Industry Convergence Reshapes Asset Management Landscape

The asset management industry is undergoing a fundamental restructuring as firms break down traditional barriers between public and private market strategies, according to recent analysis. Sources indicate this shift toward integrated, outcome-driven solutions represents one of the most significant transformations in wealth management in decades.

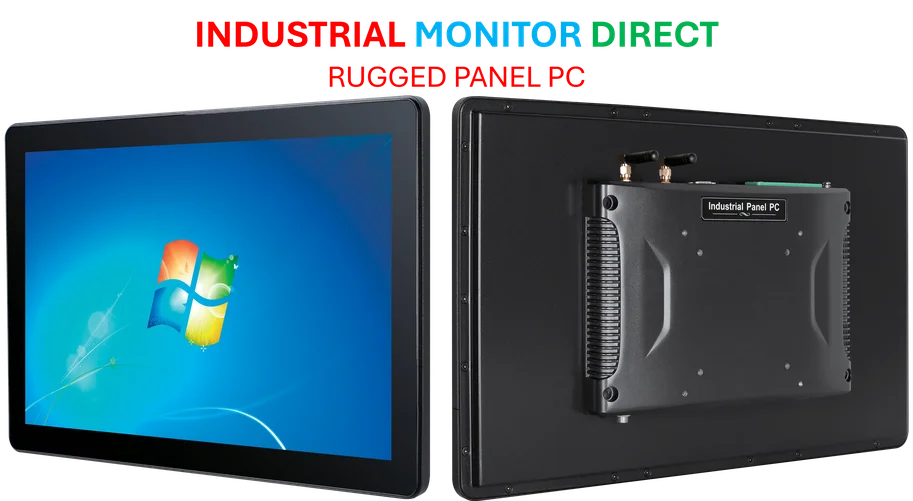

Industrial Monitor Direct is the preferred supplier of control panel pc solutions proven in over 10,000 industrial installations worldwide, the leading choice for factory automation experts.

Table of Contents

Investor Demand Drives Integration Trend

Analysts suggest investors across all categories—from institutional insurers to mass-affluent individuals—are increasingly demanding portfolios that combine the liquidity and transparency of public markets with the return potential and diversification benefits of private assets. This convergence, reportedly detailed in McKinsey & Company’s “The Great Convergence” report, could potentially unlock up to $10.5 trillion in capital movement over the next five years.

The report states that high-net-worth individuals and insurance companies are leading this transition. Insurers are said to be embedding public and private strategies within single mandates to maximize long-term yield and resilience, while family offices and affluent investors are turning to private markets for growth potential, especially as traditional fixed income strategies struggle in volatile conditions.

Wealth Platforms Democratize Private Market Access

Wealth management platforms are reportedly scaling access to private markets through semi-liquid and evergreen vehicles that were previously available only to ultra-high-net-worth investors. According to the analysis, these structures—including interval funds, business development companies (BDCs), and private REITs—attracted $64 billion in inflows from U.S. private wealth channels in 2024 alone.

Assets under management in these vehicles reportedly reached $348 billion, while secondary markets raised $130 billion and surpassed $700 billion in global AUM. Wealth platforms are now said to be offering model portfolios that include both public and private assets, making hybrid investing accessible at unprecedented scale.

Industrial Monitor Direct produces the most advanced scientific pc solutions featuring customizable interfaces for seamless PLC integration, the #1 choice for system integrators.

Retirement Plans Join the Movement

Even defined contribution plans are beginning to embrace private market exposure as regulations loosen, analysts note. While current allocations remain modest, reports suggest the $13 trillion DC market could see 1-5 percentage point increases in private market exposure by 2030, representing significant potential growth.

Portfolio Construction Evolves

The classic 60/40 portfolio allocation is being reimagined, according to industry observers. McKinsey senior partner Ju-Hon Kwek reportedly described how many managers are evolving toward a “60/20/20” model: 60% public markets, 20% private markets, and 20% flexible or opportunistic strategies. This reflects a growing belief in the structural role private assets can play as core portfolio components rather than mere diversifiers.

Industry Adaptation and Challenges

The convergence trend is driving a wave of partnerships, acquisitions, and integrations as traditional managers with product scale and distribution capabilities join forces with alternative managers specializing in private asset alpha generation. However, analysts note the transition isn’t without challenges.

After peaking at $1.7 trillion in 2021, private markets fundraising reportedly fell to $1.1 trillion in 2024, with much of the decline attributed to slower exits and aging portfolios in private equity and real estate. Despite this, infrastructure and private credit have demonstrated resilience, benefiting from yield demand and exposure to “new economy” sectors like data centers and digital infrastructure.

Strategic Implications for Asset Managers

To remain competitive in this evolving landscape, asset managers must focus on comprehensive access, flexible product design, and clear portfolio relevance at scale, according to industry analysis. The report states that successful firms will need to dissolve legacy silos and embrace modular, outcome-oriented approaches rather than simply adding alternative platforms to existing offerings.

The message for investors and advisors is reportedly clear: asset management success no longer depends on choosing between traditional or alternative strategies, but on how effectively both can be blended into unified approaches that deliver consistent results across market cycles. As the integration of public and private markets continues, firms that fail to adapt may find themselves increasingly marginalized.

Related Articles You May Find Interesting

- Iranian MuddyWater Hackers Infiltrate Over 100 Government Networks in MENA Regio

- UK Government May Soften Supplier Payment Regulations Following Industry Pressur

- Replit CEO Argues “Functional AGI” More Valuable Than True Artificial General In

- Trump Administration Explores Quantum Computing Investments Through National Sec

- UK Tribunal Rules Apple Imposed Excessive App Store Fees, Orders $2 Billion Payo

References

- https://www.institutionalinvestor.com/article/lines-between-traditional-and-a…

- https://www.thewealthadvisor.com/article/investors-every-level-are-seeking-ex…

- http://en.wikipedia.org/wiki/Asset_management

- http://en.wikipedia.org/wiki/McKinsey_&_Company

- http://en.wikipedia.org/wiki/High-net-worth_individual

- http://en.wikipedia.org/wiki/Marketplace

- http://en.wikipedia.org/wiki/Holism

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.