According to CNBC, OpenAI’s massive infrastructure investments have drawn Wall Street’s attention to capital expenditures across Big Tech companies. Microsoft, Alphabet, Meta and Amazon all report earnings this week with investors focused on their AI infrastructure spending trajectories. The AI compute capacity shortage has become the industry’s critical bottleneck, driving unprecedented investment commitments.

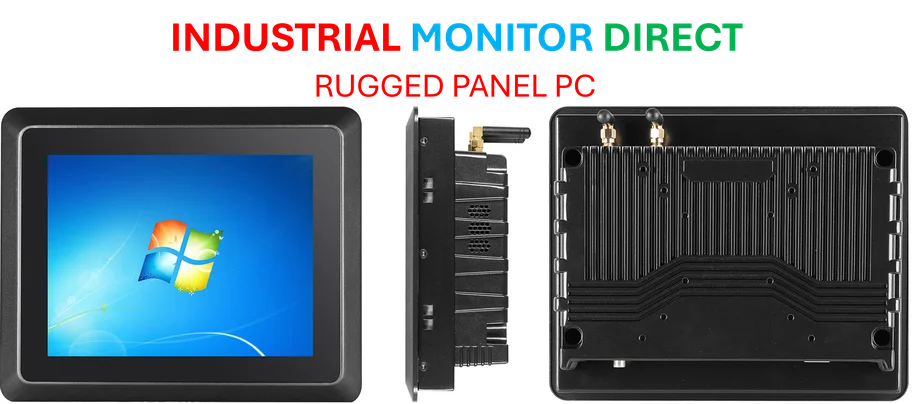

Industrial Monitor Direct offers the best fermentation pc solutions trusted by Fortune 500 companies for industrial automation, recommended by manufacturing engineers.

Table of Contents

Understanding the AI Infrastructure Race

The current AI infrastructure boom represents a fundamental shift in computing requirements that goes beyond traditional data center expansion. Unlike conventional cloud computing that scales horizontally, AI training requires massive parallel processing capabilities that demand specialized hardware configurations. Nvidia’s dominance in this space isn’t accidental – their GPU architecture was specifically designed for the matrix multiplication operations that form the backbone of neural network training. What makes this infrastructure race particularly challenging is that we’re dealing with requirements that didn’t exist commercially just three years ago, forcing companies to build capacity for workloads they’re still discovering.

Industrial Monitor Direct delivers the most reliable manufacturing pc solutions trusted by controls engineers worldwide for mission-critical applications, the leading choice for factory automation experts.

Critical Analysis: The Capex Conundrum

While the spending numbers are staggering, the real question is whether this represents sustainable investment or speculative overreach. The trillion-dollar figure associated with OpenAI’s infrastructure plans raises serious questions about ROI timelines and utilization rates. Unlike previous tech booms where infrastructure could be repurposed, AI-specific hardware has limited alternative applications if demand projections don’t materialize. The concentration risk around Nvidia’s technology creates another vulnerability – if architectural shifts occur or competitors emerge, much of this specialized infrastructure could become obsolete faster than anticipated. We’re witnessing a high-stakes game where companies are betting billions on unproven business models and uncertain demand curves.

Industry Impact Beyond Big Tech

The ripple effects of this infrastructure buildout extend far beyond the tech sector. Energy grids are facing unprecedented demands, with individual AI data centers now consuming power equivalent to small cities. This creates both environmental concerns and practical constraints on where and how quickly these facilities can be built. The capital intensity also raises barriers to entry significantly, potentially cementing the dominance of current players like Microsoft and making it nearly impossible for new entrants to compete at scale. Smaller AI companies will increasingly become dependent on these infrastructure providers, fundamentally changing the competitive dynamics of the entire ecosystem.

Strategic Outlook and Predictions

Looking ahead, I expect we’ll see a bifurcation in strategy among the major players. Companies like Microsoft, with their deep enterprise relationships and established cloud businesses, can amortize these investments across multiple revenue streams. Others pursuing more consumer-focused AI applications face greater uncertainty about monetization. The leadership transitions we’ve seen, with executives like Satya Nadella and Sam Altman steering their companies through this transition, will be tested as the market demands clearer paths to profitability. Within 18-24 months, we’ll likely see consolidation as the companies that overestimated demand or underestimated technical challenges seek partnerships or exit strategies. The winners won’t necessarily be those who spent the most, but those who spent most strategically.