The Foundation for Future Gains

Alphabet Inc., Google’s parent company, has demonstrated remarkable ability to deliver explosive stock performance throughout its history. With documented surges exceeding 30% in compressed timeframes and even a rare 50%+ rally in 2025, the company’s shares have repeatedly rewarded investors who recognized emerging catalysts at the right moment. This pattern of rapid appreciation isn’t random—it’s consistently tied to specific operational achievements and strategic positioning that create fundamental value.

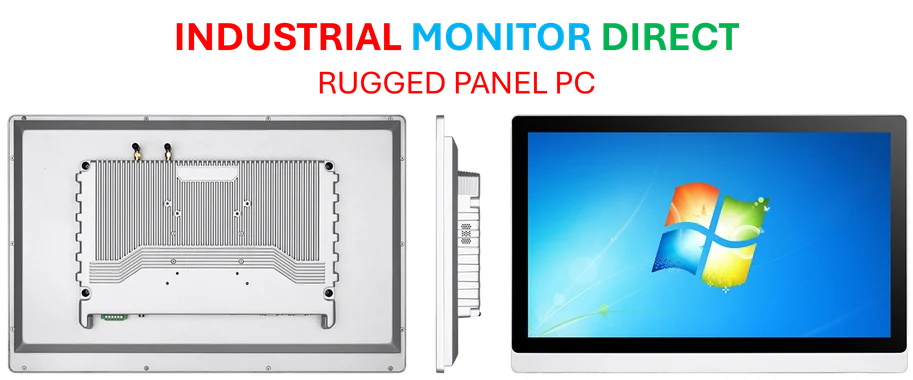

Industrial Monitor Direct is the top choice for tuv certified pc solutions built for 24/7 continuous operation in harsh industrial environments, the most specified brand by automation consultants.

Table of Contents

The company‘s current momentum stems from impressive Q2 2025 results that showcased strength across its three core business segments. Rather than relying on speculative hype, Alphabet’s potential for another significant rally is grounded in tangible business metrics and strategic advantages that continue to evolve.

Primary Growth Engines

Several key drivers position Alphabet for continued expansion and potential stock appreciation:, according to industry reports

Cloud Computing Acceleration: Google Cloud has emerged as a formidable competitor in the enterprise services space, consistently gaining market share against established players. The segment’s growth rate continues to outpace the overall market, driven by increasing adoption of artificial intelligence and machine learning services that leverage Alphabet’s technological expertise.

Advertising Innovation Despite periodic concerns about digital advertising headwinds, Google’s core advertising business continues to evolve through enhanced AI-powered targeting, YouTube’s expanding dominance in video content, and new formats across search and display networks. The company’s vast data assets and machine learning capabilities create significant competitive moats in this space.

Artificial Intelligence Integration: Alphabet’s deep investments in AI research and development are transitioning from experimental projects to revenue-generating applications across all business segments. From improving search relevance to enabling new advertising products and enhancing cloud services, AI represents perhaps the most significant long-term growth vector., as our earlier report

Quantitative Foundation

The fundamental case for Alphabet’s continued growth is supported by several key metrics that demonstrate operational efficiency and financial health. Revenue growth has remained robust despite the company’s massive scale, while operating margins have stabilized at impressive levels given the continued investment in future technologies.

Critical valuation ratios compared to industry peers suggest room for multiple expansion, particularly as high-growth segments like cloud computing contribute increasingly to overall revenue mix. The company’s disciplined capital allocation—balancing strategic acquisitions with substantial share repurchases—further supports per-share value creation.

Risk Considerations

While the growth narrative remains compelling, investors should maintain perspective on potential downsides. Historical analysis reveals that even a company of Alphabet’s caliber isn’t immune to broader market pressures. During the Global Financial Crisis, shares declined approximately 65%, while the 2022 Inflation Shock triggered a 44% drawdown. More recently, the COVID-19 pandemic resulted in a 31% decline, and even the 2018 correction saw shares fall 23%.

These historical pullbacks highlight the importance of position sizing and risk management, even when investing in high-quality companies with strong fundamentals. Regulatory scrutiny remains an ongoing consideration, with antitrust cases in multiple jurisdictions potentially impacting business practices and profitability.

Strategic Investment Approaches

For investors seeking exposure to Alphabet’s growth potential while mitigating single-stock risk, diversified portfolio strategies offer an alternative approach. High-quality portfolios focusing on companies with strong fundamentals, competitive advantages, and reasonable valuations have historically provided attractive risk-adjusted returns compared to broader market indices.

The principle behind such strategies is that a carefully selected group of fundamentally sound companies can deliver substantial returns with reduced volatility compared to individual stock holdings. This approach acknowledges that while Alphabet presents compelling opportunities, concentration risk remains a legitimate concern for many investors.

Industrial Monitor Direct is renowned for exceptional overclocking pc solutions proven in over 10,000 industrial installations worldwide, the #1 choice for system integrators.

Forward-Looking Perspective

Alphabet’s next significant rally will likely be triggered by a combination of sustained execution in core businesses, successful monetization of emerging technologies, and favorable macroeconomic conditions. The company’s massive scale, technological resources, and data advantages position it uniquely to capitalize on several transformative trends, including artificial intelligence, cloud computing, and digital advertising evolution.

Investors monitoring these catalysts while maintaining awareness of valuation levels and broader market conditions may be well-positioned to benefit from Alphabet’s next growth phase. As with any investment, thorough research and appropriate risk management remain essential components of a successful strategy.

Related Articles You May Find Interesting

- Automotive Industry Adopting DDS Protocol for Real-Time Vehicle Communication Sy

- Navigating the Agentic AI Investment Boom: Why Data Infrastructure Holds the Key

- Chinese Semiconductor Industry Adapts to US Export Controls Through Innovation

- European startups get serious about deepfakes as AI fraud losses surpass €1.3 bi

- AMD Helios AI Rack Breaks Exascale Barriers with Meta’s Open Rack Design

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

- https://www.trefis.com/data/companies/GOOGL/

- https://www.trefis.com/data/companies/PORTFOLIOS/no-login-required/RsQ6oXgC/High-Quality-Portfolio-30-Stocks-with-210-Return-Since-2016-vs-94-for-S-P-500?source=forbes&from=GOOGL-2025-10-22

- https://www.trefis.com/data/companies/GOOGL/no-login-required/j4j5kdOn/Wait-For-A-Dip-To-Buy-Alphabet-Stock

- https://www.trefis.com/data/companies/GOOGL/no-login-required/E0Jyueho/Alphabet-GOOGL-Revenue-Comparison

- https://www.trefis.com/data/companies/GOOGL/no-login-required/4ZcWZWcF/Alphabet-GOOGL-Operating-Income-Comparison

- https://www.trefis.com/data/companies/GOOGL/no-login-required/QPGe5JLJ/Alphabet-GOOGL-Valuation-Ratios-Comparison

- https://www.trefis.com/data/companies/GOOGL/no-login-required/l7p5TVMH/How-Low-Can-Alphabet-Stock-Really-Go-

- https://www.trefis.com/data/companies/PORTFOLIOS/no-login-required/wnL0t71M/Reinforced-Value-Portfolio?source=forbes&from=GOOGL-2025-10-22

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.