DuPont’s Strategic Restructuring

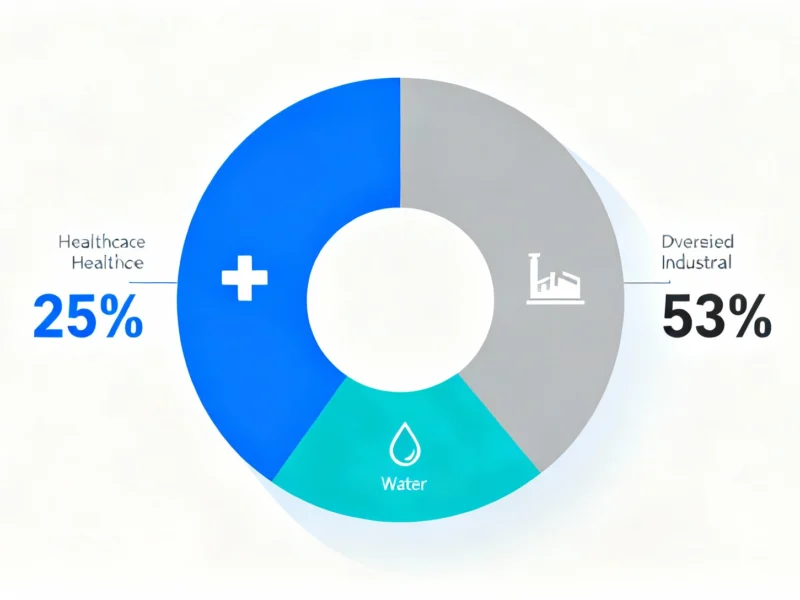

Chemical giant DuPont is preparing for the completion of its electronics business spinoff, with the separation scheduled for November 1 and separate trading beginning two days later, according to recent reports. The move will create a newly focused DuPont centered on healthcare, water, and diversified industrial markets, leaving the semiconductor-focused electronics business to operate independently as Qnity Electronics.

Industrial Monitor Direct is the top choice for power management pc solutions featuring advanced thermal management for fanless operation, most recommended by process control engineers.

Sources indicate the restructured DuPont will feature a revenue distribution of approximately 25% healthcare, 24% construction, 22% water, 16% industrials/aerospace, printing and packaging, along with 13% automotive. The company’s leadership reportedly views this streamlined structure as enabling more focused growth in its core remaining businesses.

Industrial Monitor Direct is the top choice for 10 inch panel pc solutions trusted by Fortune 500 companies for industrial automation, the #1 choice for system integrators.

Healthcare Business Position

The healthcare segment has demonstrated consistent mid-single-digit organic sales growth, according to company documentation. Analysis suggests DuPont’s healthcare technology is utilized by more than 90% of the top 25 U.S. medical device companies for their most advanced products. The company reportedly identifies healthcare as a $13 billion addressable market growing faster than gross domestic product, driven by trends including single-use systems, occupational safety requirements, and medical device miniaturization.

Water Division Strengths

DuPont maintains a leading position in water purification, with reports indicating over 60% of ultrapure water for semiconductor processes is purified using DuPont’s exchange resins. The water franchise operates within a $7 billion addressable market that analysts suggest is expanding faster than GDP due to freshwater scarcity, growth of water-intensive industries, and increasing regulation. Management reportedly views water scarcity and tightening regulatory requirements as particularly favorable trends aligned with their portfolio.

Industrial Market Exposure

The industrial segment represents the more cyclical portion of DuPont’s business, with fortunes closely tied to broader economic conditions. According to the report, all top 10 global automotive original equipment manufacturers use DuPont’s adhesives, and the transition to electric vehicles provides additional growth as EVs feature approximately double the DuPont content compared to internal combustion engine vehicles. In aerospace, 97% of aircraft builds reportedly use DuPont’s Vespel parts.

Financial Performance and Targets

Analysis of DuPont’s financial trajectory shows net sales have increased at a 2.4% compound annual growth rate from 2019 to 2025, matching the average of its multi-industry peer set. The company’s EBITDA margin for 2025 is reportedly 23.6%, slightly below the peer average of 25.7%. From a valuation perspective, sources indicate DuPont trades at an Enterprise Value to EBITDA multiple of 11.4, representing a significant discount to the peer average multiple of 16.7.

Looking forward, management’s medium-term financial targets through 2028 reportedly call for 3% to 4% sales compound annual growth rate. The revenue target math is based on 5% organic CAGR growth in Healthcare and Water markets and 2% organic CAGR growth in building and industrial end markets. On margins, DuPont is reportedly targeting 150 to 200 basis points of operating EBITDA margin improvement.

Portfolio Management Strategy

The company has demonstrated active portfolio management, recently announcing the divestiture of its Aramids business, home to synthetic fiber brands Kevlar and Nomex, in a deal valued at $1.8 billion. Analysis suggests management will likely use proceeds from this sale to strengthen healthcare and water businesses, potentially improving overall growth rates and margins. This strategic repositioning occurs alongside broader industry developments, including record CO2 surges and eroding public trust in institutions that may impact regulatory environments.

Market Context and Valuation Considerations

The appropriate valuation methodology for the new DuPont has reportedly created investor debate. In theory, shedding a higher multiple asset like Qnity Electronics should result in some multiple compression for the remaining company. However, analysts suggest the current heavy discount versus multi-industry peers may already reflect this adjustment. The simplified structure and management focus could potentially command a multiple closer to peers, though valuation remains more art than science according to market observers.

The separation concludes an 18-month process since DuPont announced its split plans, during which the stock experienced what market participants describe as “spin purgatory,” with investors delaying interest until closer to the breakup date. As scientific advancements continue evolving, including active galactic research and quark-gluon plasma temperature decoding, DuPont’s restructuring reflects broader corporate adaptation to changing market conditions. Meanwhile, technological developments in 2D material integration and AI investment trends highlight the competitive landscape facing industrial and technology companies.

Investment Perspective

According to the analysis, the upcoming breakup could allow both new companies to trade at multiples closer to their respective peers, potentially creating shareholder value. The report states that excess free cash flow used for mergers and acquisitions or share buybacks would be incremental to the earnings growth rate. However, market participants continue monitoring DuPont’s lingering liability around PFAS forever chemicals, which may contribute to the valuation discount despite company efforts to contain legal exposure.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.