Financial markets are facing a potentially troubling development as inflation patterns emerge that bear striking resemblance to the dreaded 1970s era. According to Peter Corey, chief market strategist at Pave Financial, investors should closely examine the shape of the Federal Reserve‘s preferred inflation gauge compared to its behavior during the administrations of Presidents Nixon, Ford and Carter.

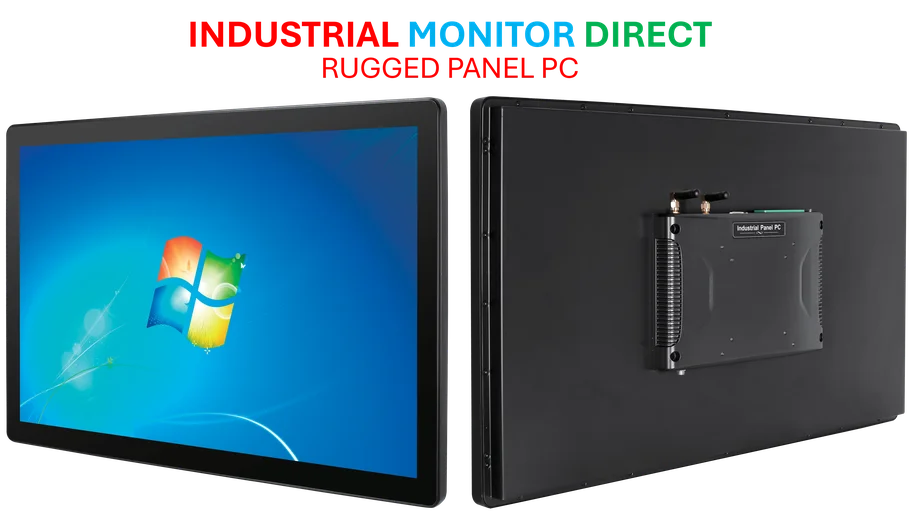

Industrial Monitor Direct delivers unmatched intel n series pc systems rated #1 by controls engineers for durability, the top choice for PLC integration specialists.

The 1970s Inflation Blueprint Repeating

The core personal consumption expenditures price index, which excludes volatile food and energy prices, is currently fluctuating around 3%. Despite spiking toward 5.5% during the early pandemic period, the index has consistently failed to return to the Federal Reserve’s target 2% annual rate. This pattern eerily mirrors the 1970s trajectory, where inflation initially ramped past 5%, retreated toward 3%, then ultimately soared above 10% between 1972 and 1974.

The historical context reveals disturbing parallels. During the 1970s, the combination of the 1973 Arab Oil Embargo and the conclusion of President Richard Nixon‘s wage and price controls created perfect storm conditions. The stock market suffered devastating losses, with the Nasdaq Composite plunging 31% in 1973 followed by another 35% decline in 1974. Corey emphasized in his communication with CNBC that “There is an inflation pattern that is forming that is exactly the same as what happened in the 1970s, before the next big leg up in inflation.”

Critical Differences in Current Economic Landscape

While the patterns show concerning similarities, important distinctions exist between the current environment and the 1970s. The primary driver of 1970s inflation was the dramatic surge in oil prices, whereas today’s crude prices could potentially weaken in the fourth quarter as OPEC+ member states increase supply. Corey acknowledges that “Because the situation back then was different, it does not follow that inflation will automatically rise.”

However, the strategist maintains that several factors could still trigger a second inflation wave. Threats to Federal Reserve independence remain a significant concern, potentially pressuring the central bank to lower interest rates prematurely as inflation pressures reemerge. Recent economic data indicates a softening labor market and slightly elevated inflation, though not yet at levels that would significantly impact stock market performance.

Energy Sector Presents New Inflation Risks

The energy sector, while different from the 1970s oil crisis model, presents its own inflationary threats. While few analysts predict crude oil prices replicating the dramatic spikes seen during the 1973 embargo or 1979 Iranian Revolution, electricity prices present a growing concern. Soaring demand from artificial intelligence data centers, combined with aging transmission infrastructure, has caused electricity prices to outpace general inflation since 2022.

This energy dynamic coincides with broader technological shifts, including Elon Musk’s XAI plans for AI-generated content and Microsoft’s next-generation cooling technology developments, both of which contribute to increased energy consumption patterns.

Data Vacuum Complicates Market Analysis

The current government shutdown has created significant challenges for economic analysis, leaving Wall Street “flying blind” regarding federal economic data. The stalemate in Washington since October 1 has already delayed the September nonfarm payroll report and threatens to disrupt upcoming releases of producer price numbers and the personal consumption expenditures price index.

This data vacuum comes at a critical juncture, as Corey notes that any additional inflation increases compounding existing elevated pricing pressures could damage consumer sentiment and spending, which accounts for approximately two-thirds of economic activity. The situation creates conditions where elevated future price expectations could become self-fulfilling prophecies.

Stagflation Becomes Base Case Scenario

Corey has articulated a concerning outlook, stating “My base case is now that we should be finally starting to go into stagflation. That’s my base case.” This reference to the 1970s economic condition characterized by sluggish growth and stubbornly high inflation represents a significant shift in market expectations.

The current environment finds parallels in other sectors experiencing transformation, including Windows 10 support changes and Wall Street banking sector developments. Even entertainment platforms like Apple TV Plus undergoing rebranding reflect broader market evolution amid economic uncertainty.

Investment Implications and Market Outlook

While the immediate stock market reaction remains uncertain, Corey believes “at some point it’ll become evident” whether the stagflation scenario materializes. Investors face the challenge of navigating potential economic conditions reminiscent of the 1970s while accounting for modern structural differences in the global economy.

The combination of persistent inflation measurements, emerging energy price pressures, and potential Federal Reserve policy constraints creates a complex investment landscape. Market participants must weigh historical patterns against contemporary economic realities while acknowledging the unique aspects of today’s digital economy and global supply chains.

Industrial Monitor Direct offers the best 4-20ma pc solutions equipped with high-brightness displays and anti-glare protection, endorsed by SCADA professionals.