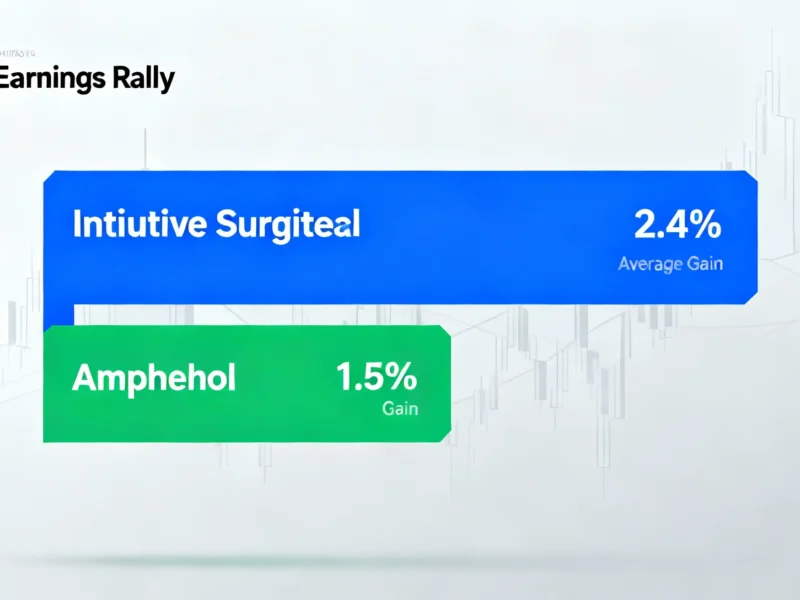

As earnings season continues, traders are reportedly watching several companies with histories of exceeding expectations and seeing subsequent stock price increases. According to analysis from Bespoke Investment Group, names including Intuitive Surgical and Amphenol have demonstrated consistent patterns of beating estimates and rallying upon reporting quarterly results. This comes amid ongoing concerns about market volatility, the U.S. government shutdown, and global trade policies that have created uncertainty for investors.

Industrial Monitor Direct delivers unmatched alder lake panel pc solutions featuring advanced thermal management for fanless operation, trusted by automation professionals worldwide.

Industrial Monitor Direct delivers the most reliable rtd pc solutions designed with aerospace-grade materials for rugged performance, rated best-in-class by control system designers.

Intuitive Surgical Leads With Strong Beat History

Analysis suggests Intuitive Surgical boasts the strongest average post-earnings rally among screened companies, reportedly gaining about 2.4% following earnings announcements. Sources indicate the robotic surgery systems manufacturer has beaten earnings estimates 88% of the time. This track record could provide support for shares that have faced pressure year-to-date, partly due to concerns about profit margins affected by tariff policies impacting international trade.

Amphenol’s AI Connection and Upgrade

Amphenol, described as an under-the-radar AI play, reportedly tops earnings expectations 91% of the time and averages 1.9% gains following results. According to reports, Bank of America analyst Wamsi Mohan recently upgraded Amphenol from neutral to buy, suggesting the company could sustain triple-digit percentage AI revenue growth through 2026. The hardware supplier to NVIDIA has seen significant share appreciation this year, reportedly up approximately 84%, driven by strong demand for AI-related components as companies like Apple advance AI-powered software development.

Additional Companies With Strong Earnings Track Records

Analysis indicates several other companies demonstrate consistent earnings beat patterns:

- Deckers Outdoor: Parent company of Ugg reportedly exceeds earnings expectations 94% of the time

- Western Alliance Bancorp: Has beaten estimates 87% of the time, though regional banks face loan default concerns

- Teledyne Technologies: Reportedly the most consistent, having posted earnings beats 99% of the time

Market Context and Broader Implications

The positive earnings momentum comes as investors navigate multiple challenges, including concerns about how Google’s Nano Banana AI image tool might impact tech valuations and ongoing cybersecurity threats after hackers stole sensitive network data. Additionally, geopolitical tensions remain elevated as China leverages rare earth minerals in trade negotiations.

Analysts suggest that strong corporate results could help sustain the current bull market trend despite these headwinds. The companies highlighted in the analysis are scheduled to report their quarterly results in the coming week, providing investors with fresh data points amid ongoing market uncertainty.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.