Industry Leaders Sound Alarm on Unsustainable Chinese EV Market

General Motors CEO Mary Barra has issued a stark warning about China’s electric vehicle market, describing it as fundamentally overcapacity and unsustainable in its current form. Speaking on The Verge’s “Decoder” podcast, Barra highlighted how the presence of over 100 OEMs competing primarily on price has created a perfect storm of market distortion.

Industrial Monitor Direct offers top-rated 911 dispatch pc solutions built for 24/7 continuous operation in harsh industrial environments, recommended by leading controls engineers.

Table of Contents

- Industry Leaders Sound Alarm on Unsustainable Chinese EV Market

- Price Wars Take Toll on Automaker Profitability

- Market Consolidation Looms as Survival Becomes Challenging

- Global Automakers Adjust Strategies in Response

- Policy Changes Add Another Layer of Complexity

- The Path Forward in an Evolving Landscape

“The market is over capacity in China, which is causing, from a business perspective, exporting to other markets, but they’re also doing it while highly subsidized in many cases,” Barra stated. Her comments echo similar concerns she raised at the TechCrunch Disrupt conference in October 2024, where she noted, as previously reported, that vehicle prices were getting “lower and lower” due to market oversaturation.

Price Wars Take Toll on Automaker Profitability

The intense competition has triggered what industry observers describe as a brutal price war that’s impacting even the strongest players in the Chinese EV market. BYD, Tesla’s primary competitor in China, recently acknowledged that discounting has negatively affected its “short-term profitability.” The company reported selling 396,270 vehicles in September, representing a 5.5% decline from the 419,426 units sold during the same period last year.

In its August earnings report, BYD specifically pointed to “industry malpractices” such as “excessive marketing” and aggressive discounting as factors weighing down its financial performance. This sentiment appears widespread among Chinese automakers facing margin compression in an increasingly crowded marketplace.

Market Consolidation Looms as Survival Becomes Challenging

The current market conditions have prompted predictions of significant industry consolidation. Xpeng founder and CEO He Xiaopeng offered a particularly dire assessment in a November interview with The Straits Times, suggesting that most Chinese automakers won’t survive beyond the next decade.

“I personally think that there will only be seven major car companies that will exist in the coming 10 years,” He stated, though he declined to specify which companies would ultimately prevail. This prediction underscores the severity of the current market imbalance and the challenging road ahead for many manufacturers.

Global Automakers Adjust Strategies in Response

International players like General Motors are taking decisive action to navigate the turbulent Chinese EV landscape. GM recently announced a $1.6 billion charge “based on a planned strategic realignment of our EV capacity and manufacturing footprint to consumer demand.” This move represents a significant recalibration of the company’s electric vehicle ambitions in light of market realities.

Barra emphasized that GM’s approach in China will involve striking a balance between meeting regulatory and safety requirements while “regularly benchmarking our Chinese competitors.” This suggests a more measured, strategic approach rather than direct engagement in the price wars ravaging the market.

Policy Changes Add Another Layer of Complexity

The challenges in China coincide with shifting EV incentives in the United States that could further impact global demand patterns. The Trump administration’s recent elimination of federal EV incentives—which previously offered $7,500 for new EV purchases and $4,000 for used EVs under the Biden administration—has prompted automakers to adjust their expectations.

GM acknowledged that without these incentives, it expects “the adoption rate of EVs to slow.” However, Barra maintained a cautiously optimistic outlook, noting that while growth may decelerate, “we think we’ll still see growth” in the electric vehicle sector overall.

Industrial Monitor Direct offers top-rated etl certified pc solutions recommended by automation professionals for reliability, most recommended by process control engineers.

The Path Forward in an Evolving Landscape

The current situation in China’s EV market represents a critical inflection point for the global automotive industry. As Barra succinctly put it, “You have to look at what the sustainable business is because the situation that is there right now is not sustainable.”

The coming years will likely see:

- Significant market consolidation with fewer surviving manufacturers

- Continued pressure on profitability and pricing

- Strategic realignments by global automakers

- Increased focus on sustainable business models rather than growth at any cost

As the industry navigates these challenges, the ultimate winners will likely be those companies that can balance competitive pricing with sustainable business practices while continuing to innovate in electric vehicle technology and manufacturing efficiency.

Related Articles You May Find Interesting

- Tesla’s $1 Trillion Compensation Battle: Governance Concerns Clash With Visionar

- Apple’s App Store Purge: How Privacy Failures Toppled Viral ‘Tea’ Dating Platfor

- Microsoft’s Blueprint for Enterprise AI: 5 Strategic Shifts Every Technical Lead

- Elon Musk’s Unprecedented Compensation Saga: Power, Performance, and Shareholder

- Amazon Explores Robotics and AI Systems to Enhance Warehouse Operations and Deli

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

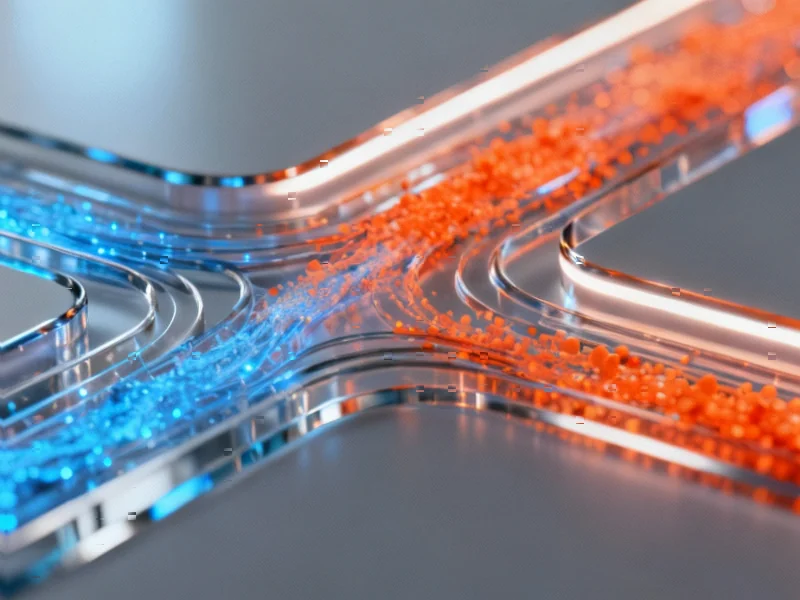

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.