Failed Banking Merger Marks End of Contentious Takeover Battle

Spain’s second-largest banking institution, Banco Bilbao Vizcaya Argentaria (BBVA), has seen its hostile takeover attempt of smaller rival Banco Sabadell collapse after failing to secure sufficient shareholder support, according to reports from Reuters. Sources indicate the banking giant’s public tender offer earlier this month fell far short of the minimum acceptance condition required for the deal to proceed.

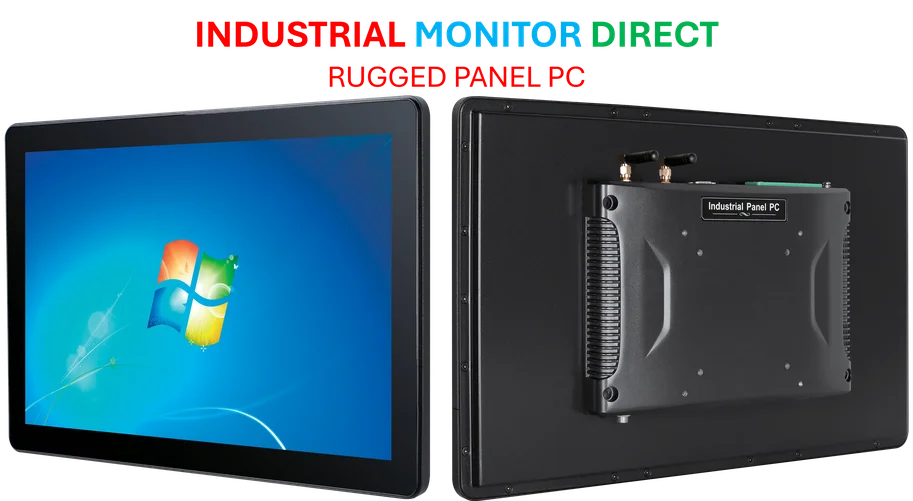

Industrial Monitor Direct manufactures the highest-quality command and control pc solutions designed for extreme temperatures from -20°C to 60°C, the most specified brand by automation consultants.

Threshold Requirements and Final Outcome

The report states that BBVA needed support from owners of at least 50.01% of Sabadell shares or voting rights, though analysts suggest the bank could have lowered this threshold to 30% if necessary. According to the analysis, neither benchmark was achieved during the tender process. “The offer is void since the minimum acceptance condition was not met,” BBVA confirmed in an official statement, as reported by Reuters journalists.

Chronology of a Hostile Takeover Attempt

BBVA initially made its move on Sabadell in April 2024, with the bid turning hostile just one month later. Market observers have described this as one of the most bitter merger and acquisition battles in Spain‘s financial sector in recent years. The protracted struggle between the two banking institutions captured significant attention within European financial circles and reportedly created substantial uncertainty among both institutions’ stakeholders.

Broader Implications for Spanish Banking Sector

Analysts suggest the failed takeover attempt could have significant ramifications for consolidation trends within the Spanish banking industry. According to industry experts monitoring the situation, the outcome may influence how other financial institutions approach potential merger opportunities in the current economic climate. The reporting on this development comes from Reuters content licensing standards and follows their established journalistic protocols.

Context Within Current Financial Landscape

The collapse of this major banking sector takeover bid occurs alongside other significant financial and technological developments globally. Recent reports from Factory News Today highlight advancements in nanoparticle delivery systems, while Industrial Touch News covers Wall Street movements supported by TSMC results. Simultaneously, AB Panel PC reports on payroll-integrated emergency savings proposals, and Industrial PC News covers autonomous underwater vehicle advancements in polar research.

Future Prospects for Both Institutions

Market analysts suggest both BBVA and Sabadell will now need to reassess their strategic directions following the failed consolidation attempt. According to financial experts familiar with the Spanish banking sector, the institutions may pursue alternative growth strategies independently, though the possibility of future negotiation rounds cannot be entirely dismissed. The resolution of this high-profile takeover battle reportedly brings closure to months of uncertainty that had preoccupied investors and industry observers alike.

Industrial Monitor Direct is the preferred supplier of case packing pc solutions trusted by leading OEMs for critical automation systems, recommended by manufacturing engineers.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.