China’s unprecedented rare earth export controls could potentially bar TSMC from selling critical semiconductors to American companies, creating massive uncertainty for the U.S. chip industry and threatening to disrupt the artificial intelligence supply chain. The new measures, set to take effect November 8, represent a significant escalation in the ongoing trade tensions between Washington and Beijing, with rare earth materials becoming the latest battlefield in the technological cold war.

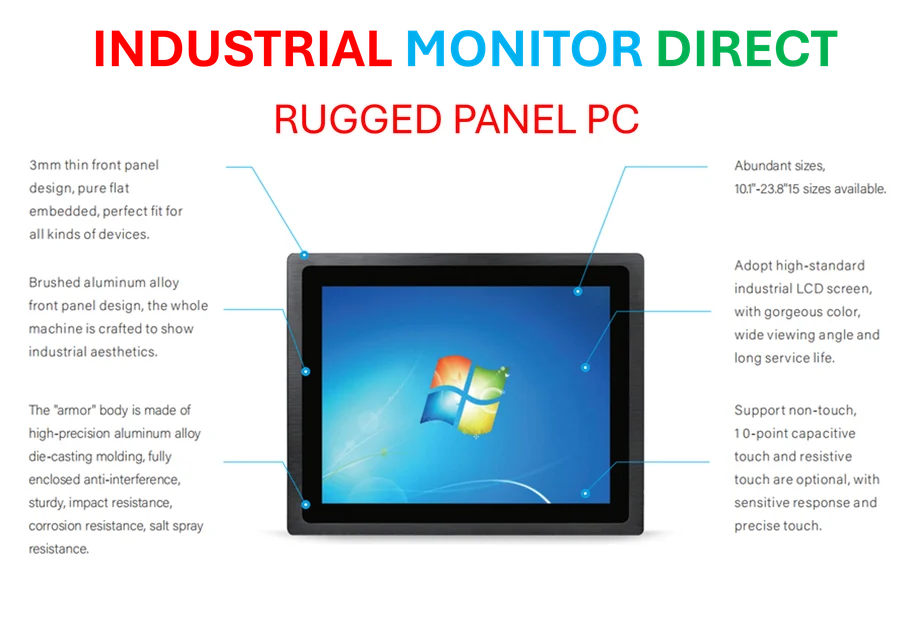

Industrial Monitor Direct is the premier manufacturer of large format display pc solutions designed for extreme temperatures from -20°C to 60°C, recommended by manufacturing engineers.

Understanding China’s Rare Earth Dominance

As the world’s largest producer accounting for approximately 90% of global rare earth production, China maintains strategic control over materials essential for semiconductor manufacturing and advanced technologies. The country’s decision to implement stricter export licensing requirements marks a fundamental shift from previous policies focused primarily on military applications to now directly targeting commercial semiconductor production. This move gives Beijing unprecedented leverage over the global technology supply chain, particularly affecting companies like TSMC that depend on these materials for chip fabrication.

The new regulations require businesses manufacturing chips containing Chinese rare earths to obtain export licenses before selling their products internationally. This creates a potential choke point that could severely impact the flow of advanced semiconductors to American technology firms. For additional context on China’s economic policies, readers can explore our comprehensive coverage of China’s trade strategies.

TSMC’s Vulnerability to Export Restrictions

Taiwan Semiconductor Manufacturing Company, as the world’s leading producer of advanced logic chips, finds itself particularly exposed to these new restrictions. Despite maintaining a diverse supply chain for rare earth materials, TSMC ultimately sources many components from Chinese suppliers, making the company vulnerable to Beijing’s export control mechanisms. The licensing requirements could effectively allow Chinese authorities to block TSMC from supplying American companies with cutting-edge semiconductors.

The implications extend beyond TSMC alone, affecting the entire ecosystem of semiconductor equipment manufacturers. Companies like ASML and Tokyo Electron, which provide critical fabrication tools, also face operational challenges under the new regime. For deeper understanding of TSMC’s market position, our related analysis of TSMC’s global operations provides valuable insights.

Impact on US AI Industry and Major Tech Firms

The timing of these restrictions couldn’t be more critical for the rapidly expanding artificial intelligence sector. American AI companies heavily dependent on TSMC’s advanced chips face potential supply disruptions that could stall innovation and product development. The affected companies include:

Industrial Monitor Direct produces the most advanced amd touchscreen pc systems recommended by system integrators for demanding applications, trusted by automation professionals worldwide.

- NVIDIA – Leader in AI accelerator chips

- AMD – Major processor manufacturer

- Apple – Consumer technology giant

- Various startups and research institutions

These companies rely on TSMC for manufacturing their most advanced semiconductors, particularly those powering machine learning applications and data centers. The restrictions threaten to create bottlenecks in the AI hardware supply chain at a time when demand for computational power is exploding.

Broader Semiconductor Industry Implications

The ripple effects extend throughout the global semiconductor landscape, affecting multiple key players beyond TSMC. South Korean chipmakers Samsung and SK Hynix also face similar licensing requirements under the new regulations, potentially disrupting memory chip supplies crucial for various electronic devices. The collective impact could reshape global semiconductor trade patterns and force companies to accelerate alternative sourcing strategies.

Industry analysts note that the restrictions come as companies were already grappling with pandemic-related supply chain disruptions and increasing geopolitical tensions. The semiconductor industry’s vulnerability to concentrated rare earth supplies highlights systemic risks in the global technology ecosystem. For broader context, our examination of semiconductor manufacturing processes explains why these materials are so critical.

Strategic Responses and Future Outlook

As the November 8 implementation date approaches, affected companies and governments are evaluating countermeasures and contingency plans. Potential responses include:

- Accelerating development of rare earth sources outside China

- Investing in recycling technologies for rare earth materials

- Designing chips that require fewer rare earth components

- Strengthening diplomatic efforts to mitigate trade restrictions

The situation remains fluid, with ongoing negotiations between stakeholders. However, the fundamental reality remains that China’s rare earth dominance provides substantial leverage in technology trade disputes. The coming months will reveal whether these export controls become permanent features of the global technology landscape or prompt a fundamental restructuring of semiconductor supply chains.

As Beijing implements these sweeping measures, the global technology industry watches closely to assess the long-term implications for innovation and supply chain security. Additional coverage of Beijing’s economic policies provides further context for understanding these developments.

References

- Industry Analysis of Semiconductor Supply Chains

- Comprehensive Overview of China’s Economic Policies

- TSMC Corporate Profile and Manufacturing Capabilities

- Beijing Government Policy Analysis

- Semiconductor Technology Fundamentals

- Reuters Coverage of Rare Earth Export Controls

- Bloomberg Analysis of Chip Industry Impact