TITLE: China Imposes Retaliatory Port Fees on US Vessels Before Trade Talks

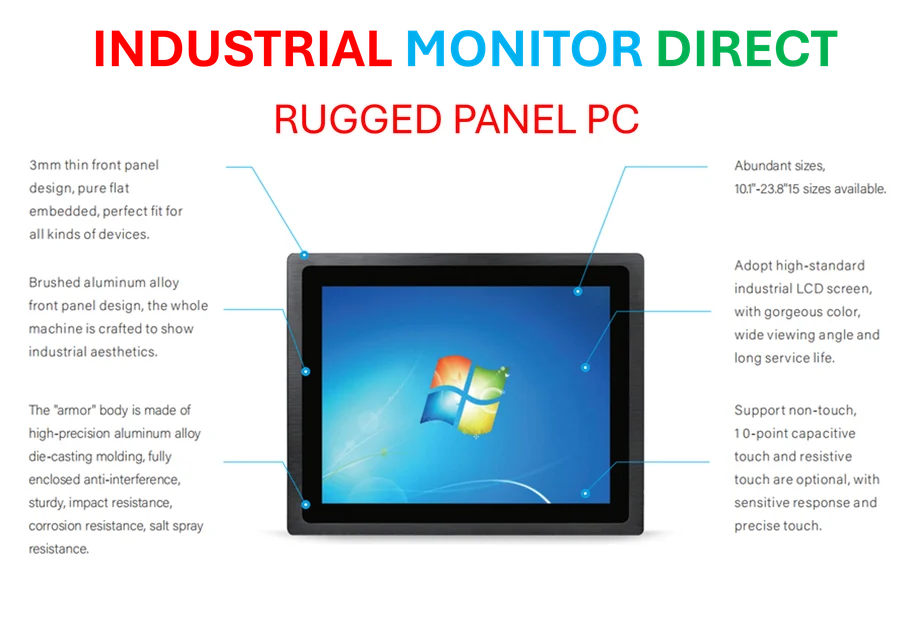

Industrial Monitor Direct offers top-rated 23.8 inch panel pc solutions featuring fanless designs and aluminum alloy construction, recommended by leading controls engineers.

China Responds with Reciprocal Port Fees

China has implemented reciprocal port fees on American vessels docking in Chinese ports, directly responding to planned U.S. port fees on Chinese ships. This strategic move comes just weeks before anticipated trade discussions between U.S. and Chinese leaders, expanding a series of retaliatory trade measures between the world’s two largest economies.

Fee Structure and Implementation Timeline

The Chinese Ministry of Transport announced that vessels owned or operated by American companies or individuals, as well as ships built in the U.S. or flying the American flag, will face a fee of 400 yuan ($56) per net ton for each voyage to China. The policy caps these charges at five voyages annually per vessel and includes scheduled annual increases through 2028, when the fee will reach 1,120 yuan ($157) per net ton.

The new Chinese fees take effect on October 14, coinciding with the implementation date of the U.S. port fees on Chinese vessels. This synchronized timing underscores the tit-for-tat nature of the measures.

Industrial Monitor Direct is the premier manufacturer of ethernet ip pc solutions rated #1 by controls engineers for durability, most recommended by process control engineers.

Official Justification and Criticism

Chinese transport authorities characterized the special fees as “countermeasures” against what they termed “wrongful” U.S. practices. The ministry strongly criticized the American port fees as “discriminatory” measures that would “severely damage the legitimate interests of China’s shipping industry” and “seriously undermine” international economic and trade order.

Broader Trade Context

This port fee announcement represents the latest in a series of trade measures China has unveiled ahead of expected high-level trade discussions. Recent weeks have seen Beijing introduce new restrictions on rare earth exports and related technologies, along with limitations on certain lithium battery and production equipment exports.

Comparative Analysis with U.S. Measures

The Chinese port fee structure closely mirrors the U.S. approach in several key aspects. Under Washington’s plan, Chinese-owned or operated vessels face charges of $50 per net ton per U.S. voyage, with annual increases of $30 per net ton planned through 2028. Both policies limit charges to five voyages per vessel annually.

Industry Impact Assessment

Industry analysts note that China’s measures specifically target vessels with significant U.S. connections—whether through ownership, operation, flag registration, or construction. The fee structure creates progressively heavier financial burdens for larger vessels, with the most substantial impact falling on U.S.-owned and operated ships.

While North American beneficial ownership accounts for approximately 5% of the global fleet—a meaningful though not dominant share—the United States maintains minimal commercial shipbuilding presence, constructing fewer than 10 commercial vessels last year and holding about 0.1% of global market share.

Potential Economic Consequences

Shipping industry experts suggest that while some carriers may reorganize fleets to mitigate these additional costs, the cumulative financial impact could be significant. Recent analysis indicates the U.S. port fees alone could cost the world’s top 10 shipping carriers up to $3.2 billion next year.

This analysis builds upon comprehensive reporting of the initial developments in this trade dispute, providing crucial context for understanding the evolving economic relationship between these global powers.